KEY

TAKEAWAYS

- NVDA’s inventory value has retested its $130 assist degree and bounced greater, which may present a bullish buying and selling alternative utilizing choices.

- NVIDIA’s fundamentals are compelling and assist an increase in its inventory value.

- Promoting a put vertical unfold supplies a limited-risk situation with a excessive chance of revenue.

As demand for superior computing and synthetic intelligence continues to surge, NVIDIA Corp. (NVDA) stands on the forefront of this revolution, with current NVDA inventory value motion suggesting it could provide a compelling bullish alternative. On this put up, we’ll discover the technical and elementary elements contributing to the bullish outlook in NVDA and how you can construction an choices technique—all recognized utilizing the OptionsPlay Technique Middle inside StockCharts.com.

As demand for superior computing and synthetic intelligence continues to surge, NVIDIA Corp. (NVDA) stands on the forefront of this revolution, with current NVDA inventory value motion suggesting it could provide a compelling bullish alternative. On this put up, we’ll discover the technical and elementary elements contributing to the bullish outlook in NVDA and how you can construction an choices technique—all recognized utilizing the OptionsPlay Technique Middle inside StockCharts.com.

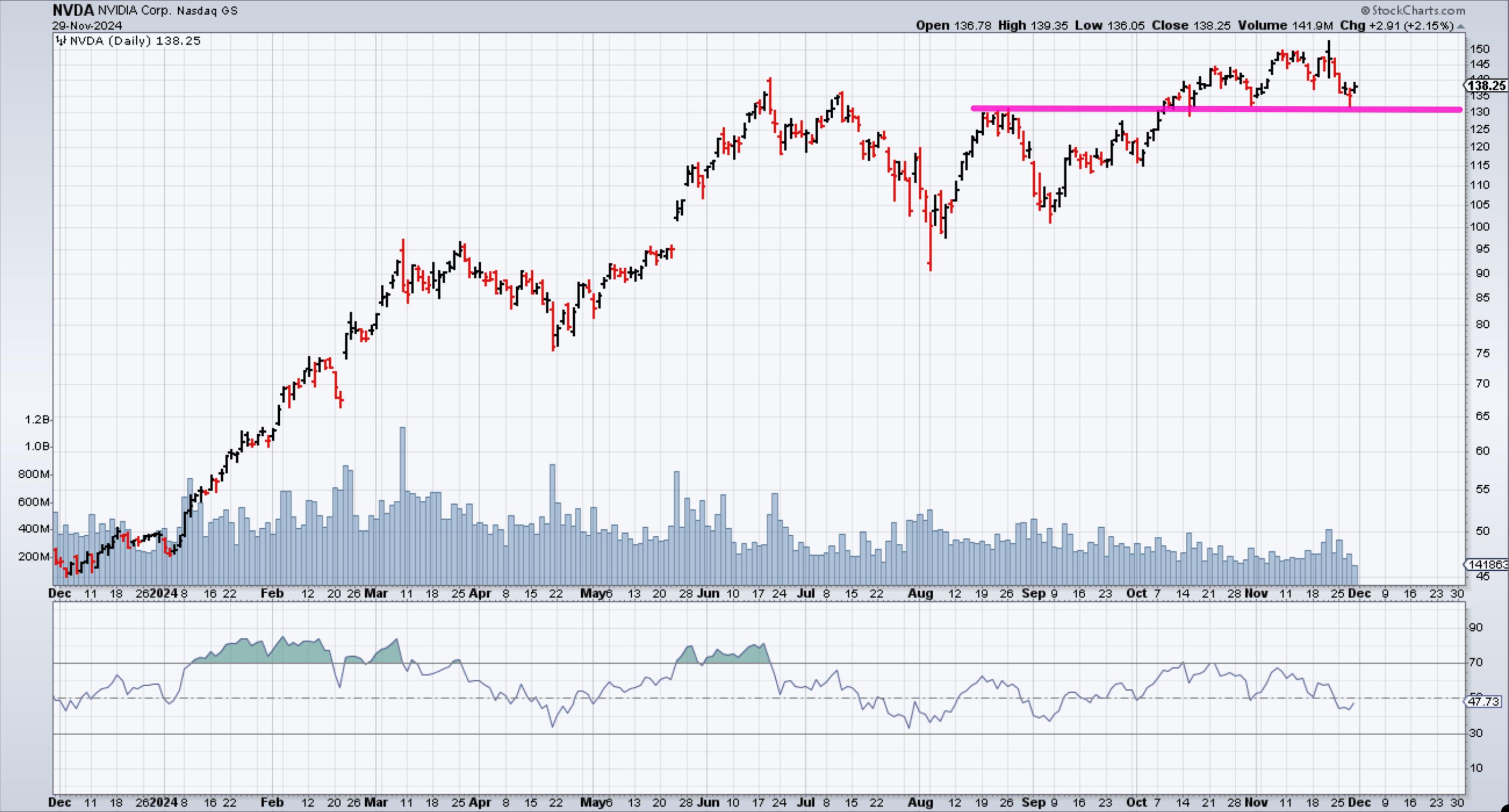

When you have a look at the NVDA inventory value chart beneath, there are a number of bullish indicators:

- Retesting Assist at $130. After breaking out above the numerous resistance space of $130 in October, NVDA has retested this degree as assist twice.

- Robust Threat/Reward Setup. The profitable retests current a good threat/reward for bullish publicity.

FIGURE 1. DAILY CHART OF NVDA STOCK PRICE. Since October, NVDA has retested the $130 assist degree.Chart supply: StockCharts.com. For instructional functions.

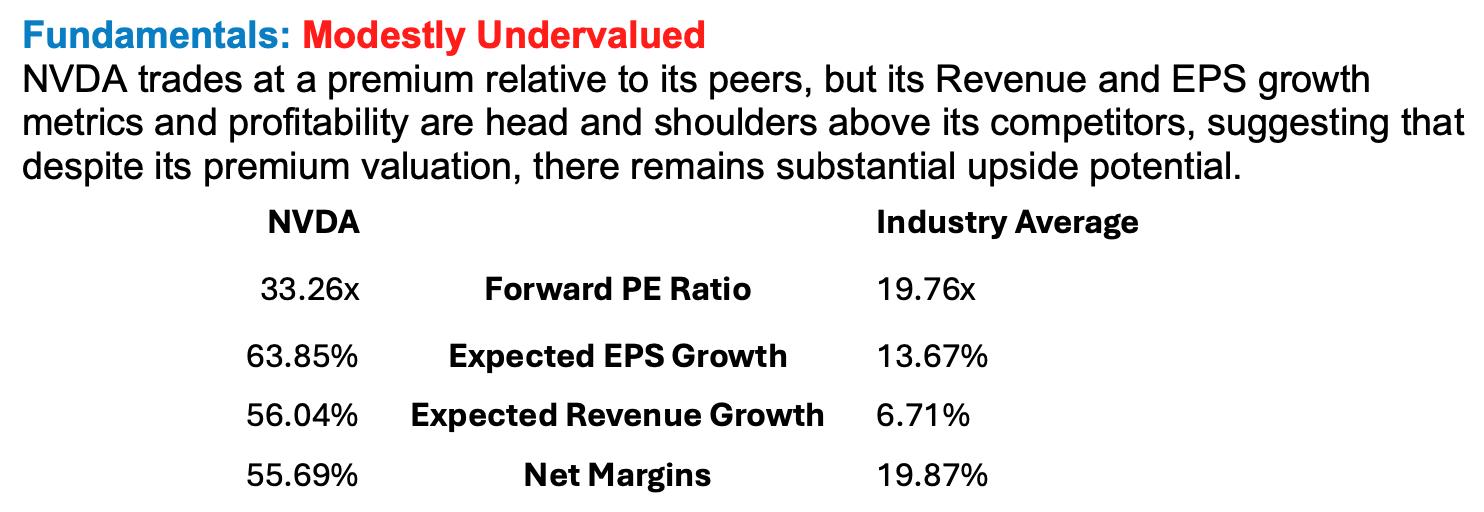

NVDA’s valuation additional strengthens the bullish thesis:

- Enticing Valuation. Regardless of buying and selling at 33x ahead earnings, which is a 60% premium relative to the business, the valuation is justified by NVDA’s excellent development metrics and market management.

- Distinctive EPS Development. NVDA’s anticipated earnings per share (EPS) development is almost 5 instances greater than its friends.

- Strong Income Development. NVDA’s anticipated income development is about 8 instances greater than the business median, indicating superior efficiency in increasing its market share and enterprise operations.

- Main Internet Margins. With internet margins of 55%, NVIDIA leads the business, showcasing its capacity to transform income into revenue successfully.

- Dominant Place in AI and Accelerated Computing. NVIDIA’s Q3 FY2025 outcomes underscore its management in synthetic intelligence and accelerated computing sectors, with report revenues and important development in knowledge heart operations.

FIGURE 2. NVIDIA FUNDAMENTALS. From a valuation perspective, NVDA’s inventory value has the potential to rise additional.Picture supply: OptionsPlay.

Put Vertical Unfold in NVDA

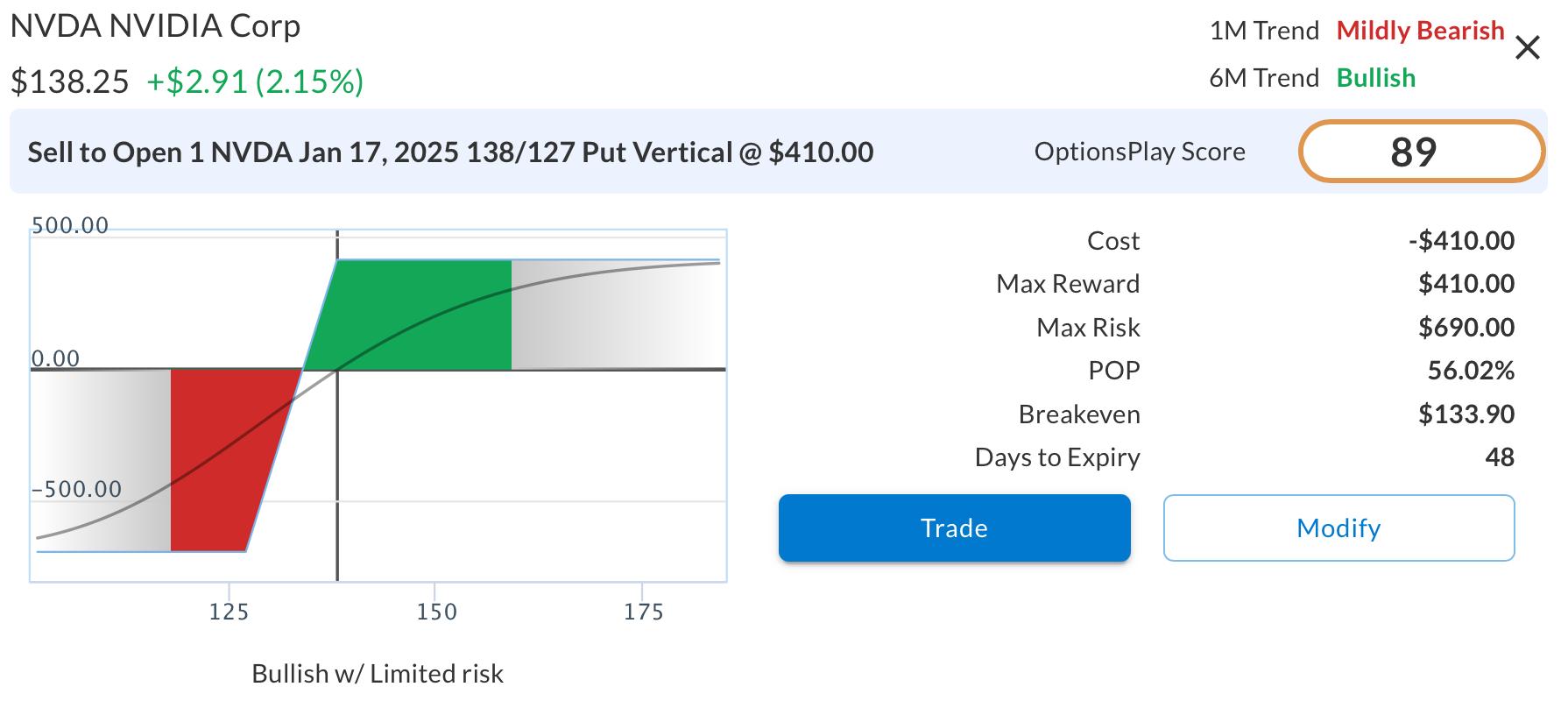

Regardless of a low IV Rank, NVDA choices skew supplies a possibility to promote a put vertical unfold and nonetheless acquire over 37% of the width. This supplies a impartial to bullish outlook with restricted threat and the next chance of revenue.

Promoting the Jan 2025 $138/$127 Put Vertical @ $4.10 Credit score:

- Promote: January 17, 2025, $138 Put Choice at $7.45

- Purchase: January 17, 2025, $127 Put Choice at $3.35

- Internet Credit score $410 per contract

FIGURE 3. RISK CURVE FOR SELLING NVDA PUT VERTICAL SPREAD. This technique supplies a impartial to bullish outlook and has the next chance of revenue (POP).Picture supply: OptionsPlay Technique Middle at StockCharts.com.

A breakdown of promoting the put vertical is as follows:

- Potential Reward: Restricted to the web credit score obtained or $415.

- Potential Threat: Restricted to $685 (the distinction between the strike costs multiplied by 100, minus the web credit score).

- Breakeven Level: $133.85 (strike value of the offered put minus the web credit score per share).

- Likelihood of Revenue: Roughly 56.12% if NVDA closes above $133.85 by January 17, 2025.

The bull put unfold advantages from time decay and permits for revenue if the inventory stays above the breakeven level at expiration. It supplies a good risk-to-reward ratio aligned with the bullish outlook on NVDA’s inventory value.

How To Unlock Actual-Time Commerce Concepts

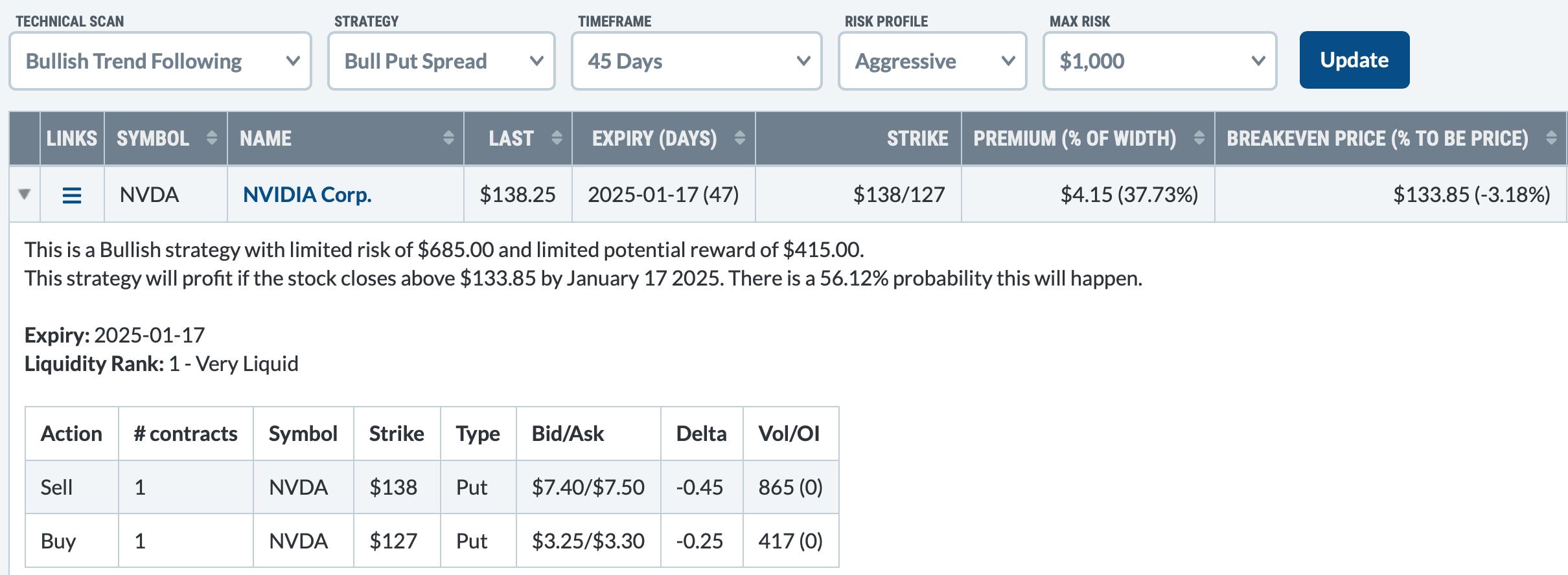

This bullish alternative in NVIDIA was recognized utilizing the OptionsPlay Technique Middle inside StockCharts.com. The platform’s Bullish Pattern Following scan mechanically sifted by way of the market to spotlight NVDA as a powerful candidate, and it structured the choices technique effectively.

FIGURE 4. BULLISH TREND FOLLOWING SCAN FILTERED NVDA AS A STRONG CANDIDATE. Right here, you see a synopsis of the bull put unfold commerce for NVDA.Picture supply: OptionsPlay Technique Middle at StockCharts.com.

By subscribing to the OptionsPlay Technique Middle, you’ll be able to:

- Uncover Alternatives Immediately: Make the most of automated market scans to seek out the perfect buying and selling alternatives primarily based on real-time knowledge.

- Obtain Optimum Commerce Structuring: Get tailor-made choices methods that match your market outlook and threat preferences.

- Save Time with Actionable Insights: Entry complete commerce concepts inside seconds, eliminating hours of analysis and evaluation.

Do not miss out on potential buying and selling alternatives. Subscribe to the OptionsPlay Technique Middle at present and improve your buying and selling expertise with instruments designed to maintain you forward out there. Empower your funding selections and discover the perfect choices trades swiftly on daily basis. Let OptionsPlay be your companion in navigating the markets extra successfully.

Tony Zhang is the Chief Strategist at OptionsPlay.com, the place he has assembled an agile workforce of builders, designers, and quants to create the OptionsPlay product suite for buying and selling and evaluation. He has additionally developed and managed most of the agency’s partnerships extending from the Choices Business Council, Nasdaq, Montreal Alternate, Merrill, Constancy, Schwab, and Raymond James. As a confirmed thought chief and contributor on CNBC’s Choices Motion present, Tony shares concepts on utilizing choices to leverage acquire whereas lowering threat.

Study Extra