KEY

TAKEAWAYS

- SPY is pushing in opposition to resistance.

- The expertise sector is out of favor, and semiconductors are a drag for it.

- NVDA is large, however it isn’t the one semiconductor inventory.

It is All Nonetheless Relative

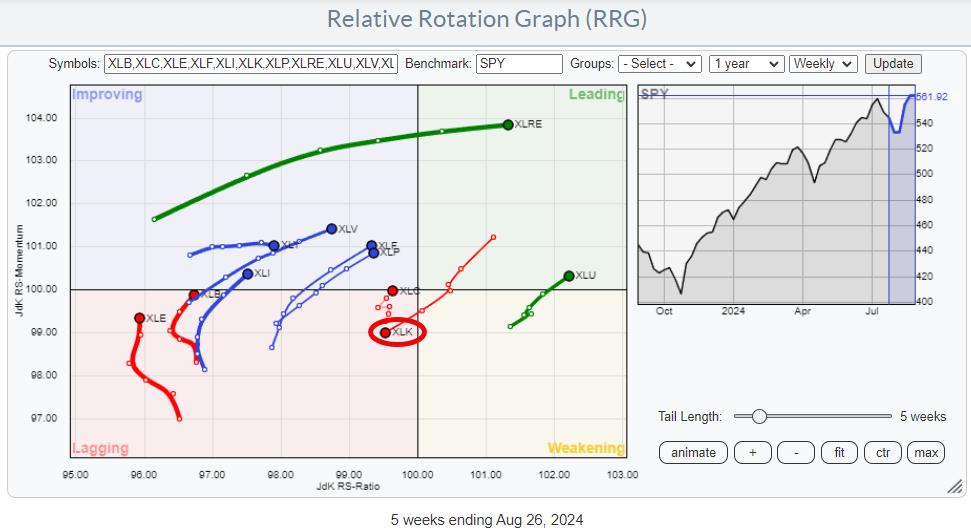

The weekly Relative Rotation Graph, because it seems towards the shut of this Friday (8/30) exhibits a transparent image — out of Expertise, into every little thing else.

Easy sufficient, proper? Nevertheless, this can be a relative comparability, so it solely tells us whether or not a sector is in a relative up- or downtrend or whether or not its relative pattern is bettering or weakening. Which means that when SPY begins to maneuver decrease, these sectors will doubtless outperform SPY, however their costs will nonetheless go down.

When simply wanting on the JdK RS-Ratio worth as a gauge, there are solely two sectors on the right-hand aspect of the graph with a studying above 100. These are Actual Property and Utilities. All different sectors are beneath 100 on the RS-Ratio scale and, due to this fact, technically nonetheless in a relative downtrend vs. SPY.

Nevertheless, apart from XLK, all these different sectors are on a optimistic RRG-Heading, between 0 and 90 levels, which is a optimistic takeaway. There’s nonetheless a danger that these tails could roll over whereas nonetheless contained in the bettering quadrant and proceed their relative downtrend, however XLV, XLF, and XLP are wanting particularly sturdy, as they’re getting near crossing over into the main quadrant.

XLY, XLI, XLB, and XLE are nonetheless too low on the RS-Ratio scale for consideration, imho.

SPY is Hitting Resistance

SPY pushing in opposition to resistance is creating an fascinating state of affairs. 565 is clearly an important overhead resistance stage for SPY. Solely when this barrier will be convincingly damaged will there be new upside potential for SPY to proceed the longer-term uptrend. Nevertheless, it’s questionable whether or not SPY can break that barrier with out the assistance of the expertise sector. On the finish of the day, that’s now greater than 30% of the full market capitalization of the S&P 500.

Over the previous few weeks, SPY began to commerce in a variety between 555 and 565. When 555 provides technique to the draw back, important draw back danger will likely be unlocked, concentrating on the latest hole space between 545-548, adopted by intermediate help round 537.5-540 after which 510, which is the extent of the final main low.

Given the significance of the tech sectors within the present atmosphere, I see the chance of a break beneath 555 as better than the potential of a break above 565.

Semis / Tech Are Key

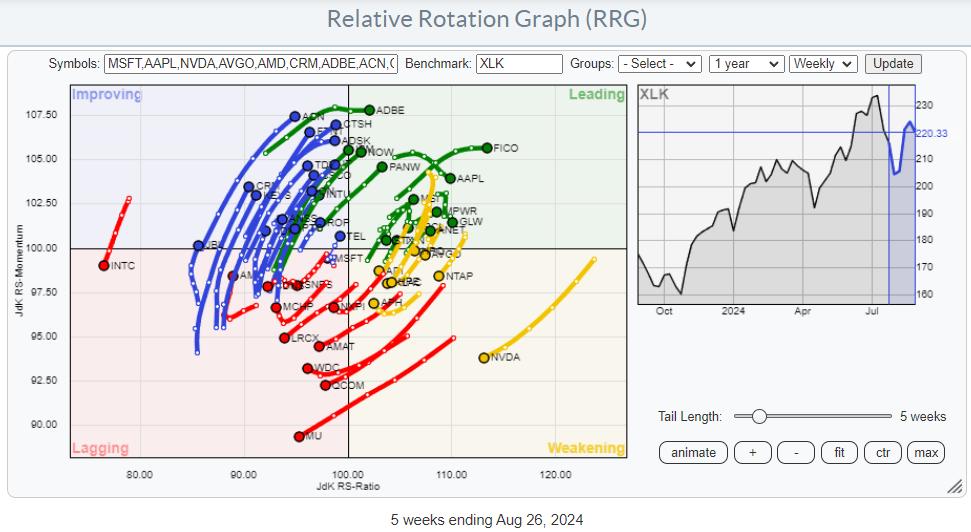

So, the tech sector, and particularly the group semiconductors, will play an necessary position within the coming weeks to find out the religion path of the final market.

This RRG exhibits the members of the Expertise sector. The massive elephant NVDA is clearly seen contained in the weakening quadrant and rotating towards the lagging quadrant at a destructive RRG-Heading.

The semiconductors and semiconductor tools group is now the biggest business contained in the expertise sector, weighing greater than 40%. NVDA itself is now the second-largest inventory within the expertise sector, with a weight of 20%. So when it strikes, it strikes, making the business and the sector transfer.

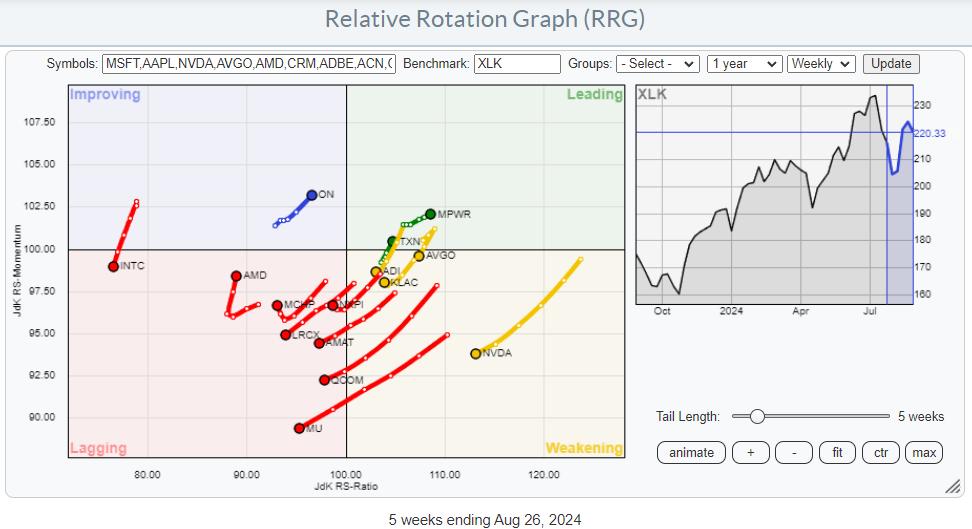

NVDA is BIG, However Not the Solely Semiconductor Inventory

After I isolate the semiconductor shares on the RRG, we see this picture:

Most of those shares are transferring in the identical path as NVDA, on a destructive RRG-Heading, weighing in on the business after which on the sector. Nevertheless, that is a particularly necessary group of shares that deserves not less than a minimal allocation in every portfolio “simply in case all of it turns round and begins to go up once more.” From that perspective, it is sensible to search for options so long as NVDA is rotating on a destructive heading, digesting its latest beneficial properties and relative outperformance.

Looking for shares on a optimistic RRG-Heading gives a couple of potentials.

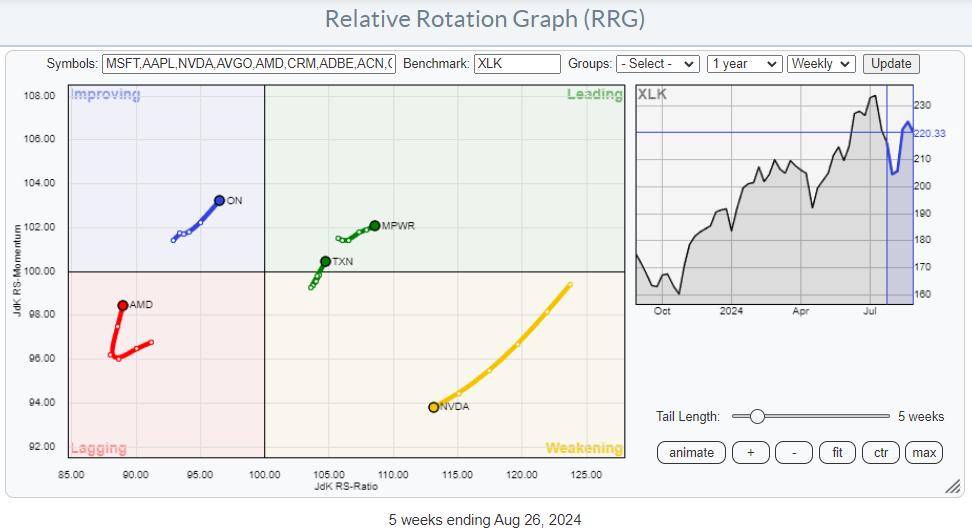

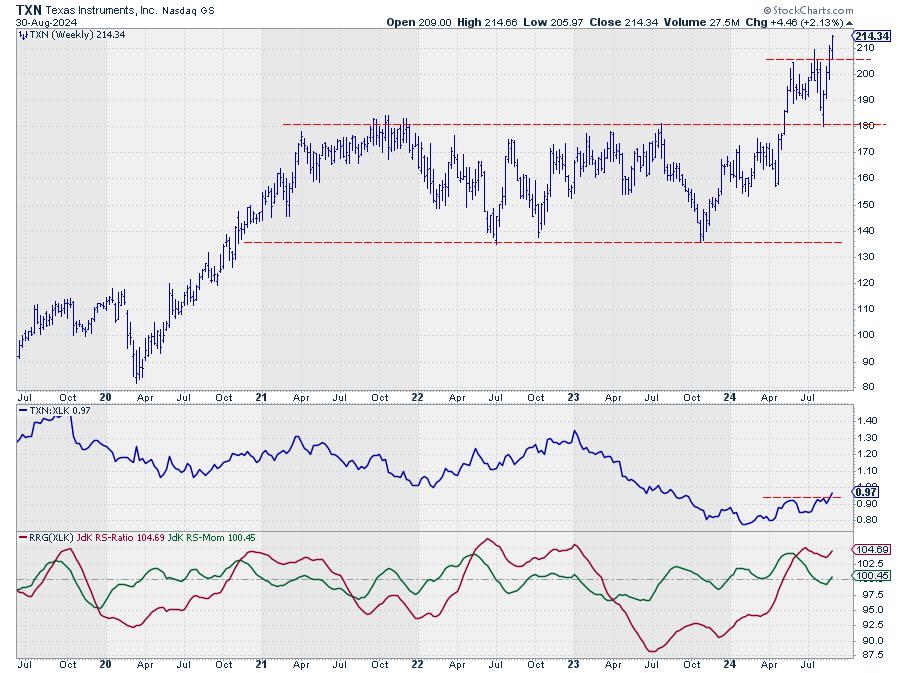

Combining the positions on the RRG and searching on the particular person charts. MPWR and TXN may very well be fascinating options if NVDA maintains its destructive RRG-Heading.

#StayAlert and have an excellent weekend. –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels below the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to reply to every message, however I’ll definitely learn them and, the place fairly doable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered emblems of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative power inside a universe of securities was first launched on Bloomberg skilled providers terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Army Academy, Julius served within the Dutch Air Power in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Be taught Extra