Welcome to OverSeer, your trusted Skilled Advisor designed to remodel the way you commerce indices. That will help you get began, right here’s an in depth information on establishing the EA and understanding its enter parameters.

Enter Parameters Defined

OverSeer provides a variety of enter parameters grouped into classes for simple configuration. Every group focuses on a selected facet of buying and selling, guaranteeing flexibility and management over your buying and selling technique. Listed below are the parameter teams and their objective:

- Basic Settings: Configure core operational settings like buying and selling mode, and the devices you need to commerce.

- Commerce Setup: Outline how trades are entered, together with strategy sort and affirmation settings.

- Place Administration: Handle trades dynamically with options like trailing stops.

- Danger Administration: Management dangers by setting limits on commerce measurement, each day wins, and losses.

- Instrument Dealer Namings Settings: Map broker-specific instrument names to OverSeer for compatibility.

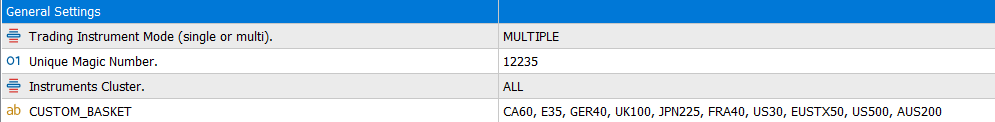

1 – Basic Settings

The Basic Settings group defines the foundational configuration of OverSeer, together with buying and selling modes, magic numbers, and instrument clusters.

Parameters:

-

EA_MODE (Default: SINGLE)

- Description: Determines the buying and selling mode.

- Choices:

- SINGLE: Trades one instrument at a time.

- MULTI: Trades a number of devices concurrently.

- Suggestion: Use SINGLE in case you are specializing in a selected index, or MULTI for a diversified strategy.

-

MAGIC (Default: 12235)

- Description: A singular identifier for trades positioned by OverSeer. This prevents interference from different EAs or guide trades.

- Suggestion: Use a distinct quantity for every occasion of OverSeer on the identical account.

-

CLUSTER (Default: CUSTOM)

- Description: Defines the cluster of devices to commerce.

- Choices:

- DEFAULT: Makes use of preconfigured clusters.

- CUSTOM: Lets you outline your personal basket of devices (see CUSTOM_BASKET ).

- Suggestion: Choose CUSTOM to specify devices tailor-made to your technique.

-

CUSTOM_BASKET (Default: “CA60, E35, GER40, UK100, JPN225, FRA40, US30, EUSTX50, US500, AUS200”)

- Description: A comma-separated record of instrument symbols to commerce.

- Utilization: Enter instrument symbols as they seem in your dealer’s platform.

- Instance: “US500, NAS100, GER40, FRA40”

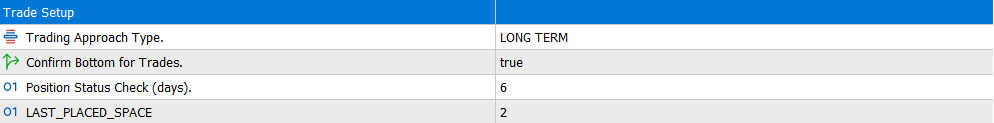

2 – Commerce Setup

The Commerce Setup group means that you can outline OverSeer’s buying and selling type, affirmation logic, and commerce placement guidelines. Notice that OverSeer solely trades primarily based on the Day by day timeframe, whatever the chart timeframe on which it’s utilized.

Parameters:

- Buying and selling Strategy Kind (Default: Lengthy Time period Buying and selling)

- Description: Selects the buying and selling type for OverSeer.

- Choices:

- Lengthy Time period Buying and selling: Focuses on capturing bigger market actions and holding positions for prolonged durations.

- Medium Time period Buying and selling: Balances between frequent trades and longer holding durations, making it very best for swing buying and selling.

- Quick Time period Buying and selling: Targets faster trades with smaller value actions, designed for extra energetic methods.

- Suggestion: Select a buying and selling strategy that aligns together with your targets. All buying and selling choices are primarily based on the Day by day timeframe for constant outcomes.

- Verify Backside for Trades (Default: true)

- Description: Permits the affirmation logic to establish and validate market bottoms earlier than inserting purchase trades.

- Function: Helps filter out false indicators and ensures OverSeer solely locations trades when situations strongly favor upward motion.

- Suggestion: Preserve this enabled to extend commerce accuracy, particularly in unsure or risky markets.

- Place Standing Examine (days) (Default: 5)

- Description: Specifies the variety of days OverSeer waits earlier than re-evaluating an open commerce.

- Function: Permits trades ample time to develop whereas avoiding untimely choices.

- Suggestion: For OverSeer’s Day by day timeframe-based technique, use 5–7 days for balanced setups or alter based on your most popular commerce period.

- Final Positioned Area (Default: 2)

- Description: Determines the minimal spacing (in bars) between two consecutive trades.

- Function: Prevents OverSeer from inserting trades too shut to one another, lowering overtrading throughout clustered value actions.

- Suggestion: For each day charts, the default worth of two works nicely. Regulate greater if wanted to fit your market situations.

How Place Administration Works in OverSeer

OverSeer’s place administration system evaluates trades in real-time utilizing a machine studying mannequin skilled for particular devices. The main focus is on optimizing commerce outcomes by dynamically adjusting TP and SL ranges primarily based on the present market situations.

- Key Advantages:

- Maximizing Earnings: Trailing stops are utilized to worthwhile trades to seize further positive aspects.

- Minimizing Losses: Cease-loss ranges are adjusted for dropping trades to scale back publicity.

- Ensures that each commerce is managed primarily based on market-specific insights, relatively than static guidelines.

3 – Place Administration

The Place Administration group allows OverSeer’s clever system to judge open positions dynamically. This characteristic is powered by an instrument-specific mannequin that identifies optimum moments to handle trades, whether or not they’re in revenue or loss.

![]()

Parameters:

- Allow Trailing Mannequin (Default: true)

- Description: Prompts the instrument-specific mannequin for managing open positions.

- Function: Ensures that open positions are evaluated at key moments, as decided by the mannequin, to maximise earnings or decrease losses.

- How It Works:

- The mannequin identifies when it’s a superb time to judge open positions for a selected instrument.

- If the place is in revenue:

- The fastened take revenue (TP) is eliminated.

- A dynamic trailing cease is utilized to permit the place to run and seize further positive aspects whereas defending earnings.

- If the place is in loss:

- The stop-loss (SL) is moved nearer to the entry value.

- This reduces the potential loss if the market hits the stop-loss degree.

- Suggestion: Preserve this enabled to leverage OverSeer’s data-driven strategy to commerce administration, particularly in risky or unpredictable markets.

How Danger Administration Works in OverSeer

OverSeer’s danger administration system dynamically adapts primarily based in your enter parameters, guaranteeing that trades are sized appropriately, and account losses are managed. By setting clear limits on each day wins and losses, the EA helps keep long-term sustainability and self-discipline in buying and selling.

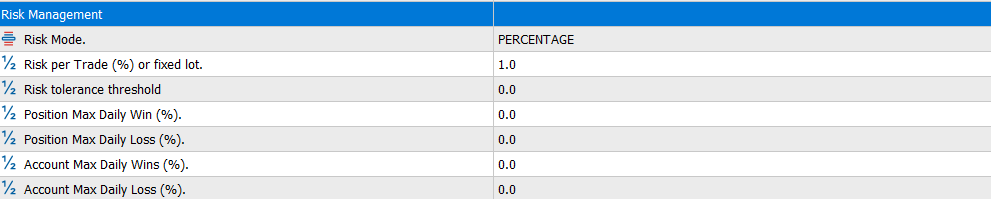

4 – Danger Administration

The Danger Administration group means that you can outline and management the extent of danger OverSeer takes on every commerce and handle each day win and loss limits to guard your account from extreme publicity.

Parameters:

- Danger Mode (Default: Share)

- Description: Determines how the commerce measurement is calculated.

- Choices:

- Share: Lot measurement is calculated as a share of your account steadiness.

- Mounted Lot: A particular lot measurement is used for each commerce.

- Suggestion: Use Share for dynamic danger administration that adapts to your account measurement or Mounted Lot should you choose constant commerce sizes.

- Danger per Commerce (%) or Mounted Lot (Default: 0.5)

- Description: Defines the quantity of danger for every commerce:

- When utilizing Share: The proportion of account steadiness risked per commerce.

- When utilizing Mounted Lot: The lot measurement for use for every commerce.

- Suggestion: For percentage-based danger, a worth between 0.5%–2% is mostly secure. Regulate primarily based in your danger tolerance.

- Danger Tolerance Threshold (Default: 0)

- Description: Specifies the utmost allowable deviation between the user-defined danger and the precise danger of a commerce. This ensures that the EA can alter to account-specific constraints (e.g., minimal lot measurement, lot steps, or instrument contract measurement) whereas respecting the person’s danger tolerance.

- Function:

- If the calculated lot measurement can not exactly match the user-defined danger on account of dealer limitations (e.g., minimal lot measurement is just too massive), this parameter defines how a lot greater the precise danger may be in comparison with the outlined danger.

- For instance, if the person units a danger of 0.5% and a threshold of 2, the EA is allowed to danger as much as 2 instances the outlined danger (e.g., 1%) if crucial to satisfy dealer constraints.

- How It Works:

- If the EA calculates so much measurement such that the precise danger exceeds the user-defined danger however remains to be inside the allowed threshold, the commerce shall be positioned.

- If the precise danger exceeds the brink, the commerce is not going to be positioned.

- Instance:

- Account steadiness: $100.

- Danger: 0.5% → Desired danger: $0.50 per commerce.

- Dealer minimal lot measurement causes the precise danger to be $1.00 (double the specified danger).

- If the brink is ready to 2, the EA will enable the commerce for the reason that precise danger ($1.00) is inside 2x the outlined danger ($0.50).

- If the brink is 1.5, the commerce wouldn’t be positioned since $1.00 exceeds 1.5x $0.50 ($0.75).

- Suggestion:

- Go away at 0 if you’d like the EA to keep away from inserting trades the place the precise danger exceeds the outlined danger.

- Set a threshold (e.g., 1.5 – 2 ) to permit some flexibility, particularly when buying and selling small account balances or devices with bigger contract sizes.

- Place Max Day by day Win (%) (Default: 0.00)

- Description: Limits the revenue that may be realized from open positions on a single buying and selling day.

- Function: Locks in positive aspects as soon as this share of the account steadiness is reached, pausing buying and selling for the remainder of the day.

- Suggestion: Set this if you wish to safe earnings after reaching a selected each day goal.

- Place Max Day by day Loss (%) (Default: 0.00)

- Description: Limits the utmost loss allowable from open positions on a single buying and selling day.

- Function: Prevents extreme losses by halting buying and selling if this share of the account steadiness is misplaced in a day.

- Suggestion: Use this to outline a strict each day loss restrict, sometimes between 2%–5% of the account steadiness.

- Account Max Day by day Wins (%) (Default: 0.00)

- Description: Units the utmost revenue that may be achieved throughout all trades for the account in a single day.

- Function: Stops buying and selling for the day as soon as this goal is reached, guaranteeing positive aspects are preserved.

- Suggestion: Use this to set a each day profit-taking purpose to your total account.

- Account Max Day by day Loss (%) (Default: 0.00)

- Description: Defines the utmost loss allowed for the account in a single buying and selling day.

- Function: Ensures that losses are capped at a predefined degree, defending the account steadiness from vital drawdowns.

- Suggestion: Set this to a worth you’re snug with dropping in a day, sometimes not more than 5%.

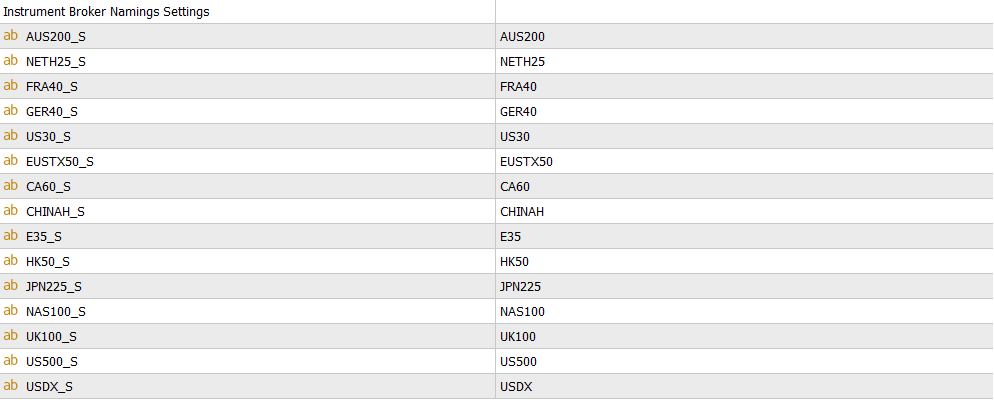

5 – Instrument Dealer Namings Settings

This part ensures compatibility between OverSeer and your dealer’s instrument names. Since completely different brokers might use variations of ordinary instrument symbols (e.g., “US500” vs. “US500.professional”), these settings help you map OverSeer’s instrument record to the names utilized by your dealer.

-

How It Works:

For every instrument, you may specify the precise title your dealer makes use of. For instance:- In case your dealer lists the S&P 500 as “US500.professional,” replace the US500_S parameter to “US500.professional.”

-

Why It’s Vital:

Correct mapping ensures OverSeer can acknowledge and commerce the proper devices in your account. With out correct names, the EA might not operate as meant. -

Suggestion:

Confirm your dealer’s instrument names within the Market Watch panel and replace the parameters on this part accordingly.