On this weblog, I’ll share key fundamentals of buying and selling methods that will help you acknowledge and keep away from frequent pitfalls. My purpose is to equip you with the information to make smarter choices and keep away from the traps that many new merchants fall into.

Completely different Forms of Buying and selling Technique

For systematic buying and selling methods(utilizing bot to execute trades), all of them fall into the next two sorts of methods

Constructive Skew

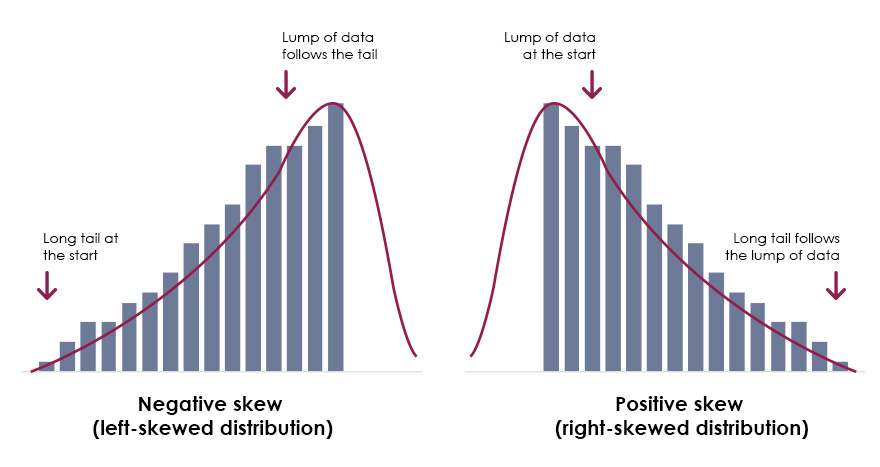

A optimistic skew technique is characterised by frequent small losses and rare giant wins. As proven within the graph, the distribution encompasses a lengthy tail on the optimistic facet, representing the potential for important positive factors, whereas nearly all of outcomes are clustered round small losses. These methods usually have a low win charge however a excessive reward-to-risk ratio.

An instance of a optimistic skew technique is development following, the place the technique goals to seize rare, giant developments in an instrument over the course of a yr. Whereas losses could also be frequent, the occasional giant development can greater than compensate for them, making these methods doubtlessly very worthwhile in the long term.

Unfavourable Skew

A adverse skew technique, however, is characterised by frequent small positive factors and occasional giant losses. The distribution has an extended tail skewed to the adverse facet, reflecting the danger of serious drawdowns. These methods typically have a excessive win charge, as small income are accrued persistently, however they carry the hazard of rare however extreme losses.

Examples of adverse skew methods embrace carry trades and unfold betting. In carry trades, as an example, merchants earn small, common income by making the most of rate of interest differentials however are uncovered to substantial dangers throughout sudden market corrections or occasions of excessive volatility.

Summarised traits of methods

|

Constructive Skew |

Unfavourable Skew |

|---|---|

|

low win charge |

excessive win charge |

|

sometimes large positive factors |

sometimes large losses |

|

excessive reward-risk ratio |

low reward-risk ratio |

Virtually all buying and selling methods fall into certainly one of these two varieties, and there is no such thing as a such factor as an ideal technique with a excessive win charge, excessive reward-to-risk ratio, and minimal drawdowns. It is a elementary precept of buying and selling methods, and holding it in thoughts might help you keep away from many apparent scams.

So which technique is healthier? The reality is, there’s no definitive reply. Should you’ve analyzed sufficient buying and selling methods, you’ll perceive that all the pieces comes with a trade-off. To extend the win charge, you have to compromise on the reward-to-risk ratio, and vice versa.

Constructive skew methods can ship occasional huge wins, however they require important endurance and self-discipline to endure the frequent small losses encountered throughout common buying and selling days.

Unfavourable skew methods, however, present frequent small positive factors in regular circumstances however include the danger of uncommon, catastrophic losses. Managing danger is especially difficult with these methods. A well-known instance is Lengthy-Time period Capital Administration (LTCM), a hedge fund from the Nineties that relied closely on adverse skew methods and in the end collapsed throughout a monetary disaster.

Easy methods to measure a method

With an understanding of technique varieties, a pure query arises: How can we examine the efficiency of buying and selling methods? Whereas excessive returns typically seize our consideration, it’s essential to not overlook the underlying dangers. In monetary markets, return and danger are inherently linked. The basic ideas of buying and selling dictate that no technique affords excessive returns with low danger, making danger measurement important for evaluating any technique.

As an instance the significance of danger, think about the next returns:

technique 1: [10, 8, 12, 10] technique 2: [5, 25, 7, 3] technique 3: [7, -2, 15, 20]

Every of those methods yields a median return of 10%, however which one is healthier? Intuitively, many would select Technique 1 for its stability. This highlights a key metric for evaluating danger: the soundness or uncertainty of returns. People are naturally risk-averse, and on the subject of cash, we gravitate in the direction of predictability and decrease uncertainty.

To measure danger mathematically, we use variance and commonplace deviation. Listed here are the usual deviations for the methods above:

technique 1: 1.41 technique 2: 8.77 technique 3: 8.33

To mix danger and return right into a complete measure, we use the Sharpe Ratio.

The Sharpe Ratio measures how nicely an funding’s returns compensate for its danger. It compares the common return of an funding (above the risk-free charge) to its volatility (commonplace deviation of returns).

Simplifying this idea, we are able to use the return divided by the usual deviation to calculate the Sharpe Ratio for the methods:

technique 1: 7.07 technique 2: 1.14 technique 3: 1.20

Based mostly on the Sharpe Ratio, Technique 1 clearly stands out with its superior risk-adjusted return.

Now, suppose you can solely select between Technique 2 or Technique 3. The Sharpe Ratio means that Technique 3 is barely higher. Nevertheless, Technique 3 additionally has a dropping yr, introducing extra uncertainty. This may be measured by drawdowns.

To account for drawdowns alongside returns, we use one other metric: the Calmar Ratio.

The Calmar Ratio compares an funding’s common annual return to its most drawdown, offering a stability between danger and reward.

On this simplified instance, Methods 1 and a couple of don’t have any drawdowns, leading to infinite Calmar Ratios. In real-world eventualities, nevertheless, drawdowns are inevitable, making this ratio dependable for evaluating methods

What’s a Practical Efficiency?

By now, we perceive that there’s no good technique—larger returns at all times include larger dangers. One of the best merchants can do is discover numerous buying and selling concepts to extend returns and use diversification to scale back danger. Even probably the most superior buying and selling methods have limits.

Empirically, the Sharpe Ratio for energetic buying and selling methods hardly ever exceeds 2. Methods performing above this threshold over prolonged durations are extremely unlikely to be sustainable.

For instance, Lengthy-Time period Capital Administration (LTCM), a well-known hedge fund within the Nineties, initially achieved almost 40% annual returns with minimal drawdowns. Nevertheless, it employed adverse skew methods, and a monetary disaster in the end wiped it out. Whereas there have been a number of components behind LTCM’s collapse, the takeaway is obvious: no technique can persistently outperform (Sharpe Ratio > 2) over the long run.

Usually:

- A Sharpe Ratio > 1.0 is taken into account excellent.

- Growing returns at all times requires accepting extra danger.

This trade-off is a elementary constraint, akin to gravity for all times on Earth.

Why do Some Backtests Look Too Good to Be True?

When shopping technique marketplaces, you could encounter methods with unrealistically excessive Sharpe Ratios. These “off-the-charts” outcomes typically have underlying points:

Overfitting

Overfitting happens when a method is overly tailor-made to historic knowledge, capturing noise and randomness that gained’t repeat sooner or later. It’s like memorizing solutions for a selected check fairly than understanding the topic. Such methods carry out exceptionally nicely in backtests however fail in stay markets.

Imperfect Backtesting

Backtesting in platforms like MetaTrader has many limitations, together with low-quality knowledge, inaccurate tick values, and lacking prices (e.g., swaps or charges). Even with these points resolved, backtesting outcomes ought to solely function directional estimates—not actual predictors of stay buying and selling efficiency.

Ignoring Buying and selling Prices

For energetic methods, buying and selling prices can eat over 30% of income. Prices akin to spreads, commissions, and slippage range relying on leverage and brokers, and lots of backtests fail to account for these real-world bills.

Unmanaged Dangers

Even methods with stellar paper outcomes could be dangerous. Key inquiries to ask embrace:

- How is danger managed?

- Does it use adverse skew methods liable to catastrophic losses?

A method that seems “too good to be true” on paper may lack sturdy danger administration.

How we Strategy Technique Improvement

At @Lookatus, we deal with idea-driven methods grounded in well-researched buying and selling ideas. To keep away from performance-driven overfitting, we emphasize sturdy design and practical testing. Our danger discount method consists of:

- Strict stop-loss controls.

- Extremely diversified portfolios throughout a number of markets.

- Danger-weighting based mostly on correlation fairly than efficiency.

Throughout testing, we handle backtesting limitations by:

- Utilizing high-quality knowledge.

- Implementing offline simulations to account for real-world prices.

- Evaluating devices over prolonged durations (10+ years).

Abstract

On this weblog, we mentioned the ideas and traits of buying and selling methods, the way to measure their efficiency, and the pitfalls to keep away from. By understanding these fundamentals, you’ll be higher outfitted to establish failing methods and make knowledgeable buying and selling choices. Keep in mind: there is no such thing as a good technique—solely knowledgeable trade-offs between danger and reward.

About Us

We’re @lookatus, a devoted crew of merchants and engineers dedicated to creating REAL worthwhile, systematic buying and selling options. With a robust basis in quantitative evaluation and cutting-edge expertise, our mission is to ship dependable, data-driven buying and selling techniques that capitalize on market alternatives with precision and consistency. Past constructing superior instruments, we’re captivated with empowering merchants by way of sensible schooling, equipping them with actual, actionable insights to navigate markets intelligently and efficiently.

Contact us at: haylookatus@gmail.com