Provide chain disruptions grew to become a significant headache for companies within the aftermath of the pandemic. Certainly, in October 2021, practically all companies in our regional enterprise surveys reported a minimum of some problem acquiring the provides they wanted. These provide chain disruptions have been a key contributor to the surge in inflation that occurred because the financial system recovered from the pandemic recession. On this publish, we current new measures of provide availability from our Enterprise Leaders Survey and Empire State Manufacturing Survey that intently monitor the New York Fed’s World Provide Chain Stress Index (GSCPI). We’ll start publishing these knowledge on a month-to-month foundation beginning in June. These indexes point out that provide availability had usually been bettering since early 2023, however over the previous couple of months, enchancment has stalled. This development is regarding since our Could Supplemental Survey signifies that between a 3rd and a half of companies within the area are experiencing difficulties acquiring provides, and plenty of are lowering operations and elevating costs to compensate, although to a lesser extent than just a few years in the past.

A New Provide Availability Index

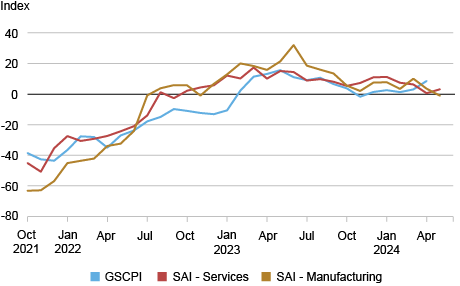

In October 2021, we started asking companies in our surveys if provide availability had improved, remained unchanged, or worsened in comparison with the prior month, permitting us to derive diffusion indexes of provide availability for each service companies and producers. We calculate our new provide availability indexes (SAIs) because the share reporting that provide availability improved over the month minus the share that report provide availability worsened. Thus, optimistic values of the SAIs recommend that, on the entire, provide availability improved over the month for companies within the area, and unfavourable values recommend that provide availability worsened. This index is just like the GSCPI, which integrates a wide selection of worldwide knowledge to derive an index that presents a complete abstract of potential provide chain disruptions from world wide. Optimistic values for the GSCPI recommend provide pressures are above their historic averages—in different phrases, worse than regular—whereas unfavourable values recommend provide pressures are higher than regular. Thus, readings of the GSCPI could be considered just like what optimistic and unfavourable values of our SAIs measure (a month-to-month change), although with the indicators reversed.

Within the chart beneath, we present our new SAIs along with the GSCPI for the interval our surveys overlap (the GSCPI begins in 1997). For comparability, we flip the signal on the GSCPI to correspond to our SAIs, in order that optimistic values on the chart point out fewer provide disruptions whereas unfavourable values point out larger provide disruptions and multiply the GSCPI by 10 to place it on the identical scale because the SAIs.

Provide Availability Indexes Seize World Provide Chain Disruptions

Notes: GSCPI is World Provide Chain Stress Index. SAI is provide availability index.

All three provide indexes intently monitor one another. The indexes usually stay beneath and above zero on the similar time, and actions within the indexes correlate fairly intently. These patterns suggests that provide chain disruptions confronted by regional companies correspond to world disruptions, which is to be anticipated since companies usually supply their provides from world wide, both instantly or not directly. Nonetheless, the sequence exhibit considerably totally different traits in late 2022. Our indexes turned optimistic (indicating enchancment) in August 2022 whereas the GSCPI remained unfavourable and edged down for some months earlier than turning optimistic in early 2023. This divergence might be resulting from variations between provide availability within the U.S. relative to the world extra broadly. Particularly, the Russia-Ukraine battle was progressing at the moment, affecting corporations in Europe extra instantly than these within the U.S., and China skilled energy outages in the summertime of 2022 resulting from a record-breaking warmth wave and drought, inflicting disruptions and closures of some transport routes.

Notably, the three provide indexes have usually been above zero since early 2023, suggesting that provide availability has been bettering for roughly the final yr and a half, a interval throughout which inflationary pressures moderated. Nonetheless, over the previous couple of months, the SAIs have hovered round zero, with the newest SAI-Manufacturing studying suggesting enchancment has stalled. This development is regarding as supplemental questions posed to companies within the Could survey point out that provide disruptions stay vital for a lot of companies within the area. Certainly, the current lack of enchancment in provide availability has occurred as inflation confirmed some stickiness.

Regardless of Progress, Enterprise Exercise Nonetheless Being Affected

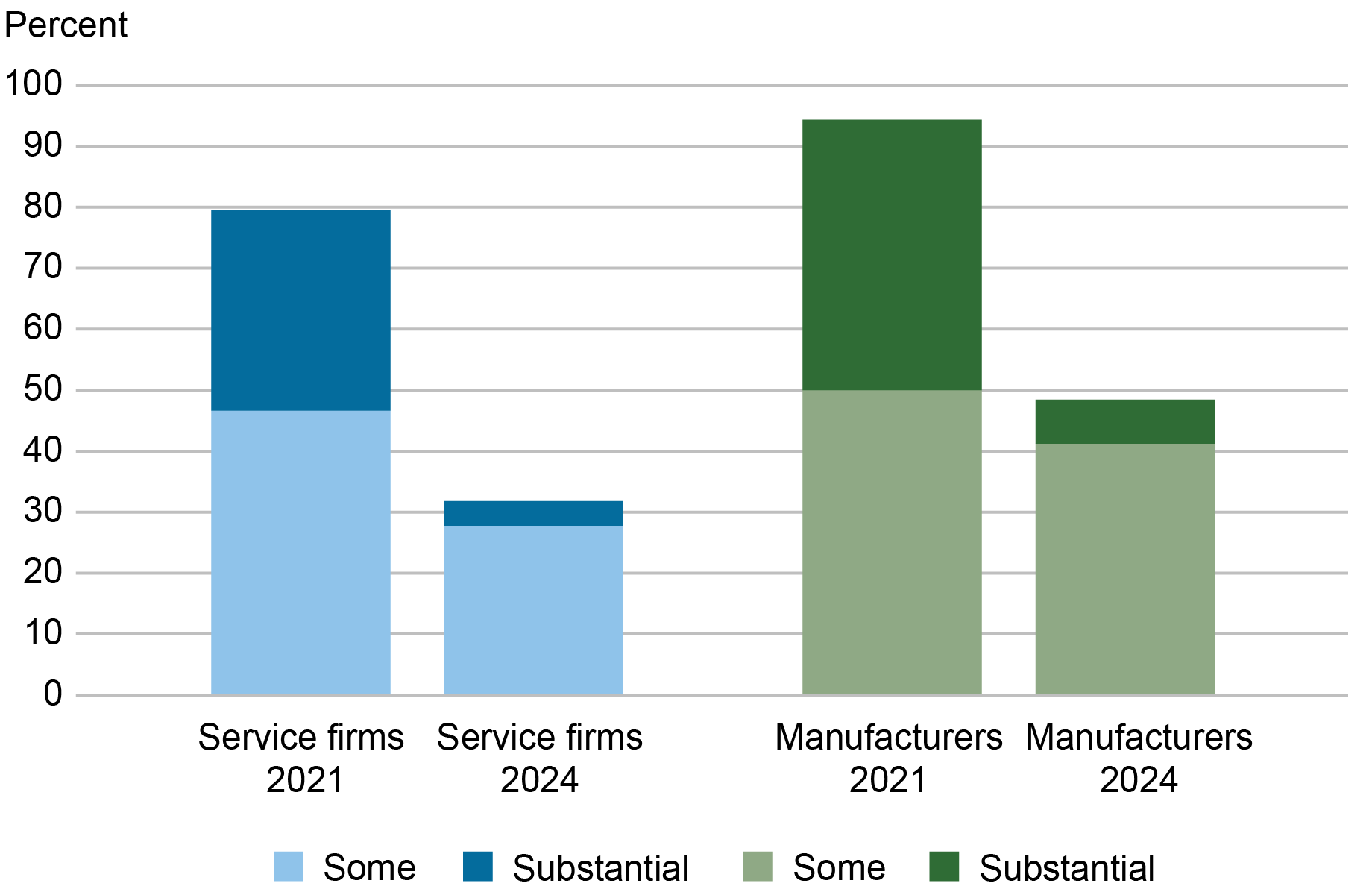

Our Could enterprise surveys requested companies how vital provide chain disruptions have been over the month, a query which we additionally requested in October 2021. As proven within the chart beneath, whereas practically 80 % of service companies and virtually 95 % of producers reported that they’d problem acquiring provides in October 2021, these shares have fallen to a few third of service companies and just below half of producers within the Could 2024 survey. Of notice, the share of companies reporting substantial provide disruptions has fallen significantly to only a small proportion.

Provide Chain Disruptions Have Subsided however Nonetheless Have an effect on a Vital Variety of Companies

And whereas roughly 70 % of service companies and 90 % of producers reported that provide disruptions have been impeding enterprise exercise in October 2021, these shares have fallen to 24 % and 43 % in Could 2024. All in all, whereas a lot progress has been made, provide chain disruptions stay vital and are restraining enterprise exercise for a lot of companies within the area, although a lot much less so than in 2021.

How Are Companies Coping?

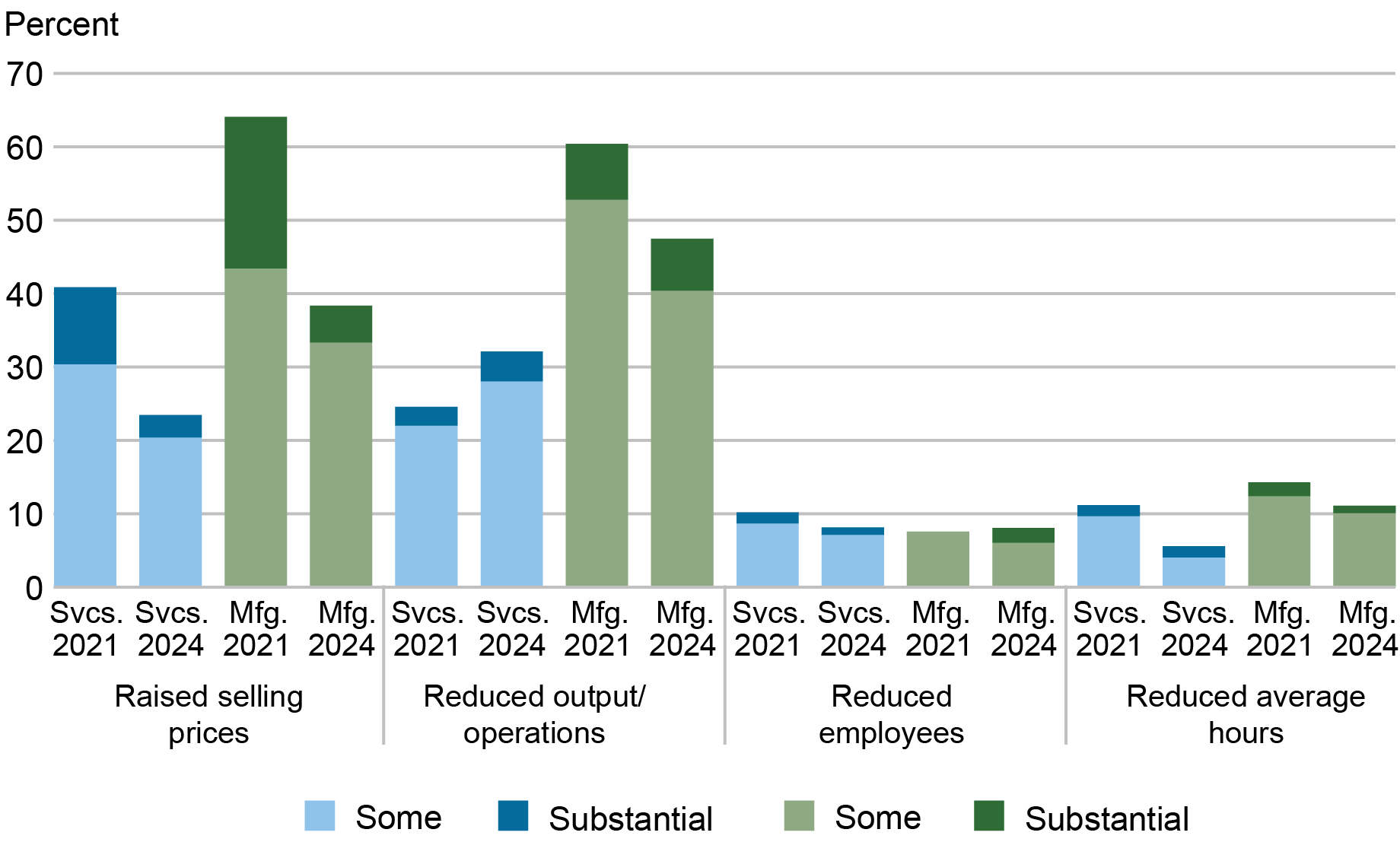

We additionally requested companies what actions they’d taken in response to produce chain disruptions over the previous three months, specializing in adjustments to costs, output, employment, and hours labored. Because the chart beneath exhibits, a few quarter of service companies and practically 40 % of producers elevated their promoting costs. Whereas such value changes have been a lot much less frequent than in October 2021, such excessive shares of companies elevating costs in response to produce chain disruptions might be contributing to inflationary pressures within the financial system.

Actions Taken Because of Provide Chain Disruptions

A few third of service companies reported reductions in enterprise operations resulting from provide chain disruptions, a better share than the 25 % who reported such reductions in 2021, whereas just below half of producers stated they’d scaled again output, beneath the 60 % who stated so in 2021. Cuts to employment or hours labored weren’t quite common, just like 2021.

Conclusion

Provide chain disruptions emerged as a significant concern because the financial system started to recuperate from the pandemic recession and have been a key contributor to excessive inflation since then. As such, understanding and measuring provide chain disruptions are an essential ingredient in understanding inflationary pressures within the financial system. Our provide availability indexes (SAIs) current a brand new gauge to measure such disruptions and have the benefit of being launched early within the month as a part of our common regional enterprise surveys, earlier than many different indicators can be found. Our Could launch, along with our supplemental survey, exhibits that provide disruptions are a lot much less vital than just a few years in the past when there have been vital imbalances within the financial system, although provide availability has not been bettering over the previous couple of months. Our survey outcomes point out that many companies are elevating costs resulting from provide disruptions at a time when there was a scarcity of additional enchancment in provide availability, a troubling mixture when inflation stays above the Federal Reserve’s inflation objective.

Jaison R. Abel is the top of City and Regional Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Richard Deitz is an financial analysis advisor in City and Regional Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

The best way to cite this publish:

Jaison R. Abel and Richard Deitz , “Provide Chain Disruptions Have Eased, However Stay a Concern ,” Federal Reserve Financial institution of New York Liberty Road Economics, Could 20, 2024, https://libertystreeteconomics.newyorkfed.org/2024/05/supply-chain-disruptions-have-eased-but-remain-a-concern/.