Introduction:

Buying and selling indices is a dynamic problem requiring precision, adaptability, and strong methods. With OverSeer, we’ve redefined how buying and selling works by integrating machine studying fashions into the very core of the Skilled Advisor. This submit will stroll you thru the distinctive method we’ve taken, how machine studying drives our technique, and the way it’s seamlessly built-in into MQL5.

Python Implementation: Harnessing the Energy of Hidden Markov Fashions (HMMs)

Step one in OverSeer’s machine learning-driven technique begins with the Python implementation. At its core, we use a Hidden Markov Mannequin (HMM) to categorise market states for every instrument. This statistical instrument permits us to research patterns in worth actions and categorize them into distinct states, forming the inspiration of our buying and selling selections.

Why Use HMM for Market State Detection?

Hidden Markov Fashions are well-suited for this activity as a result of they excel at uncovering underlying constructions in time-series information. Right here’s the way it works:

- Remark: The mannequin observes price-based options (e.g., worth adjustments, volatility, and many others.) from historic information.

- State Identification: It assigns every statement to one in all a number of hidden states, which signify distinct market circumstances (e.g., trending, consolidating, risky).

- Chance Mapping: Every state comes with chances, permitting us to know the chance of transitioning from one state to a different.

HMM is good for figuring out patterns as a result of it doesn’t depend on express labels—it learns straight from the info, making it strong and adaptive throughout numerous market circumstances.

Visualizing HMM States

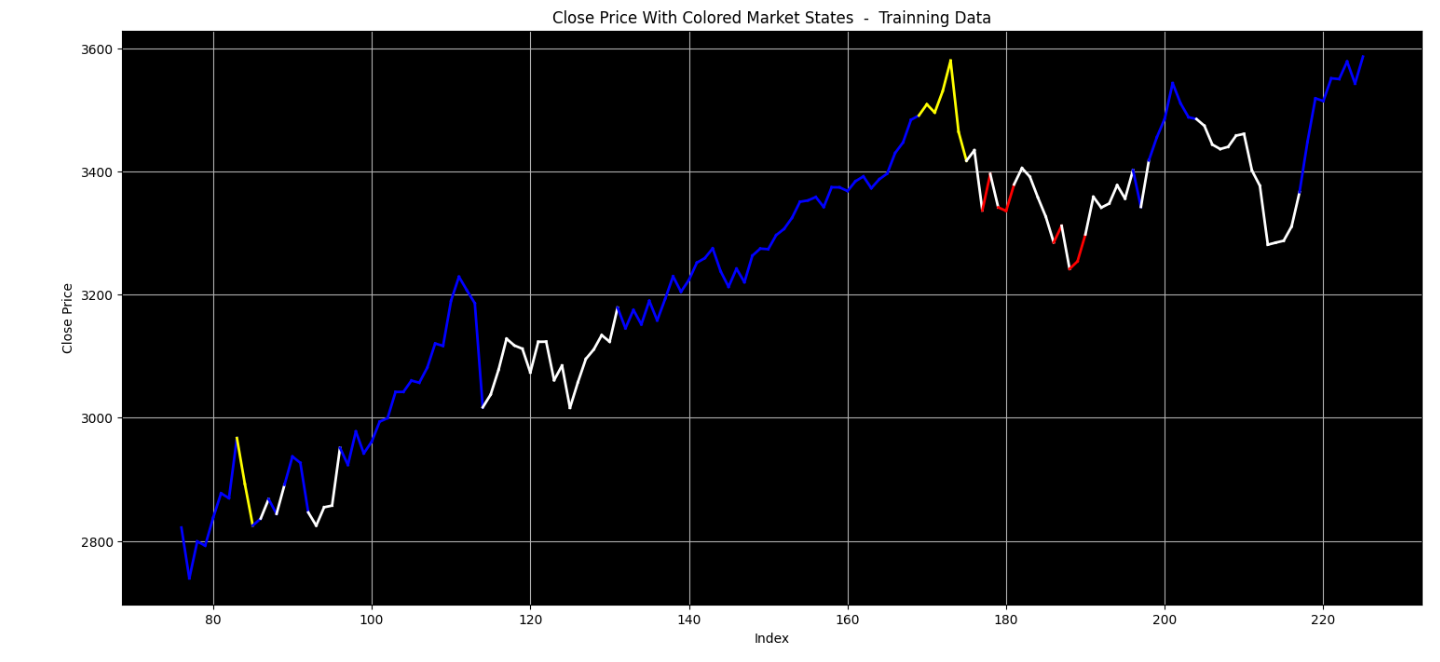

Right here’s an instance of how the HMM mannequin identifies states within the information:

The chart above shows the outlined market states of the HMM mannequin on a section of coaching information, the place every colour corresponds to a definite market state. Our focus is on figuring out states that signify comparatively good shopping for alternatives—not good entries, however favorable ones in comparison with neighboring costs. On this chart, the market states represented by white and purple align with this focus.

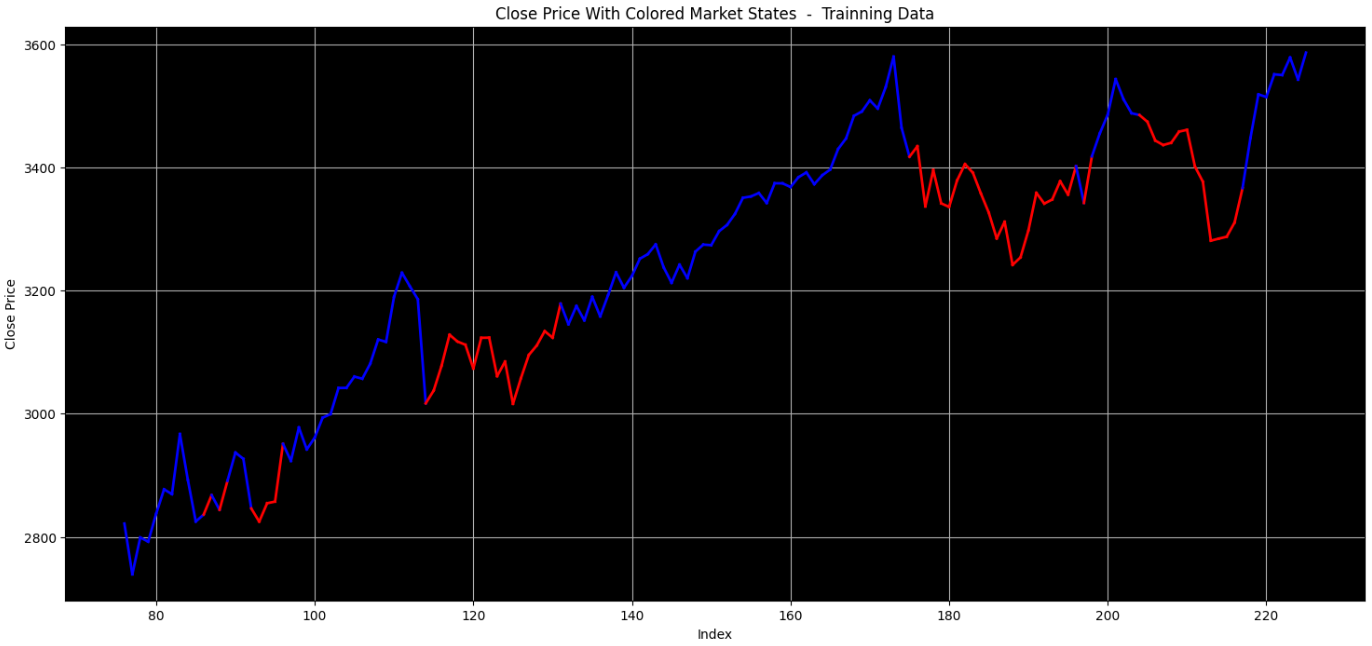

To simplify our evaluation, we consolidate the states into two classes: purple for the market states of curiosity (good shopping for alternatives) and blue for all different states. The picture under illustrates this simplified categorization on the identical coaching information slice.

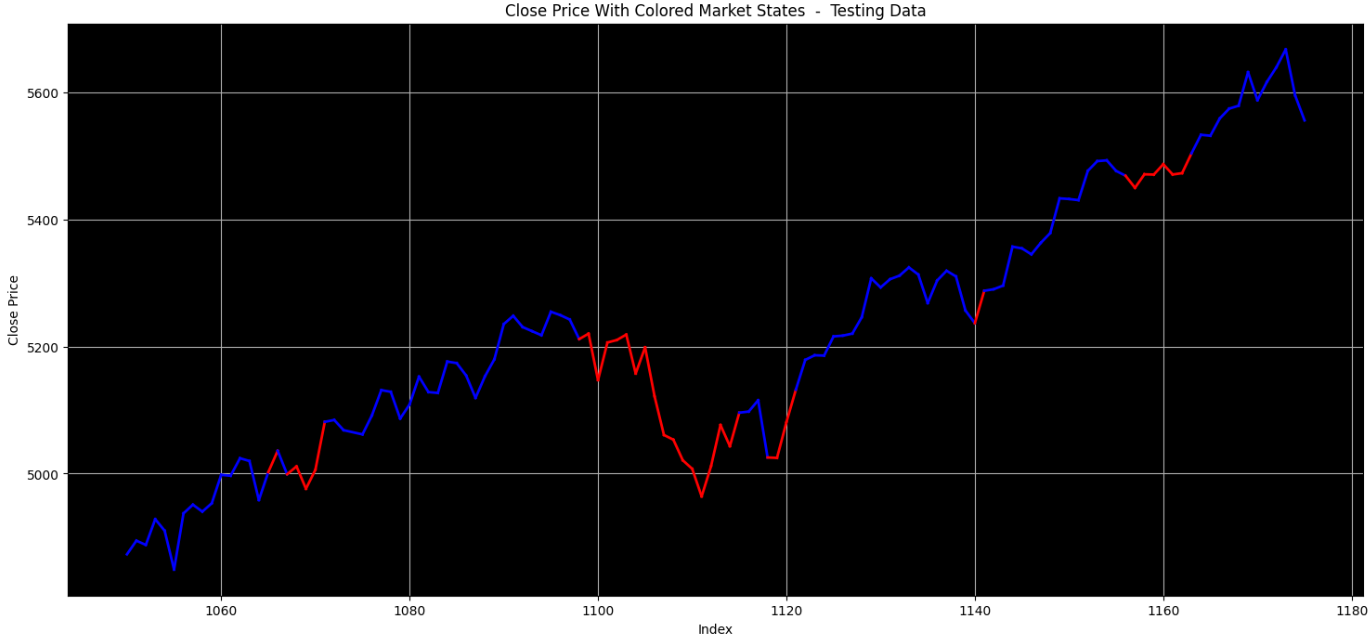

The chart under applies the identical color-coded market states to a section of testing information, utilizing the educated HMM mannequin. Right here, purple represents the states recognized as “good shopping for alternatives,” whereas blue signifies states not of curiosity. This visualization demonstrates the mannequin’s capability to generalize its understanding of favorable market circumstances to unseen information, sustaining consistency in figuring out alternatives aligned with our focus.

A Balanced Method to Buying and selling Alternatives

It’s essential to do not forget that the purpose is to not establish good commerce entries however slightly to concentrate on general good shopping for moments that present a relative benefit in comparison with neighboring costs. This pragmatic method, mixed with publicity to a number of markets—every with its personal mannequin educated particularly for its distinctive habits—is what makes OverSeer actually attention-grabbing and efficient.

In the identical approach that we use fashions to find out good shopping for alternatives, we additionally prepare separate fashions to replicate on open positions. These fashions concentrate on figuring out optimum moments for place administration, supported by further algorithms to make dynamic, data-driven selections for safeguarding earnings and managing dangers. OverSeer ensures that each entry and administration selections are grounded in actionable insights tailor-made for every market.

Machine Studying Integration Instantly in MT5

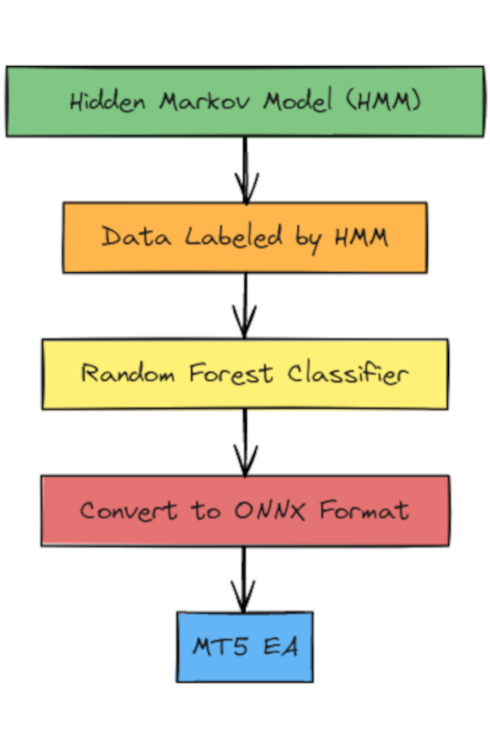

Integrating machine studying into MT5 posed a singular problem, as Hidden Markov Fashions (HMMs)—used to outline market states—don’t help direct conversion to the ONNX format required for seamless integration. To beat this, we launched an middleman step:

-

Coaching a Classifier Mannequin:

Utilizing the market states outlined by the HMM mannequin, we prepare a Random Forest Classifier. This mannequin learns to duplicate the state classifications supplied by the HMM, successfully bridging the hole between Python’s highly effective statistical instruments and MT5’s real-time buying and selling logic. -

ONNX Conversion:

As soon as educated, the Random Forest Classifier is transformed into the ONNX format. This standardized format ensures compatibility with MT5, enabling the mannequin to be straight imported into the Skilled Advisor’s supply code. -

Actual-Time Software in MT5:

Inside OverSeer, the imported ONNX fashions function in real-time, evaluating options calculated from incoming information and producing selections for each commerce entries and place administration. This integration ensures that the insights derived from machine studying are seamlessly utilized to stay buying and selling situations.

This resolution highlights OverSeer’s capability to leverage superior machine studying fashions whereas sustaining the practicality and effectivity required for real-time buying and selling in MT5.

Hyperlink to OverSeer: https://www.mql5.com/en/market/product/120625