KEY

TAKEAWAYS

- Sector rotation out of know-how

- All different sectors are selecting up relative energy

- Actual-Property, Utilities, and Financials displaying robust rotations

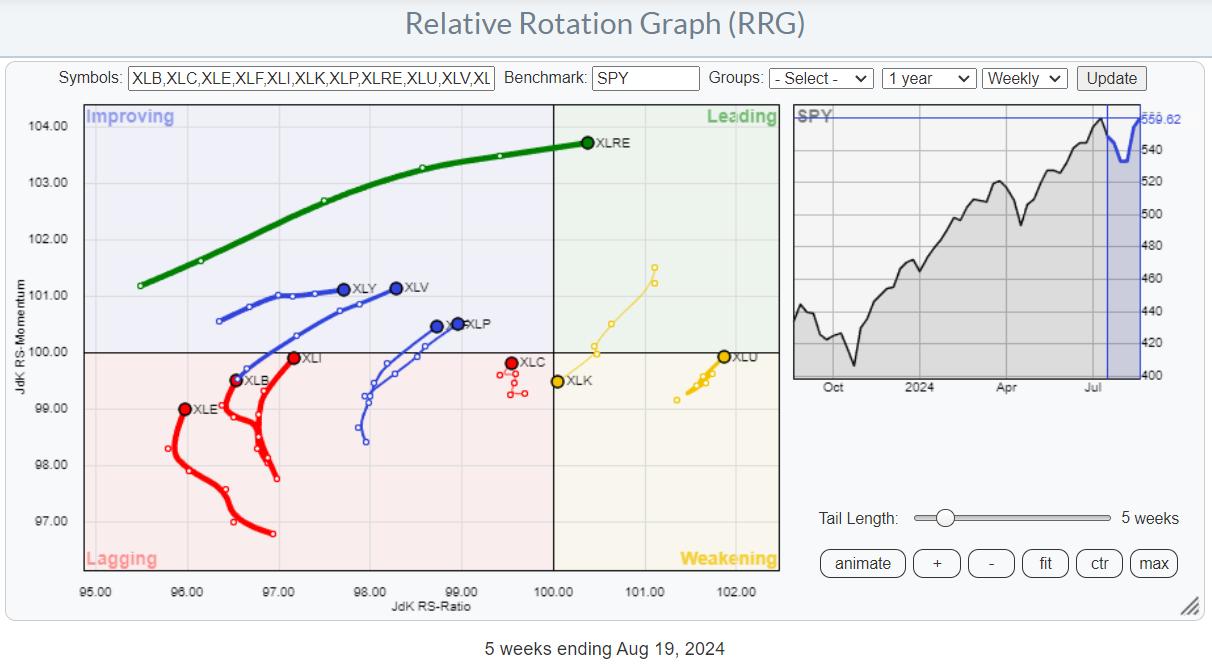

On the weekly Relative Rotation Graph, the rotation nonetheless favors virtually each sector over Know-how. I mentioned the other rotations between weekly and each day RRGs in final week’s video, which you’ll find right here.

Actual Property

Working off this weekly chart, many tails are drawing consideration to themselves. To start with, XLRE has the longest tail and is powering into the main quadrant, displaying that there’s a lot of energy behind this transfer.

That is confirmed on the worth chart, the place XLRE is breaking above horizontal resistance, which frees the best way for additional appreciation. The subsequent goal for XLRE is the height at 46, which was set in August 2022.

Utilities

The second is Utilities, whose tail has sharply rotated again up towards the main quadrant, signaling the beginning of a brand new up-leg inside the already established relative uptrend.

Utilities broke above horizontal resistance a couple of weeks in the past and managed to carry up properly, they usually now appear to be accelerating larger, focusing on the all-time-high stage close to 78.

The lengthy downtrend in relative energy has stalled, with a possible double backside within the making. The RRG-Traces are each bottoming out and beginning to transfer larger.

Financials

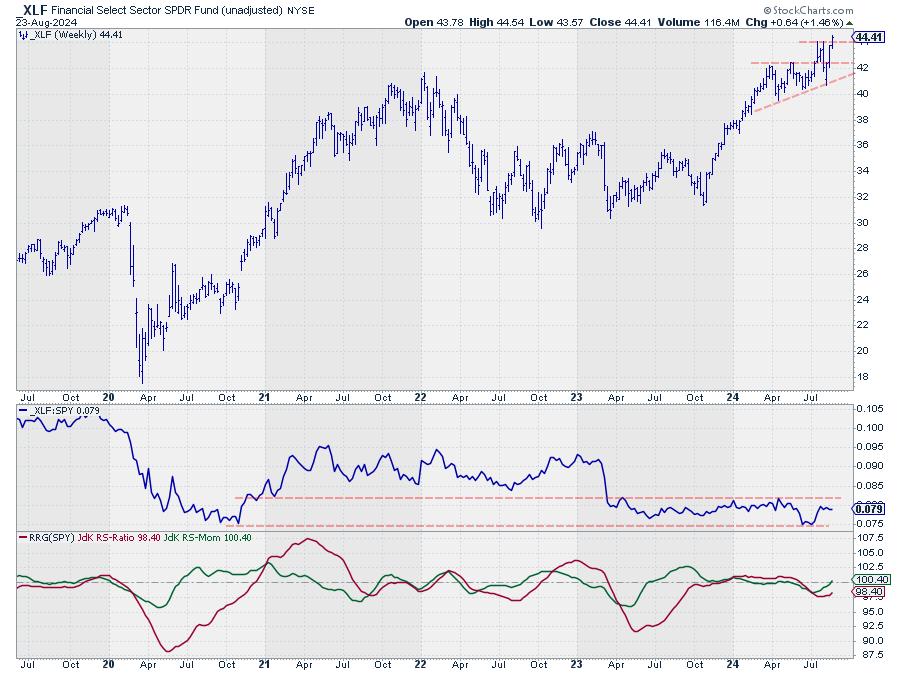

The financials sector, XLF, is simply crossing over into the bettering quadrant from lagging as the worth is breaking to new all-time highs.

Relative Power continues to be captured inside an extended buying and selling vary, however is on its solution to the higher boundary. That’s inflicting the RRG-Traces to show again up. JdK RS-Momentum has already exceeded 100, and JdK RS-Ratio is closing in on that stage.

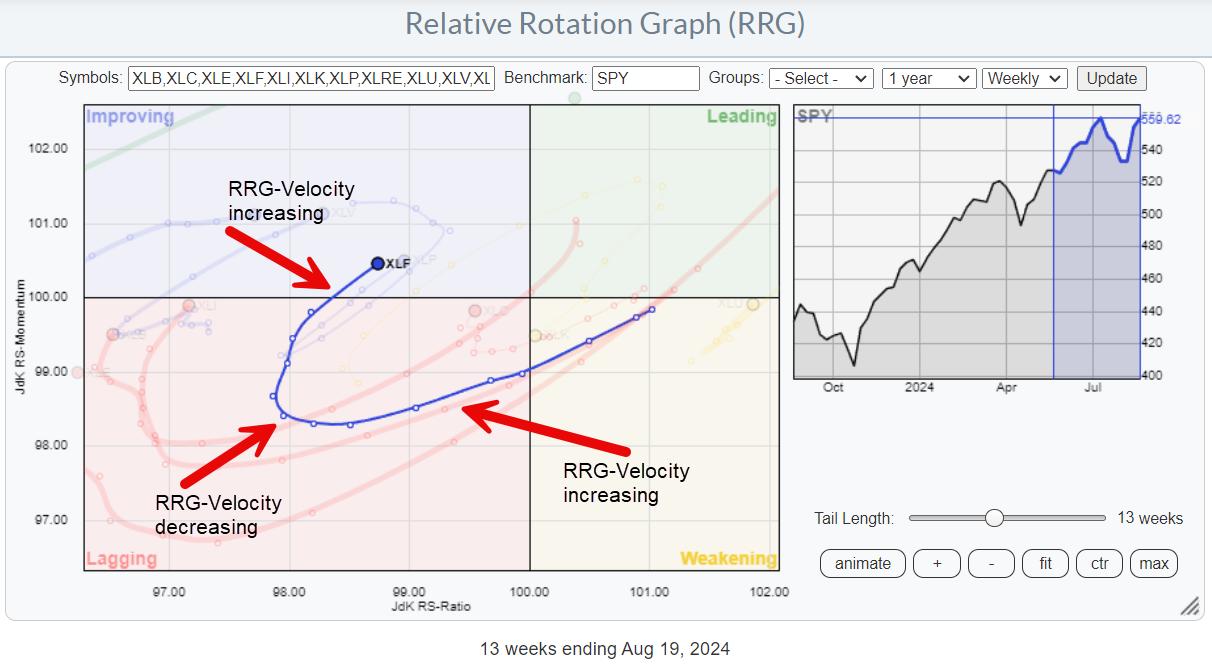

What’s attention-grabbing about this specific tail is that it’s getting longer. RRG-velocity* is growing, which suggests an acceleration of the rotation.

*RRG-Velocity measures the distances between the nodes on a tail. By including up distances, we are able to calculate the tail size, and by evaluating the totally different distances, we are able to consider whether or not the rotation is dashing up or slowing down.

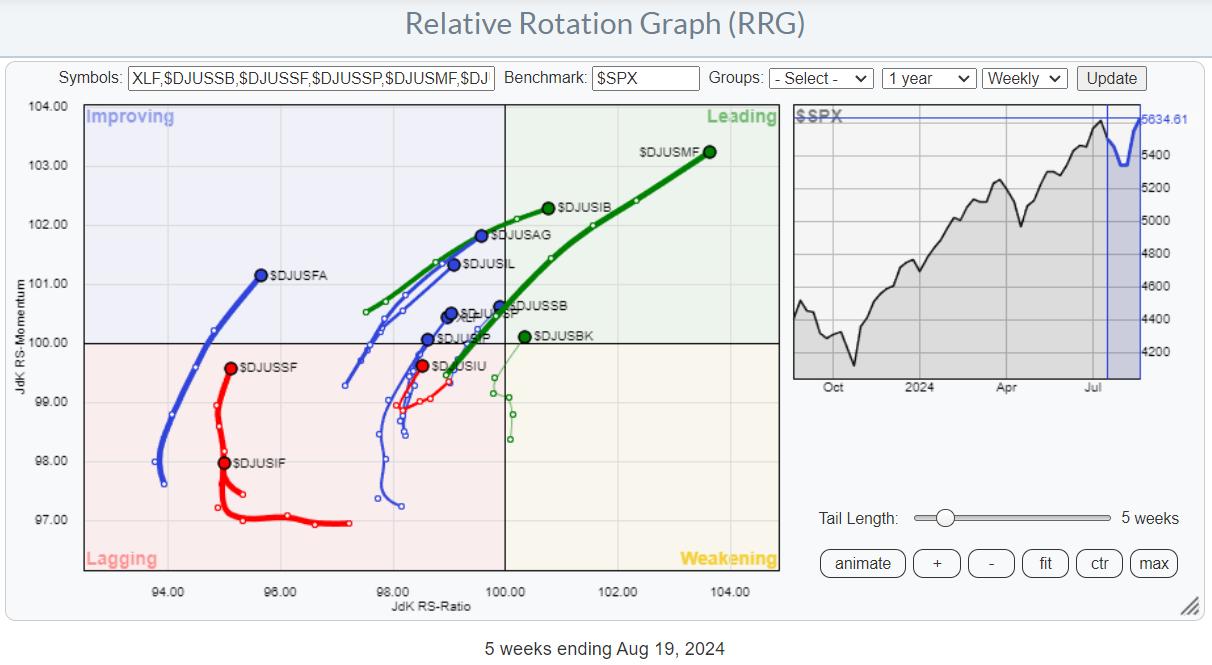

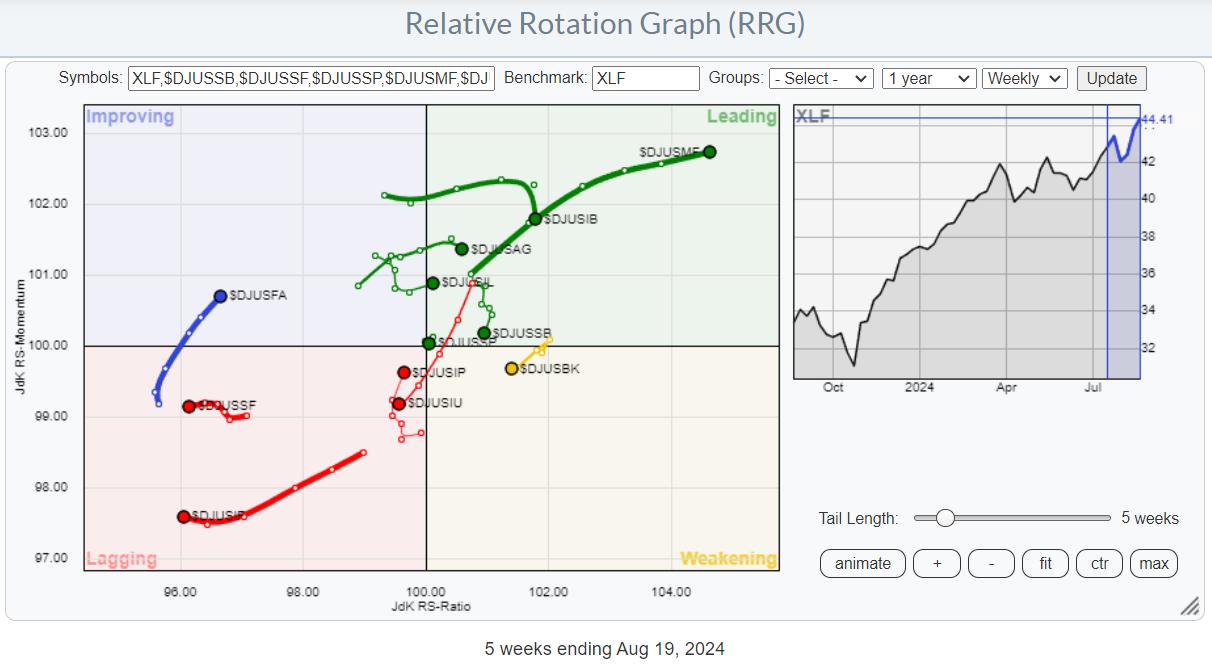

Monetary – Industries

The RRG above exhibits the industries contained in the monetary sector towards the S&P 500 because the benchmark. The advance of relative energy is seen in all teams, as they’re all on a constructive RRG-Heading between 0-90 levels. We have to change the benchmark to the monetary sector index to search out essentially the most promising teams.

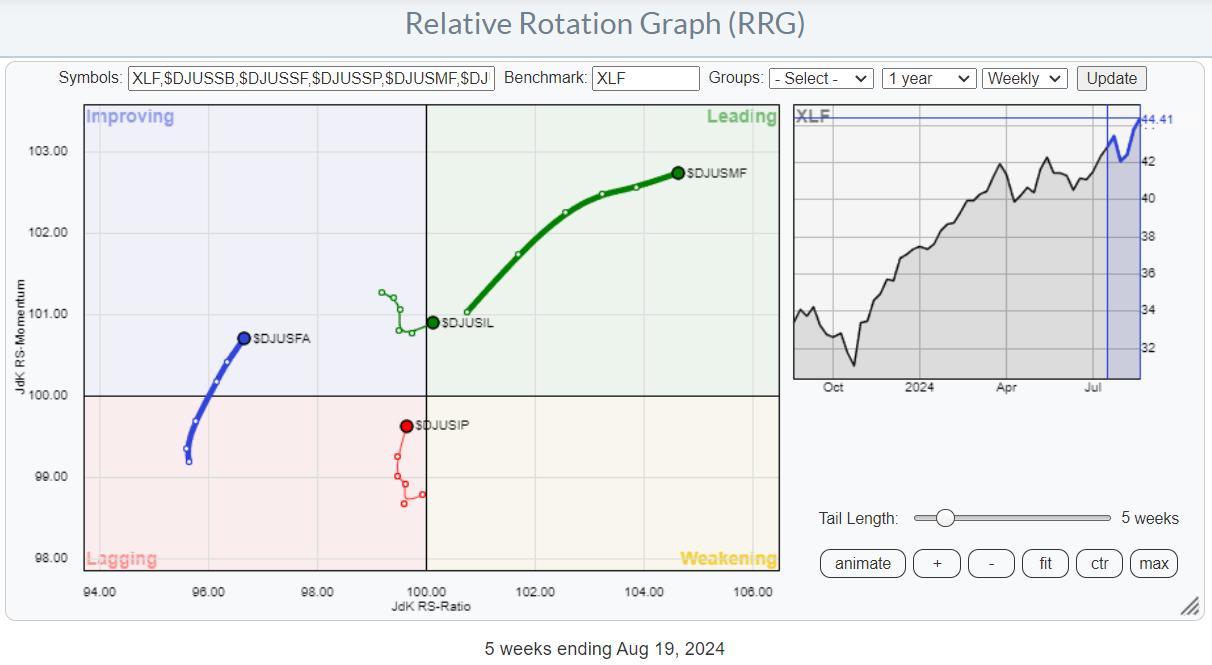

This provides a extra balanced picture of the assorted industries shifting across the sector index (XLF). The place all of the industries had been on a constructive RRG-Heading when benchmarked towards $SPX, solely 4 stay when utilizing XLF because the benchmark.

Monetary Administration

Going over the person charts of those 4 teams, I just like the one for $DJUSFA – Monetary Administration.

This group halved in worth from mid-2021 to mid-2022, then began buying and selling in a spread till now. This week, $DJUSFA closed above its earlier excessive, clearing the trail for an additional rise. This value enchancment has additionally led to an enchancment in relative energy, with each RRG strains now rising. This makes it the group that might probably lead the financials sector within the coming weeks.

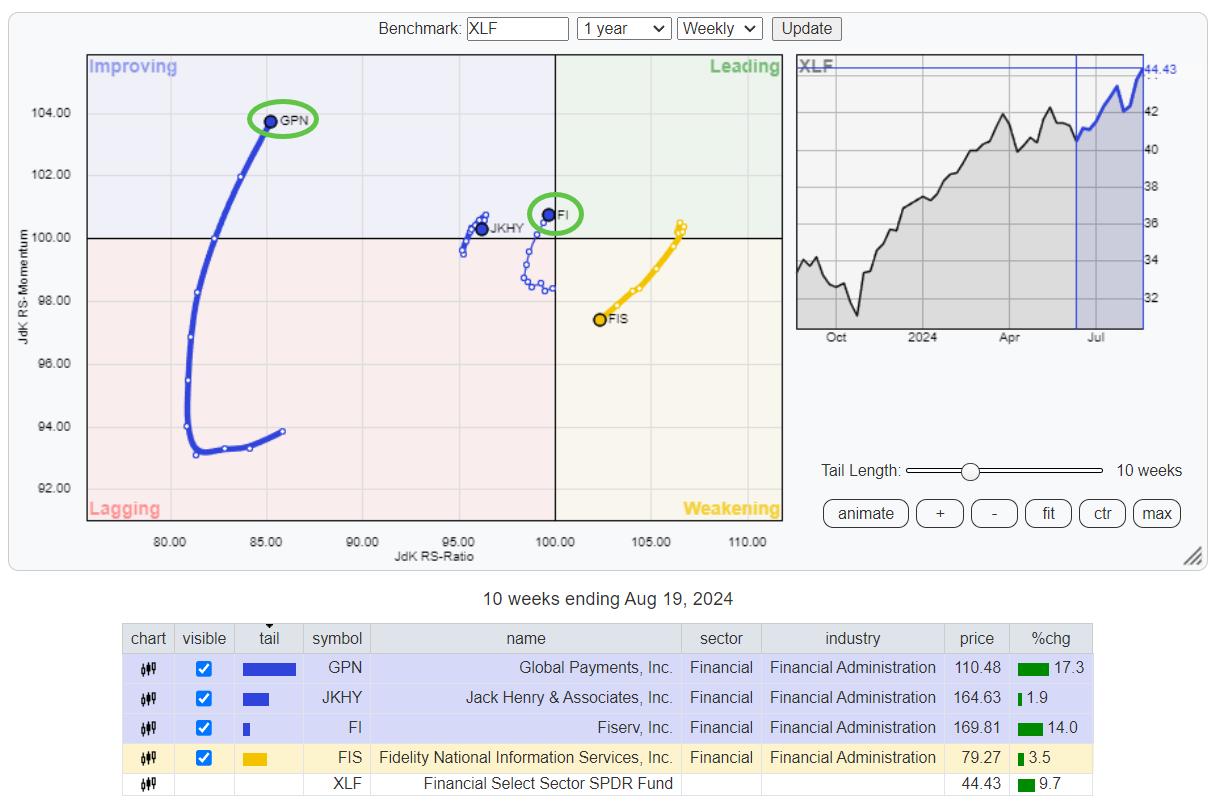

It is a small group that holds solely 4 S&P 500 shares.

Out of those 4, when in comparison with XLF, solely FI and GPN present a constructive rotation.

Fiserv just lately confirmed its uptrend by breaking past its most up-to-date peak, round 160, whereas relative energy appears prepared to maneuver out of its buying and selling vary.

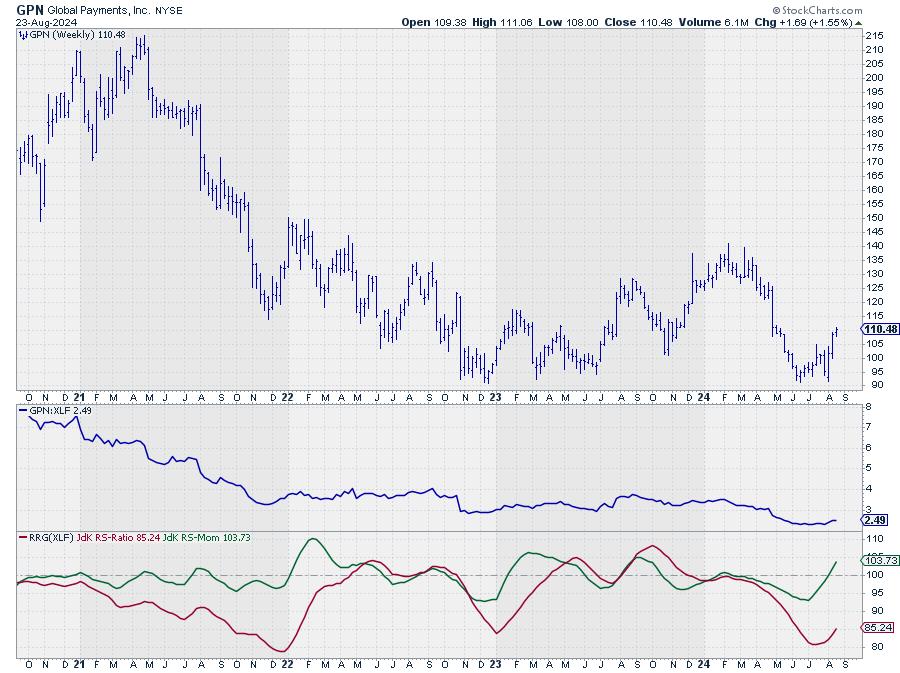

GPN examined strong assist simply above 90 twice this 12 months and accomplished a double backside from the place value is now rallying. The higher boundary of a broad buying and selling vary can now be pegged close to 140, creating properly over 20% upside potential.

#StayAlert and have an incredible weekend. –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to reply to every message, however I’ll definitely learn them and, the place fairly attainable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative energy inside a universe of securities was first launched on Bloomberg skilled companies terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Army Academy, Julius served within the Dutch Air Drive in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Regulation (now a part of AXA Funding Managers).

Study Extra