KEY

TAKEAWAYS

- Relative power traits present a latest rotation into Shopper Discretionary, Communication Providers, Financials, and Vitality.

- The offense to protection ratio nonetheless favors “belongings you need” over “belongings you want.”

- RRG charts give a reasonably clear roadmap of what to search for rotation-wise into early 2025.

Institutional traders are inclined to focus closely on relative power; in spite of everything, that is basically how they’re evaluated of their efficiency as cash managers! On this article, let’s evaluation 3 ways to research relative power and what these charts are telling us about sector rotation as we progress by way of This fall.

Relative Energy Developments Present Clear Winners in This fall

I prefer to group the 11 S&P 500 sectors into three necessary buckets primarily based on their basic tendencies: development sectors, worth sectors, and defensive sectors. Let’s focus in on the relative efficiency of the worth sectors, with every line representing the ratio of the sector ETF vs. the S&P 500 ETF (SPY).

Two of those 4 sectors stand out as strengthening within the month of November, particularly the monetary and power sectors. Each of those sectors are anticipated to profit from a Trump administration. Banks, it is assumed, shall be dealing with much less regulatory strain and likewise a steepening yield curve. For power, it is the belief that with much less assist for renewable power insurance policies, oil and fuel firms might stand to thrive going ahead.

As my good friend and fellow StockCharts commentator Tom Bowley as soon as defined, “If you wish to outperform the S&P 500, you might want to personal issues which might be outperforming the S&P 500.” So, by specializing in sectors which might be exhibiting stronger relative power, now we have the chance to outperform our passive benchmarks.

Offense vs. Protection Ratio Nonetheless Favoring Offense

I additionally love to make use of ratio evaluation to check sectors to one another, as we are able to then begin to infer what huge establishments are doing with their capital as they rotate between the 11 financial sectors. Let’s take a look at certainly one of my favourite ratios, which I name the “offense vs. protection” ratio.

The highest panel is the ratio of Shopper Discretionary (XLY) versus Shopper Staples (XLP), whereas the underside panel makes use of equal-weighted ETFs for those self same sectors (RSPD and RSPS). This evaluation was impressed from conversations years in the past with Invoice Doane, my Constancy predecessor who ran the Technical Analysis crew within the Seventies. We’re principally evaluating “belongings you need” vs. “belongings you want”, with the concept, when situations are good, customers are inclined to spend more cash on discretionary purchases.

We are able to see on this chart that offense has been outperforming protection pretty constantly since early August. And if there’s one factor I’ve discovered in 24 years of analyzing charts, it is to imagine {that a} development is constant till it does not! So this chart definitely suggests broad market power going into year-end 2024.

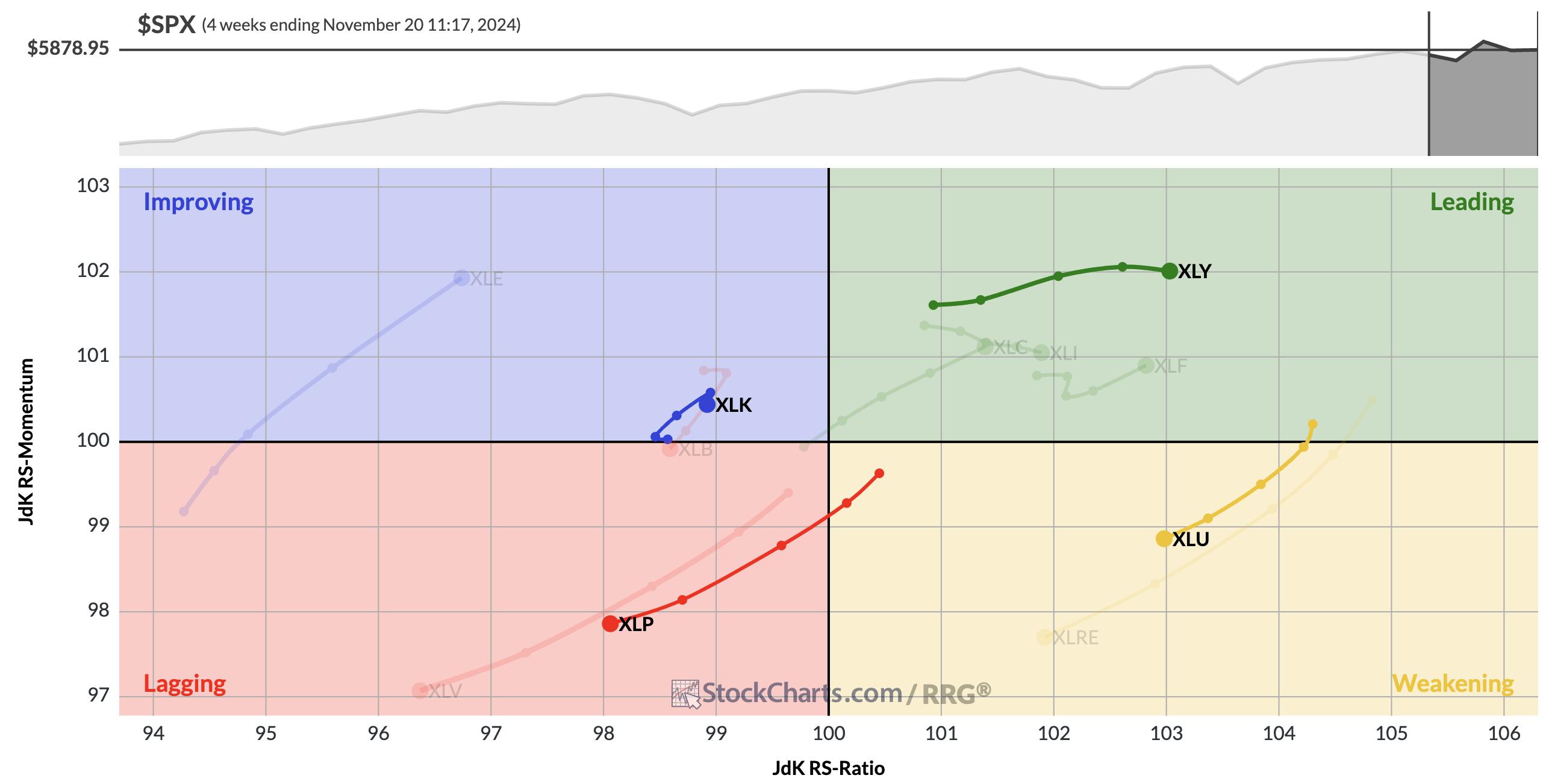

Relative Rotation Graph Signifies Resurgence in Key Sectors

No dialogue of sector rotation can be full and not using a nod to the GOAT of visualizing sector rotation, Julius de Kempenaer. His RRG charts have been a vital a part of my toolkit for a few years, and I am thrilled that we now have an upgraded model on the StockCharts platform with which to proceed our evaluation.

I’ve highlighted the 2 shopper sectors, which we are able to see assist our earlier feedback on offense over protection. The XLY is trending up and to the fitting within the Main quadrant, and the XLP is transferring down and to the left throughout the Lagging quadrant.

I’ve additionally chosen one different comparability, which is one I will be watching intently as we head into 2025. Know-how, pushed by the power of software program and semiconductors, is at present within the Bettering quadrant. Utilities, which has historically been thought-about as a defensive sector, sits within the Weakening quadrant.

If and when these relative traits would start to reverse, that would and can point out extra defensive positioning than we have seen in any respect in 2024. However till and except we see that form of defensive rotation, my sector evaluation tells me this market is poised for additional power.

RR#6,

Dave

P.S. Able to improve your funding course of? Try my free behavioral investing course!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Analysis LLC

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any manner signify the views or opinions of another individual or entity.

David Keller, CMT is President and Chief Strategist at Sierra Alpha Analysis LLC, the place he helps energetic traders make higher selections utilizing behavioral finance and technical evaluation. Dave is a CNBC Contributor, and he recaps market exercise and interviews main consultants on his “Market Misbehavior” YouTube channel. A former President of the CMT Affiliation, Dave can be a member of the Technical Securities Analysts Affiliation San Francisco and the Worldwide Federation of Technical Analysts. He was previously a Managing Director of Analysis at Constancy Investments, the place he managed the famend Constancy Chart Room, and Chief Market Strategist at StockCharts, persevering with the work of legendary technical analyst John Murphy.

Study Extra