Smart_Money_Scanner is a complete scanner that scanners the foreign exchange markets in actual time to search out low danger, excessive reward buying and selling entries based mostly on Sensible Cash Ideas. Beneath are the extra detailed details about its important options.

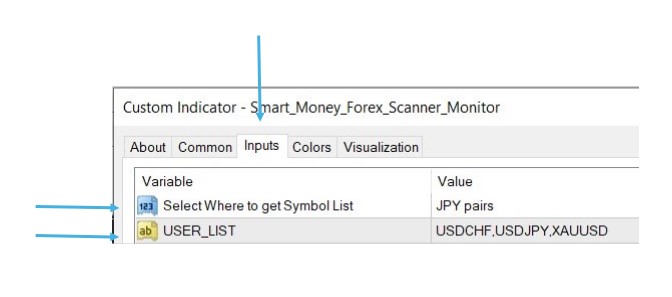

1. Open the Smart_Money_Forex_Scanner_Monitor Indicator by dragging it onto the chart.

2. Proper click on on the chart, click on the “Indicators Record”, then click on on this indicator, then click on on “Edit” button on the correct, it’s going to deliver up the properties of the indicator.

2.1) Click on the threerd button on the highest, named “Inputs”, to vary the inputs to what you want.

2.2) A dropdown menu would give the selection of image inputs with a double-click on the entry. You’ll be able to choose one entry from the dropdown listing or click on “USER_LIST” and enter the image listing your self on the twond entry line. The symbols must be separated with a comma to be acknowledged.

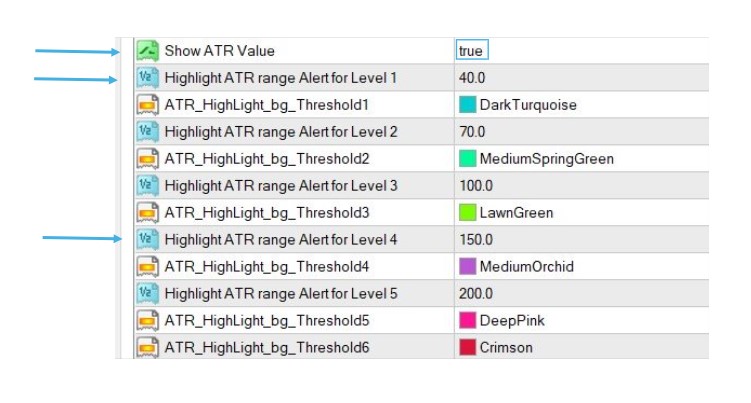

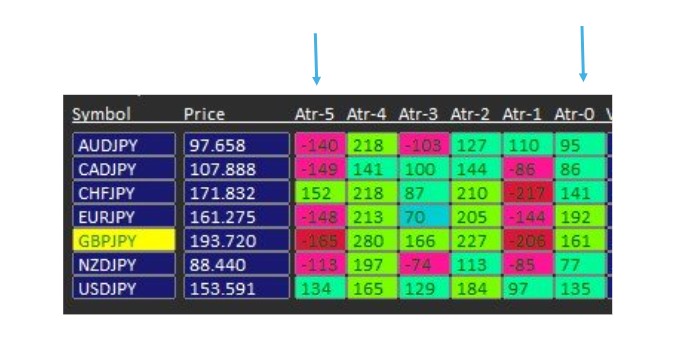

3. The columns named “Atr-5” to “Atr-0” are the typical true vary (ATR) values for the final 6 buying and selling days. The colours and the vary stage for Alert may be set from the Enter display. (At the moment I’ve set 3 totally different shades of inexperienced colours for vary from 0 to 40 pips to 70 pips, and to 100 pips. And set 3 totally different shades of crimson colours for vary from 150 pips to 200 pips and above.) You’ll be able to change all of those settings to suit your buying and selling wants and preferences. It would assist to spotlight the acute transfer days on the foreign money and present the development during the last 6 buying and selling days. Beneath is the enter display for ATR entry settings:

The Scanner will present the final 6 buying and selling days’ ATR values based mostly in your enter decisions:

4. The Quantity column offers an enter display choice to decide on the timeframe of the quantity. It’s a dropdown menu, and I’ve chosen 30 Minutes because the default. It would present when there may be excessive quantity (which means excessive liquidity, much less pip slippage, and excessive buying and selling exercise time when quantity is excessive) for a selected image. Give customers perception about when the foreign exchange pairs are energetic regularly.

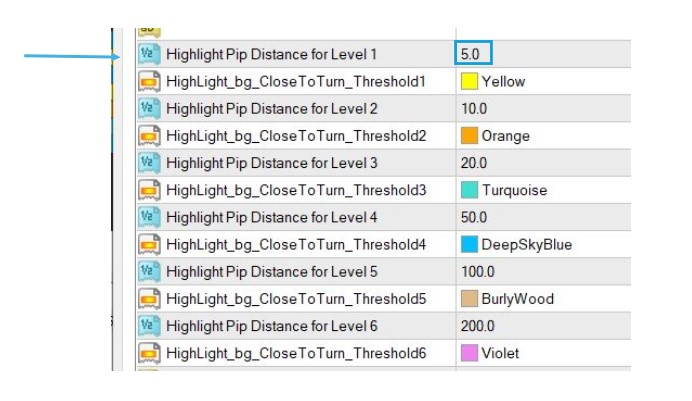

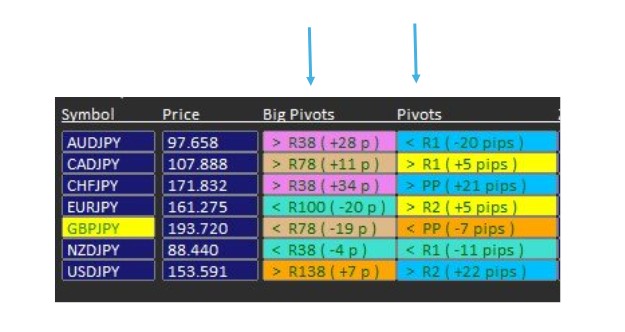

5. The Large Pivots column is calculated utilizing weekly and month-to-month pivots (for larger timeframe merchants). The colour setting for the pip distance from the present image worth to those massive pivot ranges (Help and Resistance Ranges on HTF) may also be set within the enter display, on objects known as “Spotlight Pip Distance for Stage 1, 2, 3, 4, 5, 6” enter part.

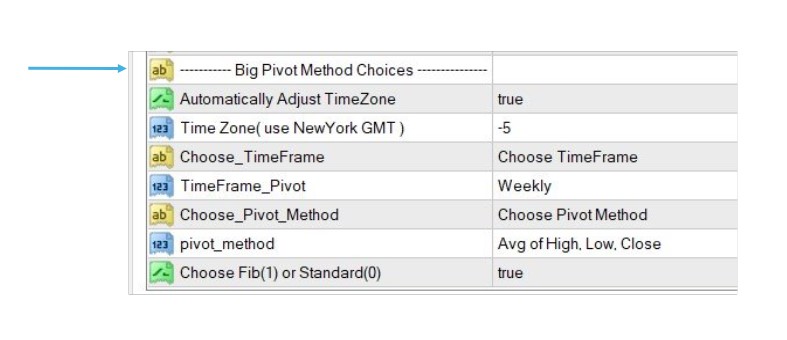

5.1) the calculation choices for Large Pivots (weekly or month-to-month, utilizing the Averages of Excessive, Low, Open or Shut, utilizing Fibonacci or not) may also be chosen from the enter display, on the backside a part of the enter display titled “Large Pivot Technique Selections”.

Beneath is the Scanner show after making use of the default enter settings for “Large Pivots” column:

6. Subsequent column is Pivots (Day by day Pivots: S1, S2, S3 and R1, R2, R3), with actual time pip distance exhibiting on the column (which is between present image worth and the corresponding pivot ranges). It is proven within the above image as nicely.

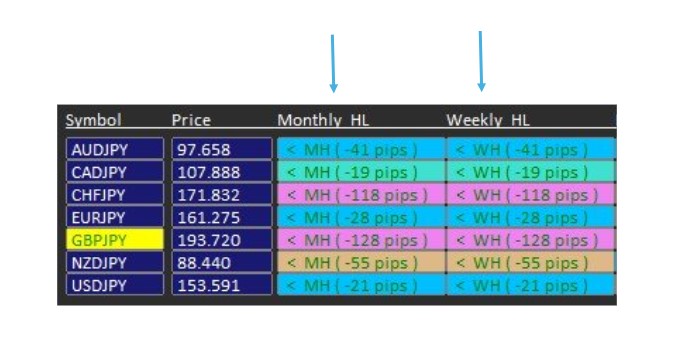

7. Subsequent are the columns for exhibiting the pip distance to the 24Month Highs and Lows, 12Month Highs and Lows, 6Month H/L, 3Month H/L, 2Month H/L, 1Month H/L, final week H/L, earlier day H/L, and present day H/L.

7.1) you may determine to point out all these columns, or solely present 1 or 2, or any mixture of the columns, by choosing them within the enter display. (Present it or not).

7.2) you can even enter the pip distance you wish to be alerted for, on every of the column choice. (In my default setting, 5 pip distance for the alert, which means it’s going to alert when the present image worth is inside 5 pips to that chosen column, be it 24Month Excessive, or Low, or Earlier Day’s Excessive, or Low). It’s utterly customizable and makes it simple so that you can discover optimum buying and selling alternatives based mostly in your standards.

7.3) the enter display for coloration choice of the pip distance is also customizable. I’ve set 5 pip distance coloration to be Yellow, and 10 pip distance coloration to be Orange. As a result of these are brighter colours to spotlight when the image worth is very shut to those vital ranges and frees the time so that you can wait in entrance of the monitor for worth to get there.

The image beneath exhibits 2 columns for illustration functions solely ( the Month-to-month Excessive/Low and the Weekly Excessive/Low ). It highlights the pip distance based mostly on the enter coloration settings, and present if present worth is above ( or beneath ) the Month-to-month Excessive (Low) and the Weekly Excessive(Low) for what number of pips as nicely. Within the image beneath, CADJPY at 107.88 is simply 19 pips beneath the Month-to-month and Weekly Highs, so it is a excessive success likelihood entry based mostly on Sensible Cash Ideas. You need not wait lengthy for the extra correct entry to happen, because it’s solely 19 pips away from these vital Highs.

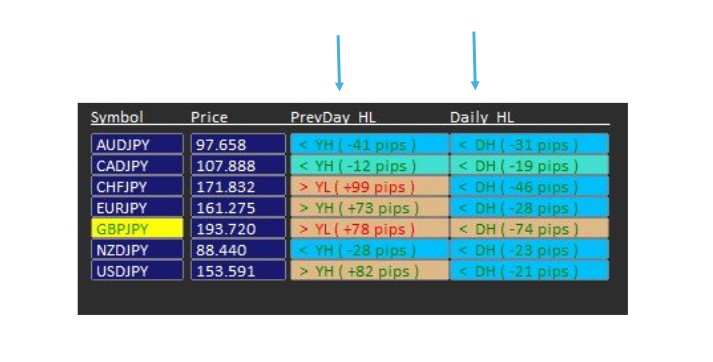

The following image exhibits the Earlier Day and Present Day Columns, and the CADJPY pair confirms with the commentary we had within the earlier image.

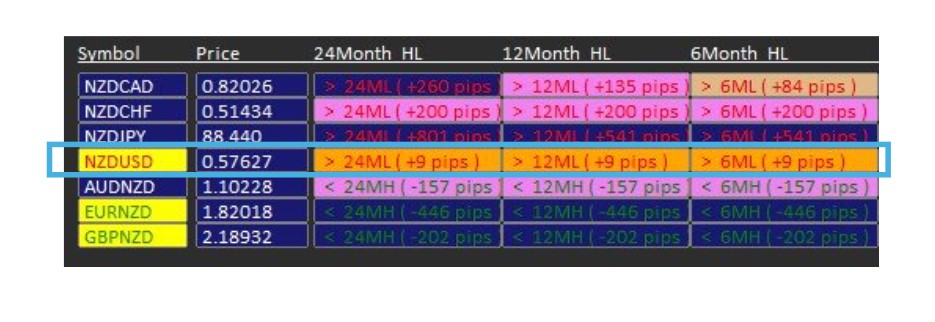

8. For instance, to search for longer timeframe alternatives, I modified the enter image listing to “FULL_LIST” choice. And located some NZD pairs are at larger timeframe extremes with the actual time scanning show. Beneath is the image for all NZD pairs after I narrowed down the search:

From the Scanner show, it exhibits NZDUSD at 0.5762 is simply 9 pips away from it is 24 Month Lows ( additionally 12 Month Low, and 6 Month Low ). This can be a unbelievable discovery as a result of there can be minimal time watch for a excessive likelihood entry based mostly on HTF. To substantiate its accuracy, I pulled out the Day by day Chart for NZDUSD:

Certainly it is on the 24 Month Low level. It might be an excellent correct reversal entry based mostly on Sensible Cash Ideas. Very low danger, and Very excessive reward. And no want to attend for this sort of alternatives, because the scanner will discover alternatives like this always on all symbols.

9. The above instance is used to point out the logic behind the right way to seek for buying and selling alternatives utilizing the Scanner. You can select all symbols, and select the columns that you simply’re all in favour of first. As soon as you discover the image ( symbols ) that matches your standards, you may slender down the search, by lowering the image listing, and lowering the columns to look at additional. And pull out the chart to confirm/affirm it certainly is on the most optimum stage that you simply’re all in favour of, based mostly in your buying and selling type.