Session Anticipated Threat Date Vary Analyzer: Analyzes worth knowledge throughout specified date ranges to offer detailed insights into monetary threat and volatility, utilizing every bar’s worth metrics for correct threat evaluation.

The Session Anticipated Threat Date Vary Analyzer is a complicated instrument designed to supply merchants and analysts detailed insights into the anticipated monetary threat throughout particular date ranges. In contrast to conventional session-based evaluation, this indicator focuses on calculating threat metrics primarily based on every bar’s worth knowledge, using varied worth varieties reminiscent of excessive, low, shut, open, weighted median, and typical costs. This method offers a nuanced understanding of worth volatility and threat over the chosen durations.

**Observe:** When the buying and selling platform is closed, the indicator could not load accurately. To make sure it really works, it’s possible you’ll have to load the indicator, unload it, after which load it once more.

**Observe:** This indicator is meant to be used with historic knowledge and doesn’t assist real-time knowledge evaluation.

**Observe:** When switching to a distinct timeframe, it is beneficial to modify forwards and backwards between timeframes to make sure that all knowledge masses correctly. This course of helps to fetch the mandatory historic knowledge, making certain that calculations primarily based on this knowledge are correct.

Hyperlink to MT5 product: https://www.mql5.com/en/market/product/122240

Hyperlink to MT4 product: https://www.mql5.com/en/market/product/122259

Key Options:

1. Customizable Date Vary Evaluation:

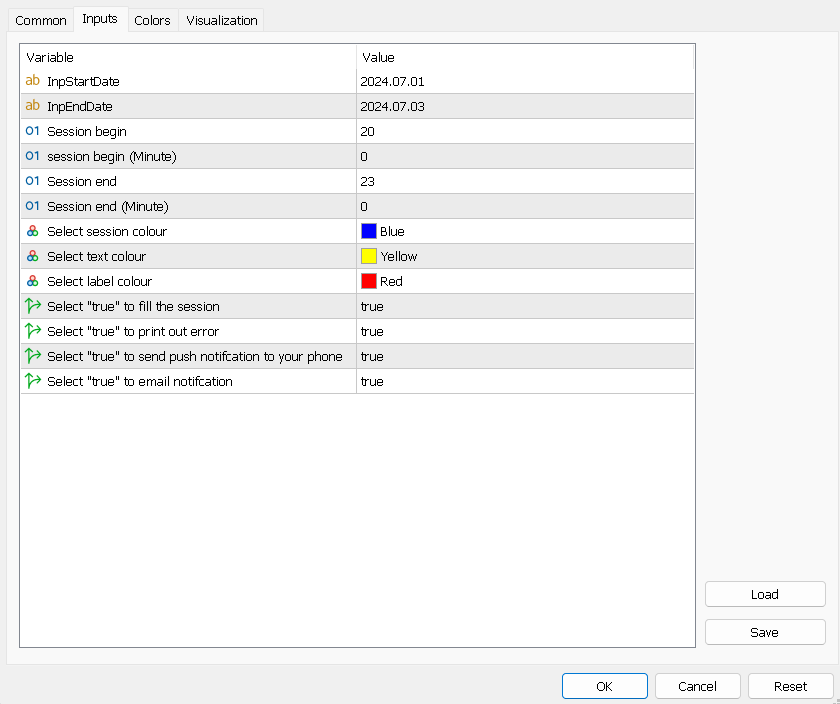

– Begin Date and Finish Date: Customers can outline exact begin and finish dates for the evaluation, permitting for an intensive examination of worth threat over particular durations. This function is helpful for finding out historic threat patterns and market habits throughout vital occasions.

2. Bar-Primarily based Threat Calculation:

– In contrast to session-based instruments, this indicator calculates threat metrics primarily based on every bar’s worth knowledge, together with excessive, low, shut, open, weighted median, and typical costs. This methodology offers a extra granular view of threat and volatility throughout the chosen date vary.

3. Monetary Anticipated Threat Formulation:

– The indicator makes use of the monetary anticipated threat formulation to evaluate potential threat ranges, providing a quantitative measure of volatility and worth habits. This method helps in understanding how totally different worth metrics contribute to total threat.

4. Enhanced Threat Insights:

– By specializing in bar-based worth knowledge, merchants and analysts can acquire a deeper understanding of threat dynamics inside specified durations. This detailed evaluation is effective for refining buying and selling methods and assessing historic threat developments.

5. Software for Historic Information Evaluation:

– The instrument is right for analyzing historic knowledge, making it appropriate for customers all in favour of long-term threat research and the impression of historic occasions on worth volatility.

Sensible Use Case:

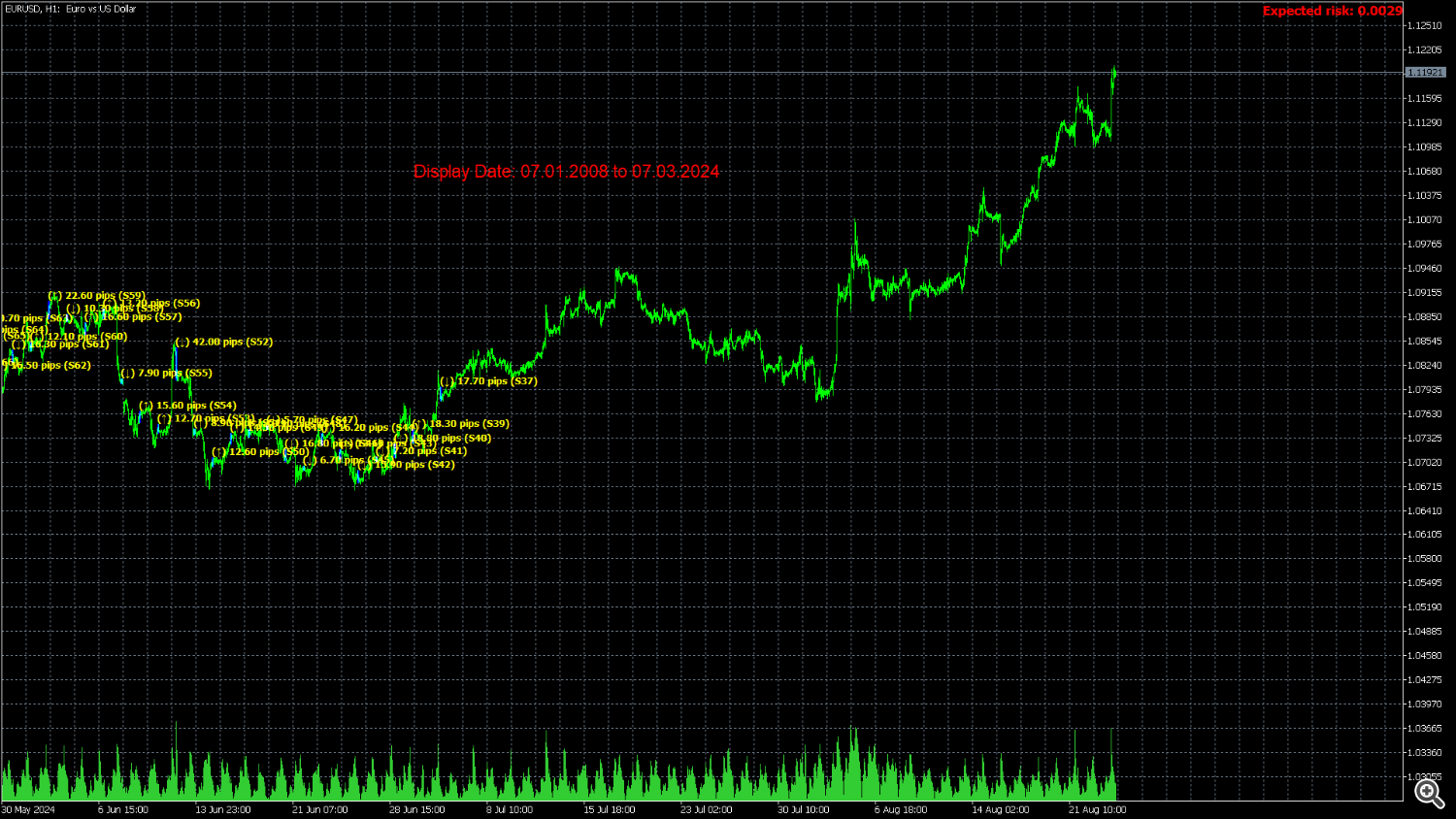

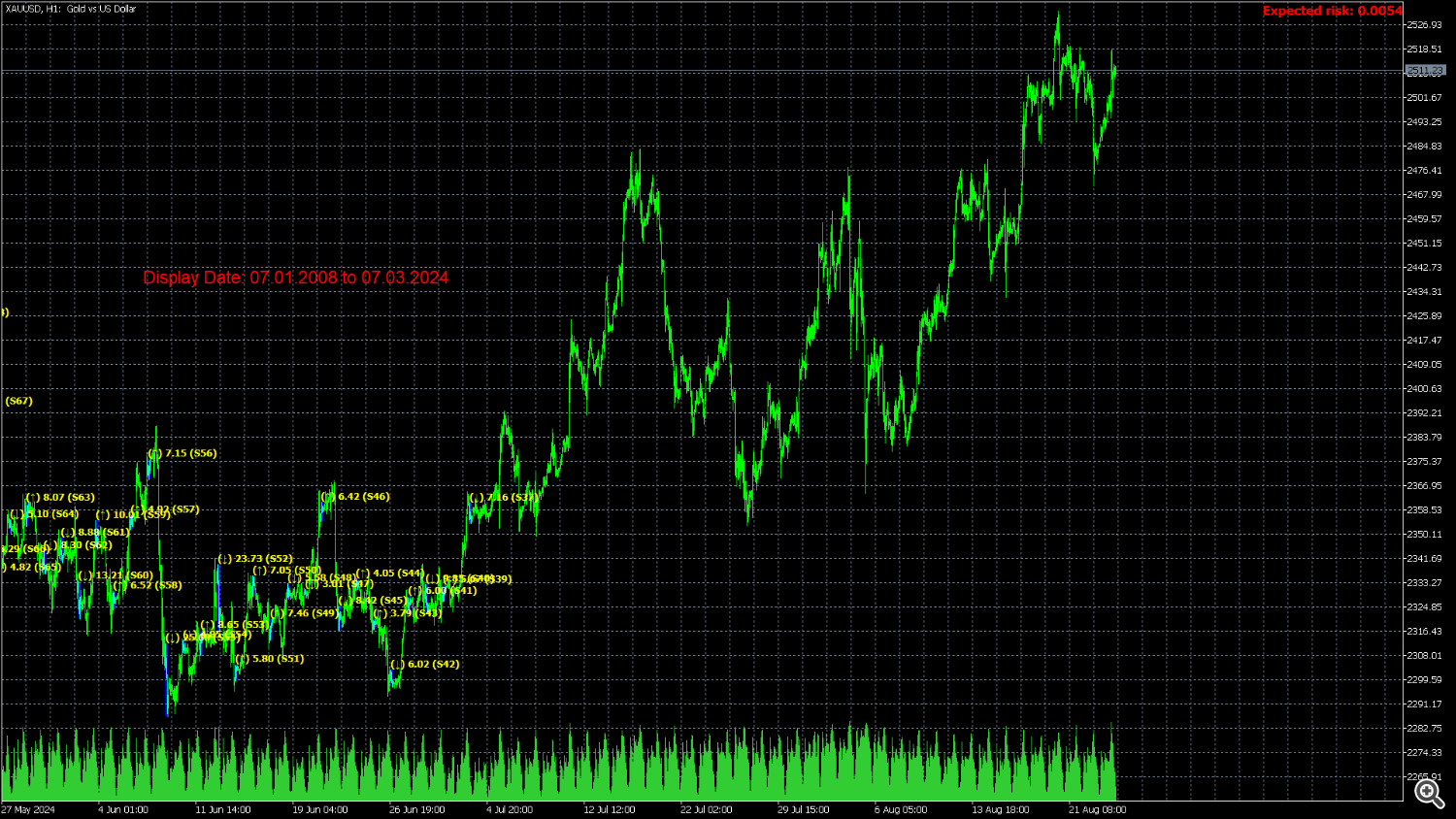

Think about a dealer analyzing the danger related to EURUSD throughout a unstable market interval. By utilizing the **Session Anticipated Threat Date Vary Analyzer**, the dealer can specify the beginning and finish dates for the evaluation, and the indicator will calculate threat metrics primarily based on every bar’s worth knowledge. This detailed evaluation helps the dealer perceive the danger profile and modify buying and selling methods accordingly.

**Observe:** This indicator is designed to work with timeframes of H4 and under.

Foremost Inputs:

– InpPrice: Specifies the kind of worth used for traditional deviation calculation inside the chosen session and date vary. Choices embrace:

- Excessive: Use the best worth of every bar.

- Low: Use the bottom worth of every bar.

- Shut: Use the closing worth of every bar.

- Open: Use the opening worth of every bar.

- Weighted: Use the weighted worth of every bar.

- Median: Use the median worth of every bar.

- Typical: Use the standard worth of every bar.

– InpStartDate: Specify the start date for the evaluation interval. This defines the beginning of the vary for threat analysis.

– InpEndDate: Outline the ending date for the evaluation interval. This marks the tip of the vary and limits the danger analysis to this date.

– SColor: Select the colour for displaying the danger metrics on the chart. `clrBlue` will present the danger in blue.

– InpTextColor: Set the colour for the textual content displayed by the indicator. `clrYellow` will render the textual content in yellow.

– InpLabelColor: Outline the colour for labels inside the indicator. `clrRed` will shade the labels purple.

– InpFill: Choose whether or not to fill the danger space with shade. `true` fills the danger space with the colour specified by `SColor`.

– InpPrint: Decide whether or not to print error messages to the log. `true` permits error logging.