On the earth of buying and selling algorithms, transparency, and moral practices are sometimes compromised.

Rivals could use to promote recklessly:

📌 Over-Optimization (Curve Becoming) 📊

📌 Cherry-Selecting Information 🍒

📌 Manipulating Cease-Losses & Take-Income 🚫

📌 Excluding Slippage & Unfold Prices 💰

📌 Hiding Drawdowns 📉…

Examine right here to know how to not be fooled once you purchase an algo.

In consequence, merchants are left with instruments that

📍 fail in actual market circumstances

📍 crash their accounts

📍 and disgust them from algotrading

At MetaSignalsPro, we need to obtain success as a supplier with these core values:

Transparency, reliability, and a relentless pursuit of excellence.

Extra technically, as we’re each guide and algo-traders, we all know that

Sturdy Performances come from Rigourous Backtests, Danger-management and Diversification

Our coming very quickly Professional Advisor (EA), is the embodiment of those values and experience.

👋 Be a part of our group if you wish to be a part of the primary ones to get particular supply for the launch

That is what we are going to ship:

💼 The very best Moral and rigorous Requirements in Backtesting

Our system adheres to strict backtesting protocols with

🔹 100% qualitative knowledge with no omissions

🔹 zero deletion or manipulation of historic cease losses or take income.

🔹 zero overfitting

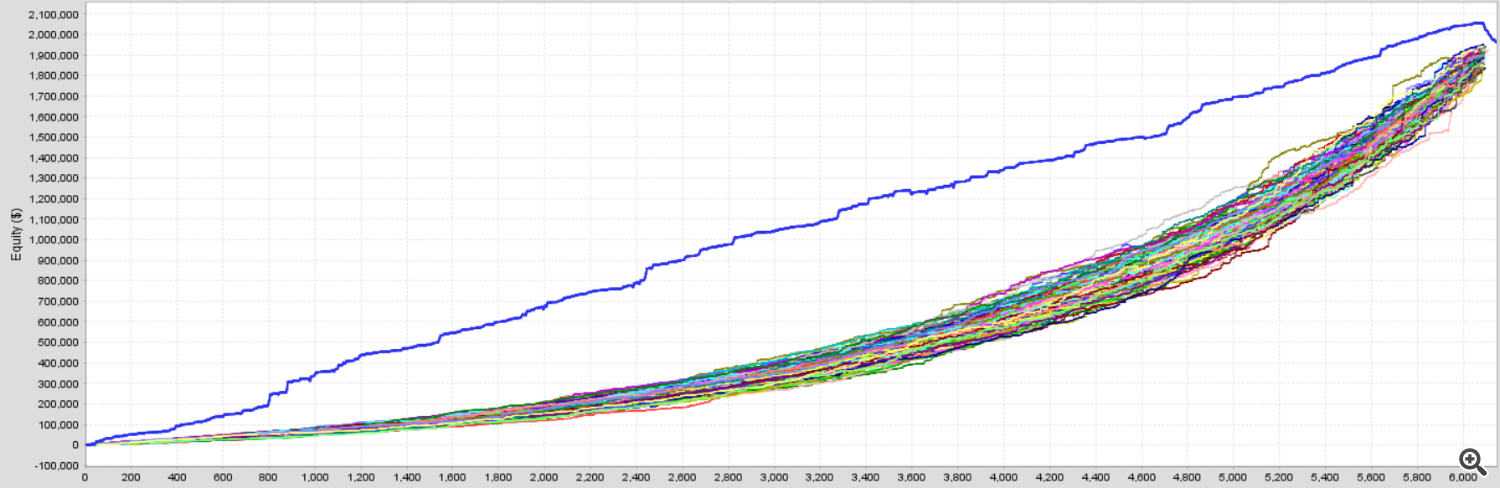

🔹 validated walkforward simulation

🔹 validated montecarlo simulation

🧬 Reliable Stay Efficiency

How will you make certain that an EA that appears good on paper will carry out the identical means in actual time?

🔹 For this reason we developed the Similarity Rating.

This proprietary protocole ensures that

👉 our EA in reside mirrors its walk-forward backtest outcomes

👉 What you see is what you get.

🌍 Diversified Danger

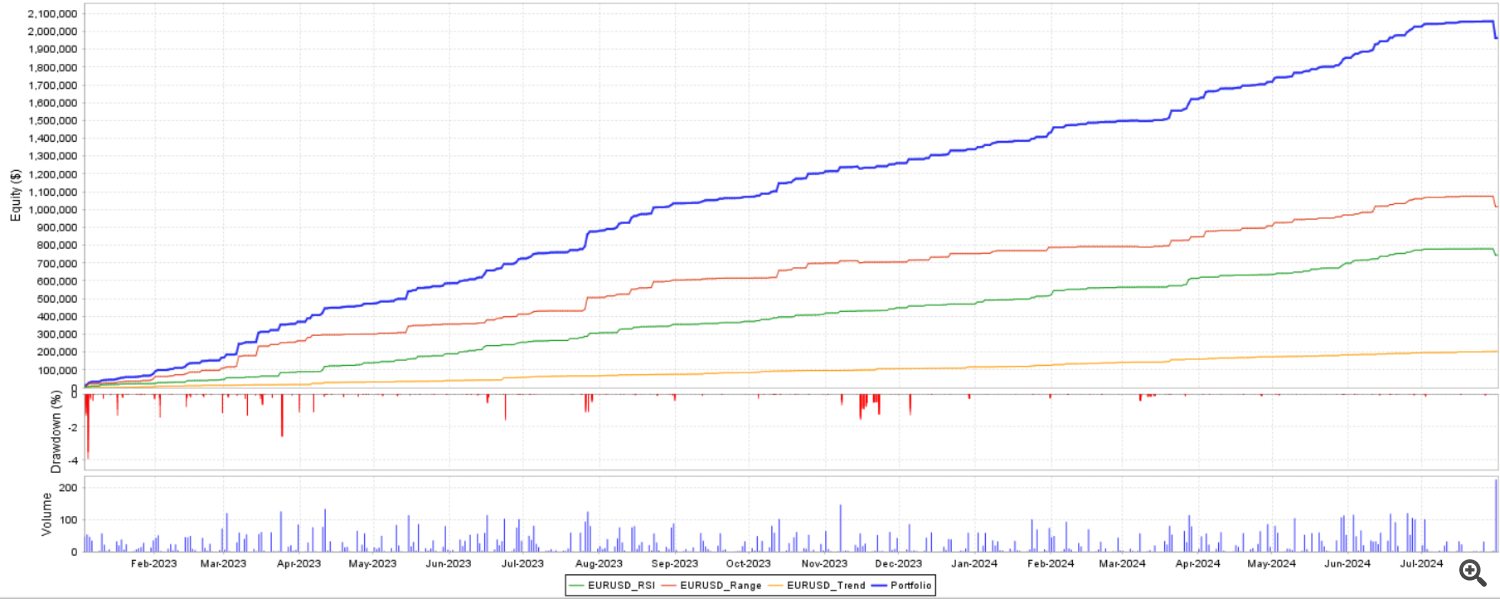

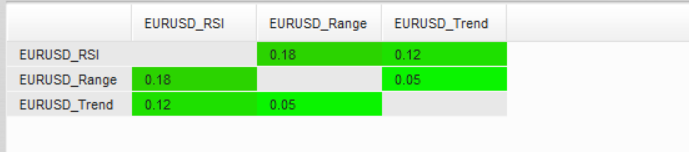

Our core innovation is to suggest per key asset a batch of three set information

🔹 to suit the three configurations of the market

- pattern

- vary

- and excessive volatility

🔹 every configuration being not correlated as proven within the desk hereunder

👉 will get a multi-layered security internet in your portfolio

👉 and might ship sturdy efficiency

✅ Key property lined

🔹 We cowl the largest and hottest property with our assortment of set information

🔹 After all our group will permit us to create any set file for any asset on demand

With MetaSignalsPro’s new EA, you are not simply getting an algorithm

👉 you’re getting an entire, clear, and diversified buying and selling answer. 🌟

👋 Be a part of our group if you wish to be a part of the primary ones to get particular supply for the launch

🔑 Key Takeaways:

- Ethics First: No manipulation, no shortcuts—simply clear, correct testing.

- Actual Outcomes: Stroll-forward testing ensures reside efficiency mirrors backtested efficiency.

- Diversification: Set information present a multi-market circumstances strategy to cut back threat and improve robustness.