Supply: The Faculty Investor

There’s an outdated aviation joke that asks “How do you make 1,000,000 {dollars} within the airline enterprise”? The punchline (“Begin with two million {dollars}”) is a little bit of hyperbole however there’s a kernel of fact to it. A lot of the identical may be mentioned for investing in Bitcoin and different types of cryptocurrency. However with Bitcoin (BTC) hovering over $75,000 USD proper now, it is bought increasingly individuals pondering – may I change into a Bitcoin millionaire?

Until you bought in on the bottom flooring within the early 2010s or get extremely fortunate, you are unlikely to make any life-changing quantities of cash in cryptocurrency.

Let’s check out Bitcoin, what it means to spend money on cryptocurrency and a few alternate options which have a greater monitor file of historic success.

What Is Bitcoin?

Bitcoin is the oldest and hottest type of cryptocurrency (launched in 2009), and many individuals use the 2 phrases interchangeably. However Bitcoin is only one type of cryptocurrency — another varieties are Ethereum, Litecoin or Dogecoin. Cryptocurrency is a type of digital foreign money that’s backed by a type of cryptography also known as the blockchain. Due to the best way that cryptocurrencies are arrange, they’re almost unattainable to counterfeit.

There are a number of methods you could spend money on Bitcoin and cryptocurrency. The best method to spend money on Bitcoin is to easily get a Bitcoin pockets and purchase Bitcoins. We suggest Coinbase for U.S. traders – it’s the simplest, hyperlinks to your checking account, and lets you purchase and promote Bitcoins.

One other manner is to If you wish to spend money on an ETF by way of your dealer, take a look at the GBTC. This ETF tracks Bitcoin, and you may spend money on fractional shares.

Another choice is mining for Bitcoin, since so long as the markets stay energetic you possibly can mainly make cash for nothing. However the issue is, mining is such a tricky gig now that it’s hardly price it. Turning your pc right into a miner will seemingly make it noisy and warmth up. It might seemingly take you a very long time to even mine a single Bitcoin, by which period you in all probability would have spent extra on electrical energy.

Remember the fact that investing in Bitcoin is extremely risky. For nearly all individuals, it isn’t a good suggestion to speculate the vast majority of your portfolio in any type of cryptocurrency. For those who actually wish to dabble in crypto investing, put aside a small portion of your investments — solely sufficient that you’d be snug dropping completely.

When You Would Have Wanted To Spend money on Bitcoin To Be A Millionaire

The historical past of Bitcoin is risky and turbulent. Lengthy gone are the times that you might make a token funding in Bitcoin and change into a bitcoin millionaire seemingly in a single day.

To offer you a little bit of context:

- Investing $10 in Bitcoin in January 2011 would have changed into $1.2 million by March 2022.

- You’d have wanted to speculate $160 in Bitcoin in January 2012, $440 in January 2013 or $24,000 in January 2014 to have that very same quantity.

- By January 2018, you’d have wanted to speculate almost $450,000 in Bitcoin so as to have $1.2 million right now.

- For those who began investing in BTC in January 2024, you’d wanted to make investments $589,000 in Bitcoin to have $1,000,000 right now.

Over the previous few years, we have seen a smaller and smaller rise within the worth of Bitcoin. This doesn’t suggest that there is not cash to be made, however gone are the probabilities you possibly can flip $10 into $1,000,000.

The “Dangers” Of Changing into A Bitcoin Millionaire

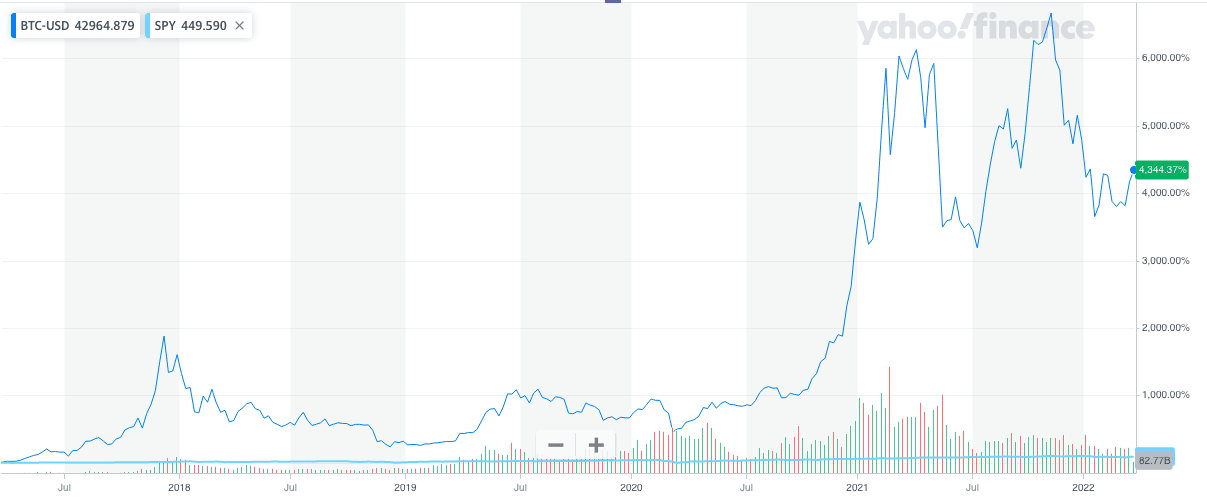

Even for those who had invested in Bitcoin manner again then, it could have taken nerves of metal to carry onto it by way of the 12 months. Wanting on the historic BTC chart, you’d have needed to survive and maintain by way of a number of intervals the place your funding misplaced almost 50% of its worth inside the interval of some weeks.

Bitcoin Historic Value Chart. Supply: Yahoo! Finance

With hindsight, it is easy to say that “it is simply $10” if that is all you invested initially. However would you might have been prepared to not panic when your Bitcoin portfolio had gotten up close to $1M and dropped a whole bunch of 1000’s of {dollars} in a single day?

One other threat of getting all your cash in Bitcoin is discovering locations that can settle for it as fee for items and providers. Whereas it’s changing into increasingly prevalent to discover a enterprise that can settle for cryptocurrency as fee, it’s nonetheless comparatively uncommon. You are not going to have the ability to get bread and milk from the nook retailer by paying with crypto. As an alternative, you may have to vary your foreign money, seemingly incurring extra charges and taxes.

Associated: How Taxes On Cryptocurrencies Like Bitcoin Works

Options To Successful Huge In Crypto

In case you are a person of “regular” threat tolerance, Bitcoins in all probability don’t excite you an excessive amount of. The danger/reward profile of the Bitcoin market isn’t going to be very interesting to the savvy investor. That is simply an opportunity to both make a fast buck, or lose all the things.

That’s one cause why most savvy traders will preserve the vast majority of their cash in dependable investments like index funds.

Plus, relying on while you began investing, index funds could outperform Bitcoin anyway.

For instance, From March 2021 to March 2022, you’d see the next returns:

- Bitcoin: -21.28%

- S&P 500: +14.49%

You’ll have executed remarkably higher investing in easy index funds over the past 12 months than Bitcoin.

The Backside Line

Any time individuals see investments with meteoric returns, it’s normal to attempt to duplicate what occurred in quest of the following “dwelling run”. This consists of investing in Bitcoin, different types of cryptocurrency or “meme shares” like Gamestop or AMC.

It is a significantly better monetary technique to attempt for “singles” or “doubles” with the vast majority of your portfolio with issues like index funds which have reliably given stable returns.

In case you have the vast majority of your portfolio in index funds or different comparable investments, that can provide you peace of thoughts to know that almost all of your funds are sufficient on your retirement. Then you possibly can make investments a small portion of your portfolio in riskier investments like cryptocurrency, meme shares, dangerous actual property ventures or different excessive threat/reward performs. Simply do not threat greater than you are prepared to lose utterly.