Solana lately broke its yearly excessive at $210, sparking a surge in buying and selling exercise because the altcoin now makes an attempt to consolidate above this key stage. This era of risky worth motion highlights Solana’s robust place throughout the market, as traders look ahead to indicators of an extra breakout.

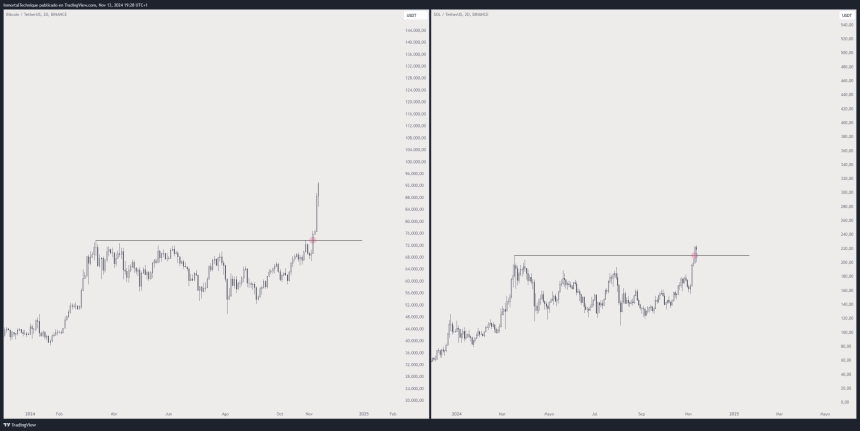

Prime analyst and investor Immortal lately shared an insightful technical evaluation evaluating Solana’s chart to Bitcoin’s historic worth actions, suggesting that Solana’s subsequent breakout could also be imminent.

Associated Studying

Because the market reaches new highs, Solana’s capability to carry above $210 might point out power, drawing in further curiosity from retail and institutional traders. Within the coming days, Solana’s worth motion will doubtless make clear whether or not this consolidation section is merely a pause earlier than a extra substantial transfer.

With the broader crypto market reaching unprecedented ranges, Solana is positioned at a vital juncture, and merchants will carefully monitor its efficiency for indicators of a continuation of its upward trajectory.

Solana Getting ready For A Rally

Solana seems poised for a big rally, having damaged out of an 8-month accumulation section that started in March. This vital improvement has caught the eye of high analyst and dealer Inmortal, who shared an evaluation on X, evaluating Solana’s latest chart patterns to these of Bitcoin. His technical perspective means that Solana mirrors Bitcoin’s previous worth motion and could possibly be on the cusp of a considerable surge.

Following its break above the yearly excessive of $210, Solana’s subsequent goal is prone to be its all-time excessive of $258. This stage is seen by many as a vital resistance, and a profitable take a look at might pave the best way for even larger worth beneficial properties. The breakout from such an prolonged accumulation section has bolstered confidence in Solana’s bullish construction, and the market is carefully looking ahead to indicators of sustained momentum.

The timing of this potential transfer can also be strategic. As Bitcoin consolidates just under its all-time excessive, a interval of stability might present the proper window for altcoins, notably Solana, to achieve traction. This pause in Bitcoin’s rally permits liquidity to shift towards different robust tasks, positioning Solana properly for a doable continuation of its upward development.

Associated Studying

The subsequent few days shall be pivotal for Solana as merchants look to see if it may maintain help above $210. If Solana holds this stage and momentum stays, a push towards the $258 all-time excessive might unfold quickly, additional solidifying its position as a number one altcoin available in the market’s present bull section.

SOL Testing Final Provide Ranges Earlier than ATH

Solana is at the moment buying and selling at $220, having damaged its yearly highs, but it’s now encountering some volatility as merchants assess the subsequent transfer. With SOL simply 17% away from its all-time excessive of $258, many are watching carefully to see if it may maintain this momentum with out giving merchants any decrease entry factors.

The $210 help stage is especially essential within the coming days. If SOL fails to carry above this mark, a short-term correction might drive costs decrease, doubtlessly providing some respiratory room for patrons trying to enter earlier than the subsequent rally. Nonetheless, ought to SOL stay regular above $210, the chance of a speedy push to new highs turns into even stronger, because it indicators ongoing bullish power in a market looking forward to upward motion.

Associated Studying

As Solana continues to consolidate at these elevated ranges, a decisive break might ignite a swift rally, drawing in each retail and institutional curiosity. Merchants are getting ready for both final result: a short correction as a shopping for alternative, or a breakout that takes Solana into uncharted territory, setting new highs and reaffirming its place amongst top-performing altcoins this cycle.

Featured picture from Dall-E, chart from TradingView