The S&P 500 Index is a capitalization weighted inventory index. Most of the lesser capitalization blue-chip shares that compose these 500 firms have been efficiency laggards. Although smaller firms within the index, these firms are among the many bluest of the blue-chip shares. These prestigious firms have been overshadowed by the immense mega-capitalization firms which were receiving consideration from institutional and particular person traders. For probably the most half, these different and forgotten shares have higher valuations and dividend yields as they’ve been considerably uncared for by Wall Avenue.

The S&P 500 Index is a capitalization weighted inventory index. Most of the lesser capitalization blue-chip shares that compose these 500 firms have been efficiency laggards. Although smaller firms within the index, these firms are among the many bluest of the blue-chip shares. These prestigious firms have been overshadowed by the immense mega-capitalization firms which were receiving consideration from institutional and particular person traders. For probably the most half, these different and forgotten shares have higher valuations and dividend yields as they’ve been considerably uncared for by Wall Avenue.

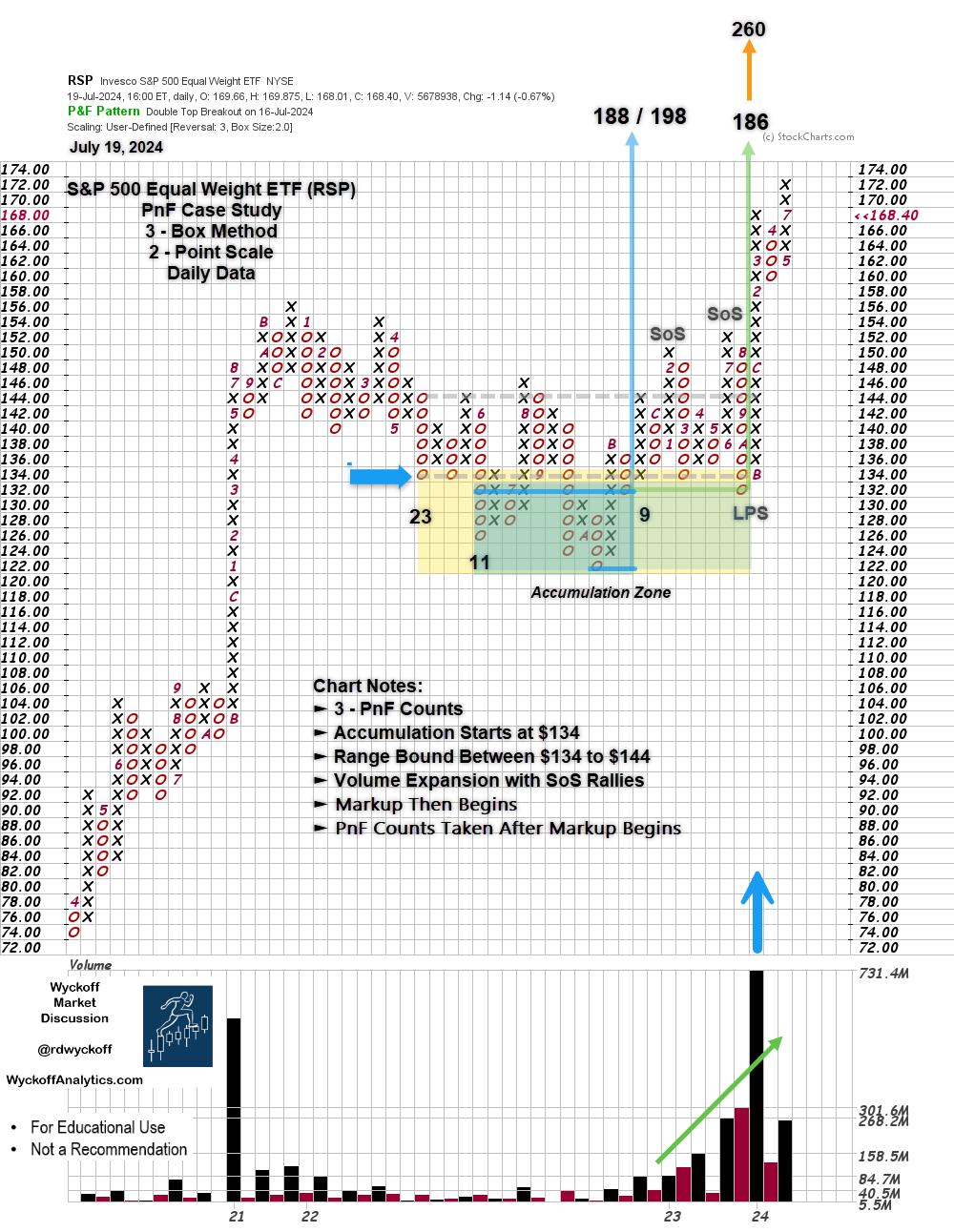

The equal weighted S&P 500 Index ETF (RSP) gives a perspective that highlights these smaller blue-chip shares within the index. Does this equal weighted index reveal a market story obscured by the mega-cap dominated S&P 500 Index ($SPX)?

S&P 500 Equal Weight ETF (RSP), Level & Determine Chart Examine

S&P 500 Equal Weight ETF (RSP), Level & Determine Chart Examine

S&P 500 Equal Weighted ETF (RSP) PnF Chart Notes:

- In ’22 an Accumulation Construction started to type.

- Markup started in ’23 and nonetheless continues.

- Three Horizontal PnF counts are estimated right here.

- Two partial counts verify one another within the $186 worth zone.

- Your entire width of the construction counts to $260.

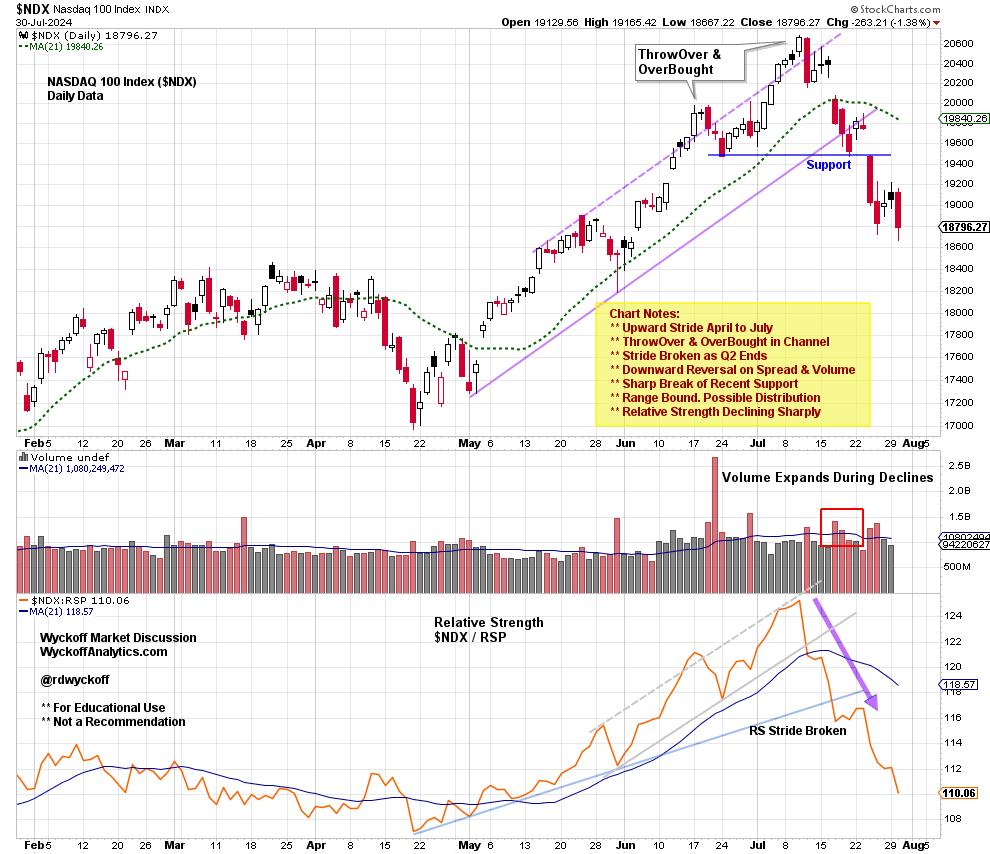

NASDAQ 100 Index ($NDX) with Relative Energy to the S&P 500 Equal Weight ETF (RSP)

This each day chart of the NASDAQ 100 Index ($NDX) illustrates the beginning and finish of the second quarter rally. A closing ThrowOver of the channel line clocks in simply because the quarter is ending and the third quarter is starting. A sudden and sharp reversal is proof of the rotation away from this Mega-Cap dominated index and into the broad checklist of blue chip shares within the S&P 500 Equal Weighted Index. The Relative Energy line clearly reveals the shift.

Broad market rotations can destabilize markets as funds movement away from prior management towards new funding themes. Look ahead to rising management from {industry} teams and shares whereas markets are usually correcting. Level & Determine horizontal counts can assist drastically with worth projection estimates. However we should needless to say PnF can’t estimate the time wanted to succeed in potential worth goals.

All of the Finest,

Bruce

@rdwyckoff

Prior Weblog Notes: On the finish of June, I printed a NASDAQ 100 PnF chart research because it was reaching worth goals. The worth of the target vary was 19,600 / 20,800. On July tenth the $NDX peaked at 20,690.97, simply as the brand new quarter was starting. (click on right here to view the chart research).

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

Wyckoff Sources:

Further Wyckoff Sources (Click on Right here)

Wyckoff Market Dialogue (Click on Right here)

Bruce Fraser, an industry-leading “Wyckoffian,” started educating graduate-level programs at Golden Gate College (GGU) in 1987. Working intently with the late Dr. Henry (“Hank”) Pruden, he developed curriculum for and taught many programs in GGU’s Technical Market Evaluation Graduate Certificates Program, together with Technical Evaluation of Securities, Technique and Implementation, Enterprise Cycle Evaluation and the Wyckoff Technique. For practically three many years, he co-taught Wyckoff Technique programs with Dr.

Study Extra