Superior Dynamic RSI: Futher growth of the RSI

Introduction

The Relative Power Index (RSI) is without doubt one of the best-known indicators in technical evaluation. Developed by J. Welles Wilder, Wilder’s objective was to offer merchants with a instrument to measure the energy of market actions in relation to overbought and oversold circumstances. The Superior Dynamic RSI builds upon Wilder’s work and has been additional developed by me to allow much more exact alerts and dynamic changes to numerous market circumstances.

J. Welles Wilder’s Contribution to Technical Evaluation

J. Welles Wilder Jr. was one of many pioneers of technical evaluation and, along with the RSI, he developed different important indicators such because the Common True Vary (ATR) and the Parabolic SAR. These indicators have revolutionized technical evaluation and proceed to offer merchants with priceless insights into market actions and volatility.

The Evolution of the RSI: Superior Dynamic RSI

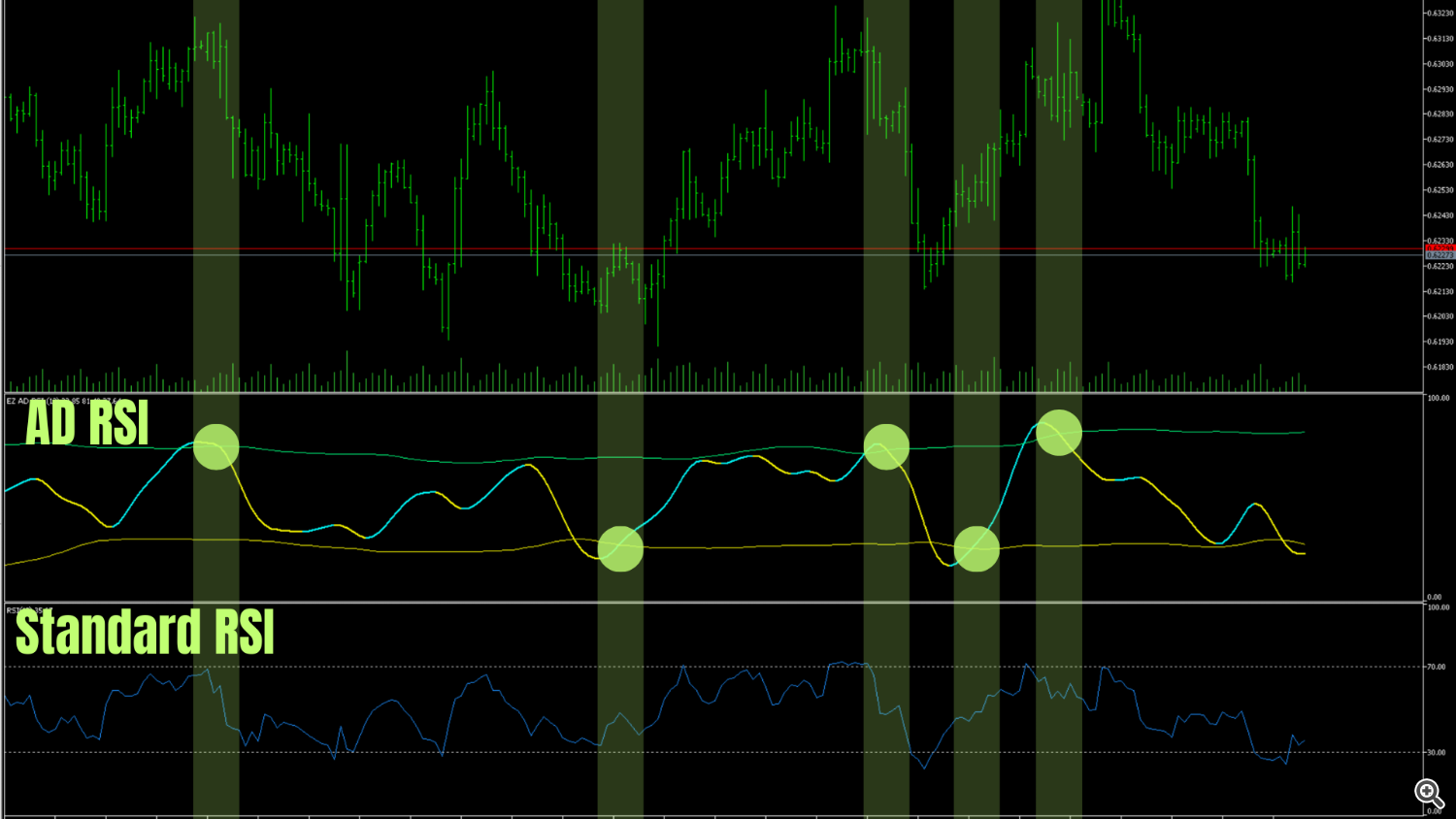

The Superior Dynamic RSI was developed by me for MetaTrader 5 and extends Wilder’s unique RSI idea, as talked about within the introduction, by incorporating dynamic ranges and an adjustable smoothing technique. These extra options are supposed to offer merchants with extra versatile and correct alerts. The picture under reveals a comparability of the AD RSI with the basic RSI. It demonstrates that utilizing dynamic ranges can yield higher sign era. As a buying and selling system developer and dealer with over 20 years within the markets, I acknowledged the worth of the basic RSI way back and have now tried to make one thing good even higher. With model 1 of the AD RSI, I consider I’ll have taken a step nearer to this objective, and I’m happy to share the outcomes of my work with you right here.

Options and Advantages of the Superior Dynamic RSI

- Dynamic Ranges: The indicator calculates overbought and oversold ranges dynamically primarily based on a transferring common and commonplace deviation. This allows the indicator to adapt to present market volatility and thus present extra exact alerts.

- Adjustable Smoothing: Impressed by Wilder’s unique smoothing technique, the Superior Dynamic RSI makes use of a modified components that reduces the influence of short-term market fluctuations and delivers extra steady alerts.

- Visible Customization: The colours and line types, for instance, for the overbought and oversold ranges, could be personalized to go well with particular person preferences and optimize visible illustration within the chart.

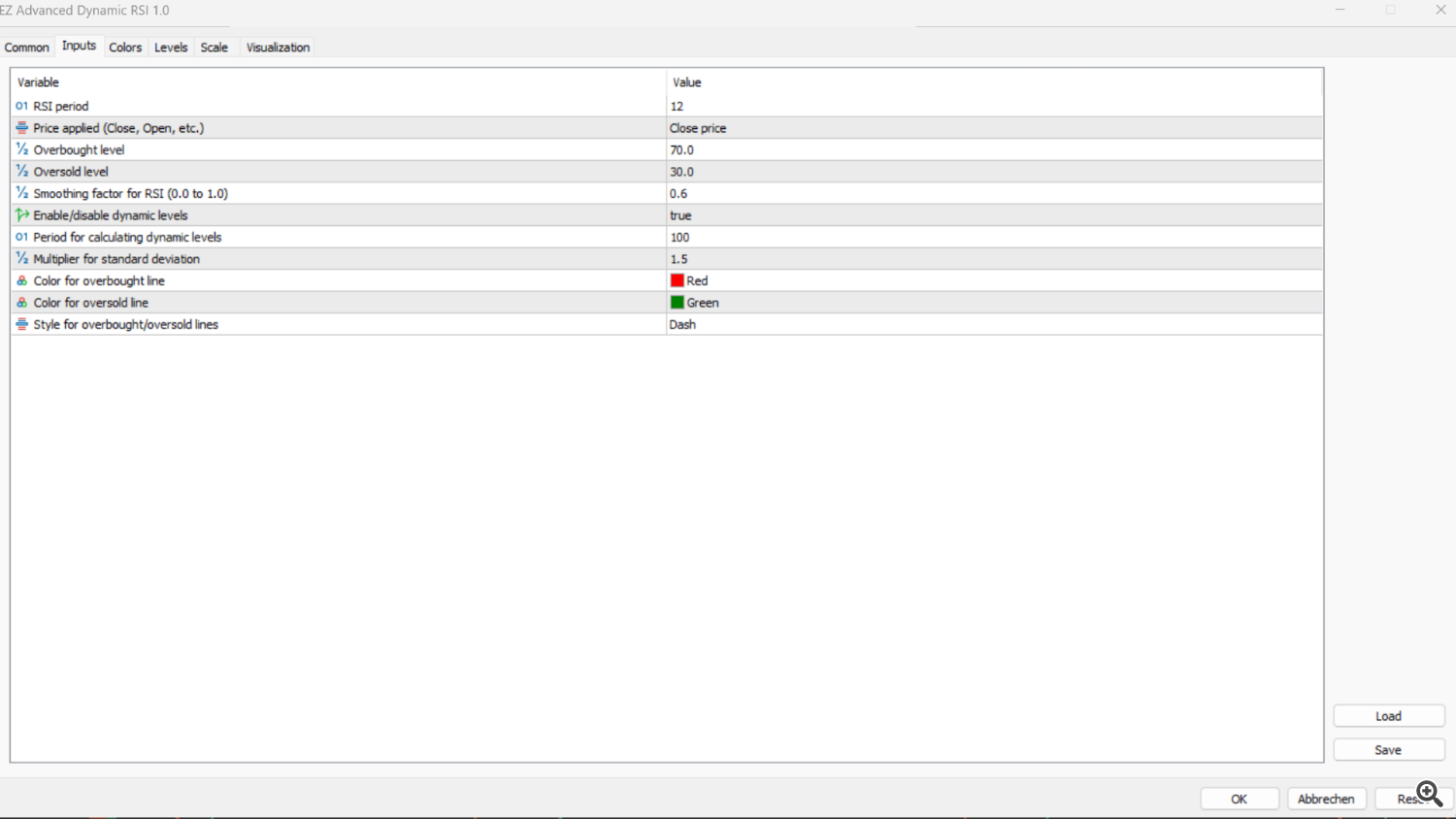

Enter Parameters and Their Features

- RSI Interval: This enter controls the size of the commentary interval for the RSI calculation. Shorter durations are appropriate for short-term merchants, whereas longer durations replicate long-term developments.

- Value Supply: The Superior Dynamic RSI permits using varied worth sources (e.g., closing worth, opening worth).

- Overbought/Oversold Ranges: Mounted values at which the market is taken into account overbought or oversold. These ranges can be calculated dynamically.

- Smoothing Issue: The smoothing issue permits merchants to clean the RSI development, offering a extra steady visible illustration.

- Allow Dynamic Ranges: Prompts the dynamic calculation of overbought/oversold areas primarily based on market volatility.

Advantages of the Superior Dynamic RSI

The Superior Dynamic RSI is designed to be a contemporary and versatile indicator that addresses the restrictions of the basic RSI. It adapts higher to numerous market circumstances, with dynamic changes and adjustable smoothing geared toward minimizing false alerts and supporting higher buying and selling choices. That’s the idea! Now, let’s let the backtest outcomes converse for themselves.

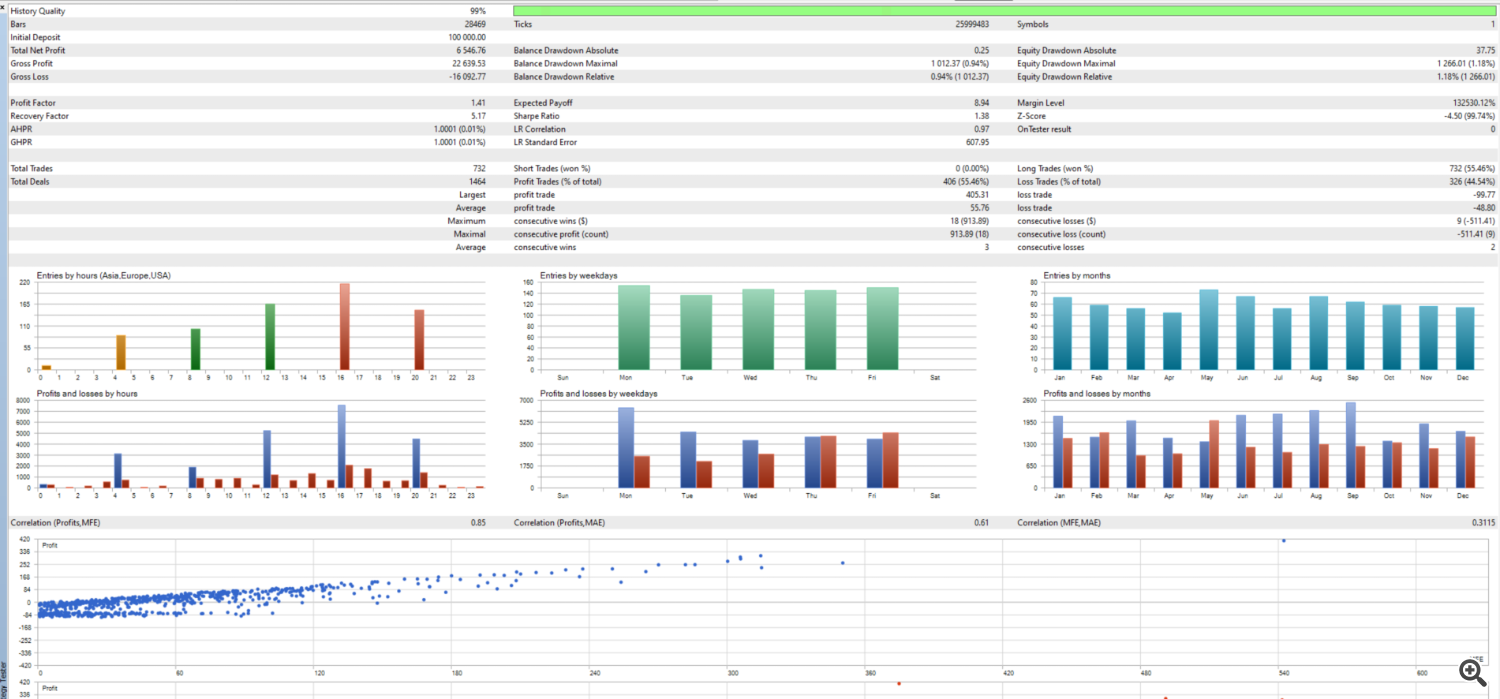

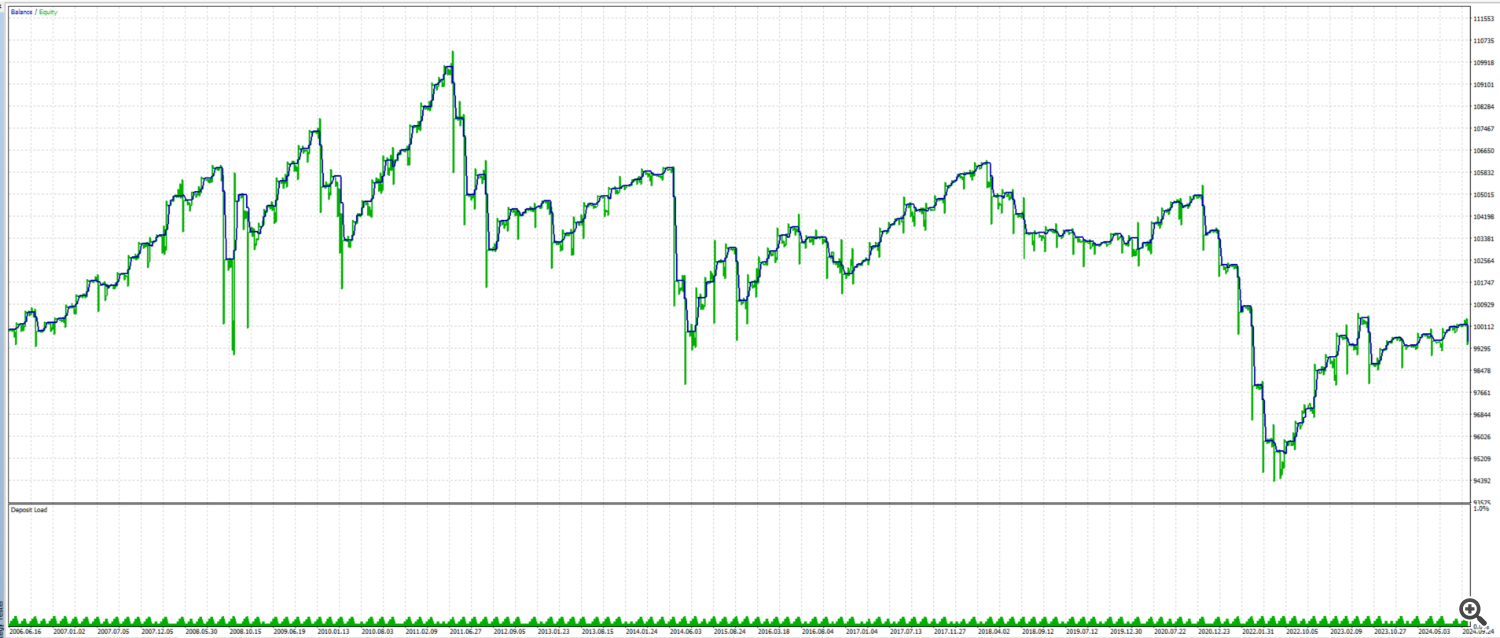

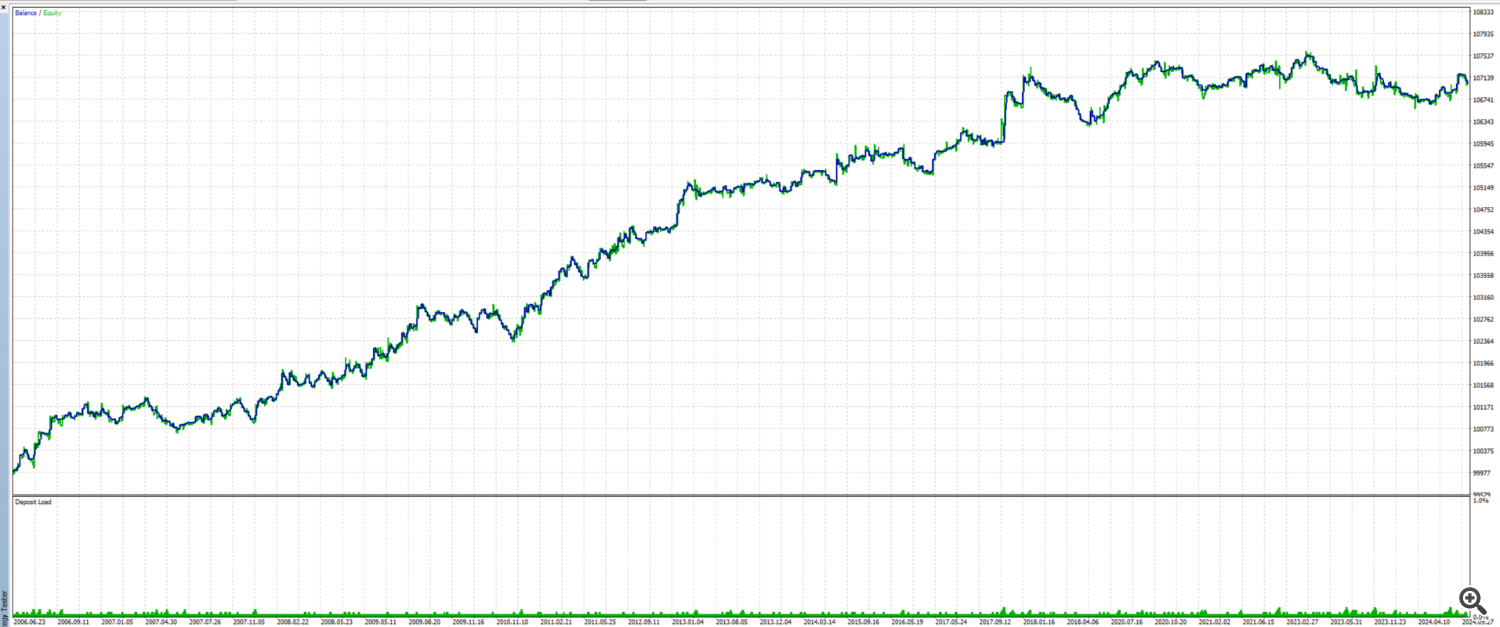

First Backtests: Superior Dynamic RSI on EURUSD

To guage the effectiveness of the Superior Dynamic RSI, I created a buying and selling technique and carried out preliminary backtests on historic information of the EURUSD pair, ranging from 2006. The take a look at introduced right here was run on a 4-hour chart, mixed with a easy development filter and a fundamental cross logic primarily based on the indicator’s dynamic overbought and oversold traces. For the preliminary take a look at, a set lot dimension of 0.1 was traded, and a tough optimization of the parameters was carried out. The outcomes of those assessments present promising insights and encourage me to proceed engaged on this indicator.

Take a look at Settings and Methodology

The backtest was carried out beneath the next circumstances:

- Time Interval: Historic information from 2006

- Time Body: 4-hour chart (H4)

- Technique Logic: A easy cross logic the place solely lengthy positions are opened when the RSI crosses the dynamic oversold line from under. Positions are closed when the RSI crosses the overbought line from above.

- Pattern Filter: A easy MA development filter was used to commerce solely within the path of the overarching development.

Outcomes and Observations

The backtest outcomes point out constructive technique efficiency, which seems to be higher than the basic RSI. Listed here are some key metrics from the assessments:

- Revenue Issue: 1.41

- Whole Trades: 732 trades, of which roughly 55.46% had been profitable.

- Common Revenue per Commerce: 8.94 USD

Along with these figures, an evaluation of income and losses by hour, weekday, and month confirmed that sure durations had been extra worthwhile than others. This may be essential for future technique optimizations primarily based on this indicator. Larger income had been seen throughout European and American buying and selling hours, notably from noon to the afternoon.

The correlation of income with most favorable and adversarial worth motion (MFE, MAE) signifies a promising linear correlation, suggesting that the technique yields constant outcomes on common.

Image under: consequence AD RSI

Image under: consequence Klassik RSI

Image under: consequence Klassik RSI

Image under: consequence AD RSI

Image under: consequence AD RSI

Conclusion of the First Backtests

The backtest outcomes are promising and make sure the effectiveness of the Superior Dynamic RSI indicator in EURUSD evaluation. The dynamic overbought and oversold ranges have proven to offer priceless alerts. These preliminary assessments encourage me to additional refine the indicator and make extra optimizations to reinforce its efficiency. The indicator is at present obtainable totally free on the MetaTrader Market. Be happy to make use of it to your personal assessments.