Editor’s be aware: Since this publish was first revealed, the be aware on the ultimate chart has been corrected to replicate that, as depicted, gold shares are calculated based mostly on nationwide valuation (June 3, 2024, 9:00 am), and the textual content has been edited to make clear the place the evaluation refers back to the authors’ pattern (June 12, 2024, 1:29 pm).

World central banks and finance ministries held practically $12 trillion of overseas change reserves as of the tip of 2023, with practically $7 trillion composed of U.S. greenback property. Nonetheless, a story has emerged that an noticed decline within the share of greenback property in official reserve portfolios represents the vanguard of the greenback’s lack of standing within the worldwide financial system. Some market members have equally linked the obvious improve in official demand for gold lately to a need to diversify away from the U.S. greenback. Drawing on current analysis and analytics, this publish questions these narratives, arguing that these noticed mixture tendencies largely replicate the habits of a small variety of nations and don’t signify a widespread effort by central banks to diversify away from {dollars}.

Central Financial institution Reserves

Overseas change reserves are property held by a central financial institution in overseas foreign money. They usually include bonds, deposits, banknotes, and authorities securities, however may embody commodities like gold and silver. Many world central banks select to carry reserves in overseas change to assist confidence of their financial and change fee insurance policies, together with the capability to intervene in assist of the native foreign money. Because the Worldwide Financial Fund (IMF) discusses, overseas change reserves may soak up stress on currencies throughout occasions of disaster or when entry to worldwide borrowing is curtailed, giving markets better confidence {that a} nation can meet its exterior obligations.

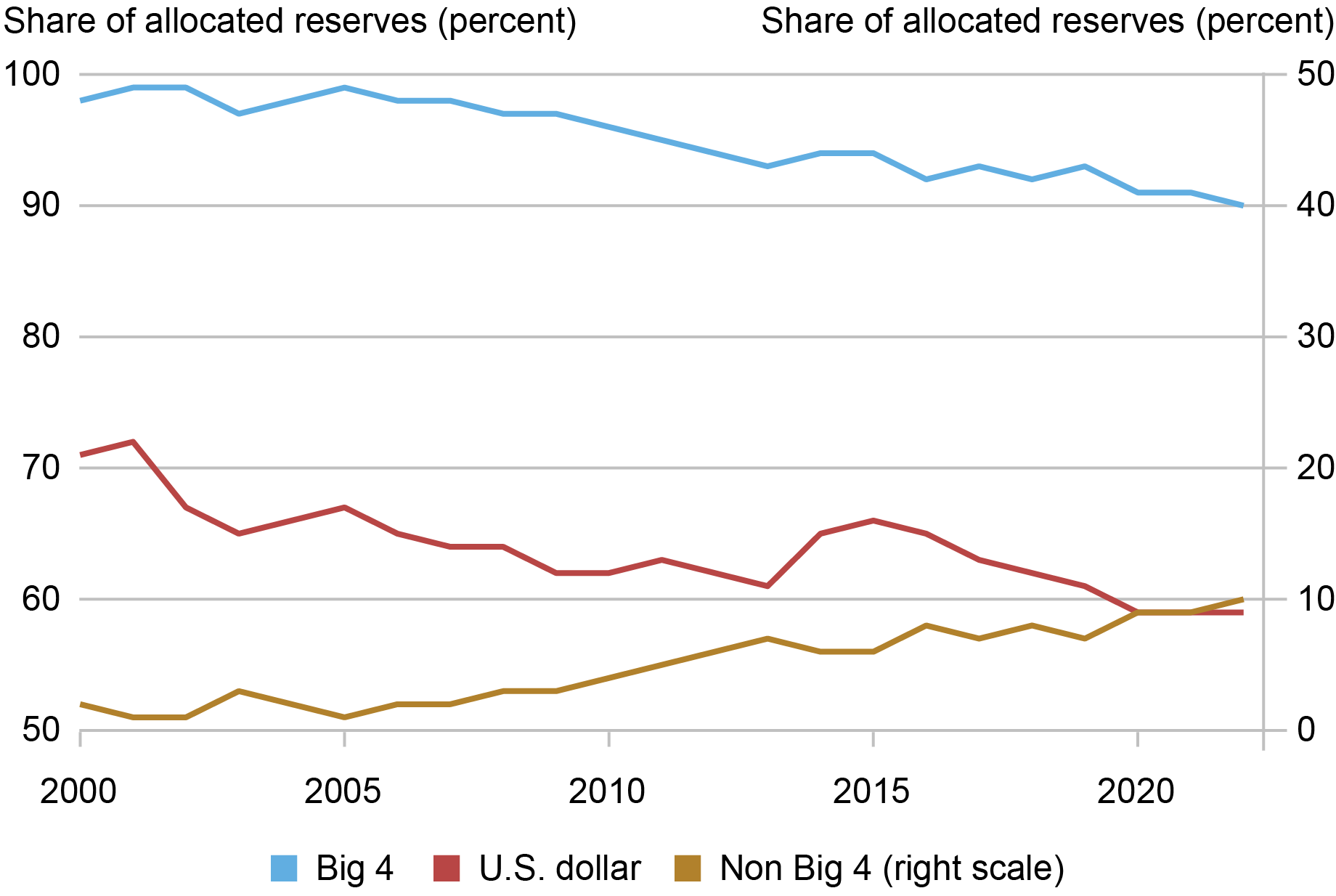

The IMF’s Forex Composition of Official Overseas Change Reserves (COFER) information stories aggregates of the foreign money composition of overseas change reserves held by central banks. The chart under presents the greenback share and the share of the “Huge 4” currencies (greenback, euro, yen, and pound), displaying that each peaked in 2001. Following the worldwide monetary disaster, the U.S. greenback share recovered to 65 p.c in 2015, however then noticed a 7 share level decline from 2015 to 2021.

Greenback Share of Overseas Change Reserves Has Declined over Current A long time

Notes: The chart exhibits world tendencies in central financial institution overseas foreign money allocations. “Huge 4” refers back to the U.S. greenback, Japanese yen, euro, and British pound.

A New (Easy) Decomposition Offers Perspective on Reserve Portfolio Adjustments

New analysis by Goldberg and Hannaoui (2024) exhibits that, conceptually, the adjustments within the greenback share of mixture reserves are pushed by two very totally different forces. First, the change in preferences for holding greenback property can evolve on the nation degree and work together with the preliminary reserve stability of a rustic. Second, world aggregates can evolve throughout durations as a consequence of adjustments within the portions of reserves held within the portfolios of nations, interacted with their preliminary greenback portfolio allocation. Thus, nations that see giant adjustments within the measurement of their reserves and with an preliminary greenback weight considerably totally different from the typical can contribute considerably to world aggregates of overseas change foreign money shares for causes unrelated to adjustments in preferences for holding greenback property.

Two kinds of country-level information are used for our 72-country pattern, whose overseas change reserves spanned two-thirds of the world complete as of 2021, to supply insights that additional unpack the significance of those components: nation overseas change reserves information (IMF Worldwide Monetary Statistics) and information on the country-level composition of reserves drawn from researcher estimates (Ito and McCauley 2020). Utilizing the latter, one can estimate the elements of the 7 share level decline within the U.S. greenback world reserve share, throughout our 72-country pattern, noticed between 2015 and 2021.

The decline is outlined by three elements. First, the weighted sum of the preferences for greenback property throughout nations for which there are estimates for each 2015 and 2021 accounts for 0.3 share factors. In mixture, this summation explains virtually not one of the complete change within the COFER greenback share. Second, the sample of accumulation and declines in reserve portfolios explains 3.8 share factors of the mixture U.S. greenback share decline. The implication of this evaluation is that half of the general greenback share decline, inside our 72-country pattern, isn’t attributable to adjustments in greenback preferences.

The decomposition permits us to estimate the third half—the portion of the mixture U.S. greenback share decline in complete overseas change reserves attributed to altering preferences for greenback property by nations for which estimated portfolio allocations are unavailable. This complete element, dominated by the bigger reserves of China and India, accounts for about 2.9 share factors of the 7 share level decline within the U.S. greenback share of the full, as estimated from our 72-country pattern. These particular estimates might change by together with different nations which might be lacking from our analytics however included inside the broader COFER development.

Wanting extra carefully throughout country-level information, a small set of nations performed a big function in our pattern. Switzerland—having raised complete reserves by virtually half a trillion {dollars} throughout this era—contributed practically 1.8 share factors to the worldwide allotted U.S. greenback share decline. The noticed impact contributed by Switzerland is because of its accumulation of euros, largely on account of a financial coverage framework that at occasions limits actions within the euro–Swiss franc pair. This contribution is, then, a narrative of Swiss financial coverage, and never one among a declining choice for greenback property. Russia additionally noticed important overseas change reserve development from 2015 to 2021, rising its reserve stability by over $150 billion whereas concurrently reducing its share of greenback property by 29 share factors. This led to an estimated contribution of 1.8 share factors to the 7 share level decline.

The information on estimated portfolio shares present a mixture of each constructive and damaging adjustments in U.S. greenback asset portfolio shares throughout nations. It’s subsequently not the case that nations are transferring away from {dollars} en masse. Certainly, rising U.S. greenback shares from 2015 to 2021 have been a function of thirty-one of the fifty-five nations for which there are estimates. The decline within the greenback preferences of a small group of nations (notably China, India, Russia, and Turkey) and the massive improve within the amount of reserves held by Switzerland clarify many of the decline within the greenback share of reserves noticed inside our pattern.

Do Relative Returns on Belongings and Geopolitical Concerns Drive Portfolio Shifts?

We use regression analytics to discover the contributions of normal determinants of the U.S. greenback share of nation reserves. The usual determinants embody using foreign money pegs; nation bilateral commerce shares with the U.S., euro space, and Japan; and the foreign money denomination and degree of exterior debt. Our analysis finds that the primary drivers of portfolio allocations proceed to be the standard ones that stress foreign money pegs, proximity to the euro space in commerce, and debt exposures.

The primary new conjecture examined is whether or not the greenback share will likely be decrease when different reserve currencies have greater returns. To get at the concept that elements of the portfolio is likely to be managed with totally different methods, official reserve portfolios are interpreted as composed of a liquidity tranche—wanted to satisfy some short-term goals within the occasion of a funding market disruption—and an funding tranche. Liquidity tranche proxies are alternatively outlined as three months of nation items and providers imports or a rustic’s short-term liabilities, each of that are approaches to defining minimal reserve balances as supplied in steerage from the IMF. The funding tranche is outlined as the surplus of complete official reserves relative to liquidity wants. Accordingly, we additionally take a look at whether or not this portfolio tilt from foreign money returns might be magnified in a low U.S. rate of interest atmosphere, and when central banks have a bigger funding tranche.

Our analysis means that relative returns on sovereign property—for conventional and nontraditional reserve currencies—haven’t performed a big function within the greenback share of official reserves. Low rate of interest and nil decrease certain durations didn’t considerably enlarge or tilt the results of relative returns on sovereign property. As well as, relative to previous evaluation, we discover a stronger impact of proximity to the euro space on tilting some portfolios away from {dollars}.

The second conjecture is that the greenback share might be decrease for nations which might be geopolitically much less aligned with the U.S., at the very least in comparison with greenback shares that may in any other case be advised by their patterns of commerce, debt finance, and foreign money regimes. One a part of the reason is likely to be that these forces are stronger when central financial institution reserves are bigger than their liquidity wants—permitting reserve managers to chase yields. Exams of this conjecture use nation voting settlement with the U.S. on the United Nations Normal Meeting, launched in steady kind or in discrete classes of settlement (low, medium, or excessive). Our analysis finds that geopolitical issues do play a job in greenback shares, although, surprisingly, they scale back the greenback share primarily when nation reserve portfolios are already giant sufficient to satisfy their potential overseas foreign money liquidity wants.

Tips on how to Interpret the Sharp Rise in Central Financial institution Holdings of Gold

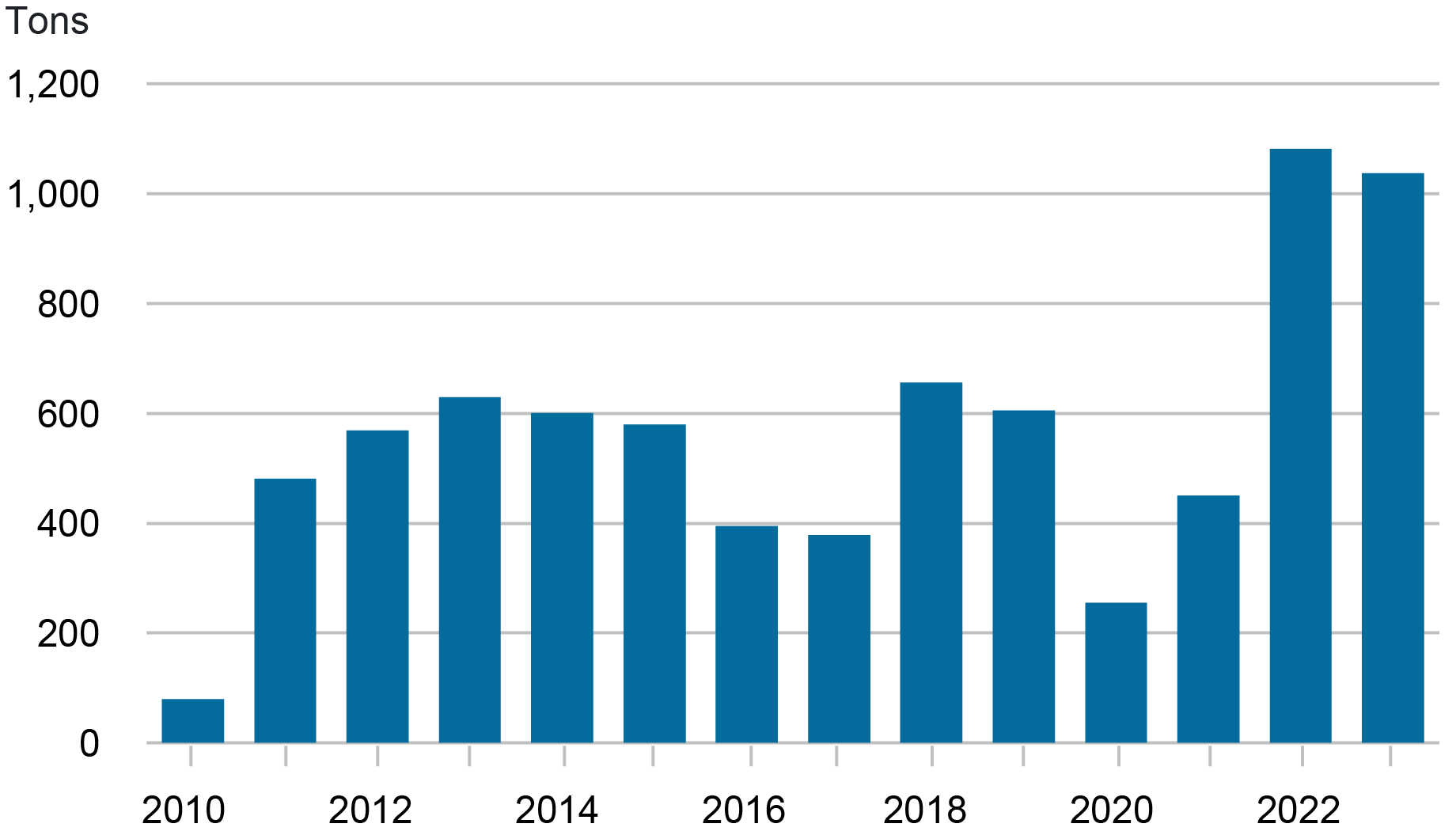

Central banks have elevated their gold purchases notably for the reason that world monetary disaster, and this pattern seems to have accelerated lately. Based on World Gold Council information, world central banks bought over 1,100 tons of gold in 2022—greater than double the acquisition quantities of the earlier yr—and maintained an analogous buy degree in 2023, as proven within the chart under.

Will increase in World Central Financial institution Gold Holdings

Market members have attributed this elevated demand to 3 components: (1) gold’s perceived worth as an inflation hedge amid rising issues round central financial institution credibility and independence, (2) gold’s use as a threat hedge, given elevated financial and monetary uncertainty, and (3) gold’s use as a sanctions hedge because it has no issuing authorities.

Gold’s seeming security from sanctions has been broadly considered as a very salient issue behind official gold purchases since Russia’s invasion of Ukraine in 2022 and the G7 nations’ subsequent determination to freeze the overseas change reserves of Russia’s central financial institution and forbid their banks from doing most enterprise with Russian counterparts. Arslanalp, Eichengreen, and Simpson-Bell (2023) present proof of the applying of multilateral sanctions as a driver for rising market and growing nations. Central banks themselves have famous sanctions issues as a driver of gold purchases and of elevated vaulting of gold domestically in current reserve supervisor surveys. Furthermore, we discover that nations which might be geopolitically much less aligned with the U.S.—as proxied with their voting settlement with the U.S. within the United Nations—have tended to be the most important gold purchasers lately (although low voting alignment with the U.S. isn’t a powerful predictor of gold accumulation general).

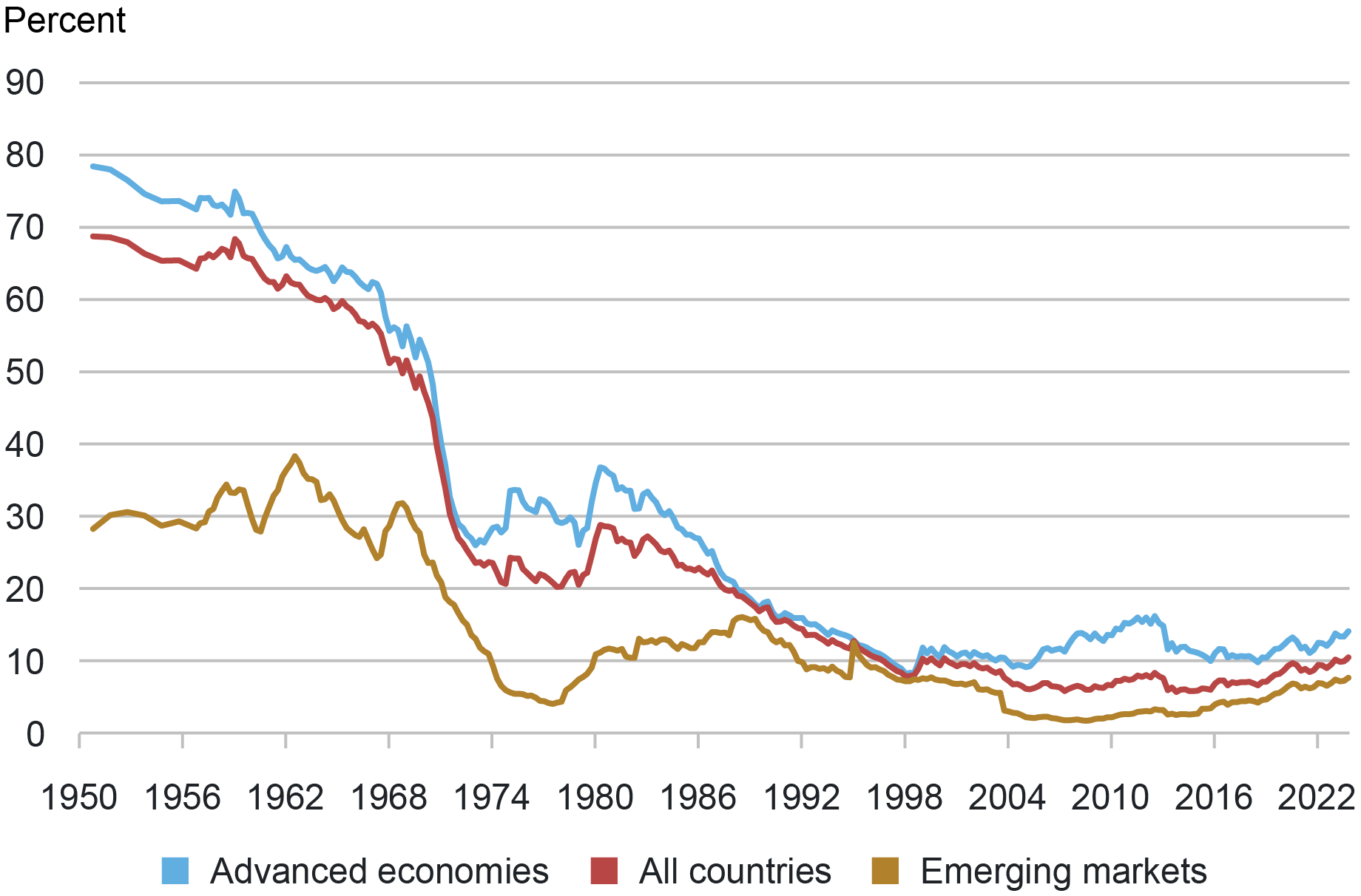

Whereas these gold purchases are definitely notable, the broader implications for central banks are restricted. First, gold’s share of mixture reserves stays modest at about 10 p.c (or 15 p.c based mostly in the marketplace valuation of gold), roughly its degree within the early 2000s, as proven within the chart under. Second, IMF country-level information counsel that many of the improve in official gold holdings has come from just some central banks. Greater than half of reported gold accumulation since 2009 was from China and Russia, with one other quarter coming from a handful of rising market central banks (Turkey, India, Kazakhstan, Uzbekistan, and Thailand). Lastly, gold retains essential shortcomings as a substitute for fiat currencies. It bears no curiosity and, as a bodily asset, is troublesome to make use of in transactions, to say nothing of its excessive transportation, warehousing, and safety prices.

Ratio of Gold to Official Overseas Change Reserves Stays Low

Be aware: Gold shares are calculated based mostly on nationwide valuation of gold.

Conclusion

Total, our analysis means that the narratives about declining greenback shares in official reserves, and rising roles for gold holdings by central banks, inappropriately generalize the actions of a small group of nations. The decline within the greenback share of reserves isn’t even all the time about greenback preferences. Our findings add insights to the messages of the ECB’s 2023 report on the Worldwide Position of the Euro, whereby a cautious survey of key bulletins of nation intent to shift the foreign money composition of their reserves was not accompanied by materials adjustments in key indicators of worldwide roles of the greenback.

Patrick Douglass is a capital markets buying and selling principal within the Federal Reserve Financial institution of New York’s Markets Group.

Linda S. Goldberg is a monetary analysis advisor for Monetary Intermediation Coverage Analysis within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Oliver Z. Hannaoui is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Tips on how to cite this publish:

Patrick Douglass, Linda S. Goldberg, and Oliver Z. Hannaoui, “Taking Inventory: Greenback Belongings, Gold, and Official Overseas Change Reserves,” Federal Reserve Financial institution of New York Liberty Avenue Economics, Might 29, 2024, https://libertystreeteconomics.newyorkfed.org/2024/05/taking-stock-dollar-assets-gold-and-official-foreign-exchange-reserves/.

Disclaimer

The views expressed on this publish are these of the creator(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the creator(s).