KEY

TAKEAWAYS

- Tech shares, particularly semiconductors, get hammered.

- Treasury yields proceed to rally larger in response to Fed feedback and powerful financial system.

- The US greenback rally confirms the energy of the US financial system.

“The financial system just isn’t sending any alerts that we have to be in a rush to decrease charges.” These phrases from Chairman Powell impacted the inventory market way more than this week’s inflation information.

“The financial system just isn’t sending any alerts that we have to be in a rush to decrease charges.” These phrases from Chairman Powell impacted the inventory market way more than this week’s inflation information.

The inventory market began promoting off on Thursday afternoon and continued to take action Friday, with the broader inventory market indexes closing decrease. The Dow Jones Industrial Common ($INDU) closed down by 0.70%, the S&P 500 decrease by 1.32%, and the Nasdaq Composite ($COMPQ) decrease by 2.2%.

It is also choices expiration Friday, which typically means elevated volatility. The Cboe Volatility Index ($VIX) gained 12.79% on Friday, closing at 16.14. That is a giant leap from earlier within the week.

Nasdaq’s Fierce Selloff

The Nasdaq skilled the most important drop of the three indexes. The chip makers obtained smoked. Utilized Supplies (AMAT), the most important US chipmaker, was down 8.76% on a disappointing income forecast. Nvidia (NVDA) was down over 3%, Micron Know-how (MU) was down nearly 3%, and Intel (INTC) fell 1.70%.

The day by day chart of the VanEck Vectors Semiconductor ETF (SMH) offers a transparent image of the semiconductor business.

FIGURE 1. DAILY CHART OF THE VANECK VECTORS SEMICONDUCTOR ETF (SMH). The sharp selloff in semiconductor shares resulted in a technical weak point within the chart of SMH. It is near a assist stage, whereas its SCTR rating, MACD, and relative energy with respect to the S&P 500 weaken.Chart supply: StockChartsACP. For instructional functions.

Though SMH continues to be throughout the sideways vary (gray rectangle), it’s totally near the underside of the vary, which aligns with the 200-day easy transferring common (SMA). The StockCharts Technical Rank (SCTR) rating is at a low 29, the transferring common convergence/divergence (MACD) signifies an absence of momentum, and SMH just isn’t outperforming the S&P 500 prefer it as soon as did.

Appears like buyers are rotating away from semiconductors, both taking income or investing in different asset lessons — however which of them? It is definitely not healthcare shares, which additionally obtained pounded on Friday. Maybe cryptocurrencies. Nevertheless, there’s extra brewing beneath the floor.

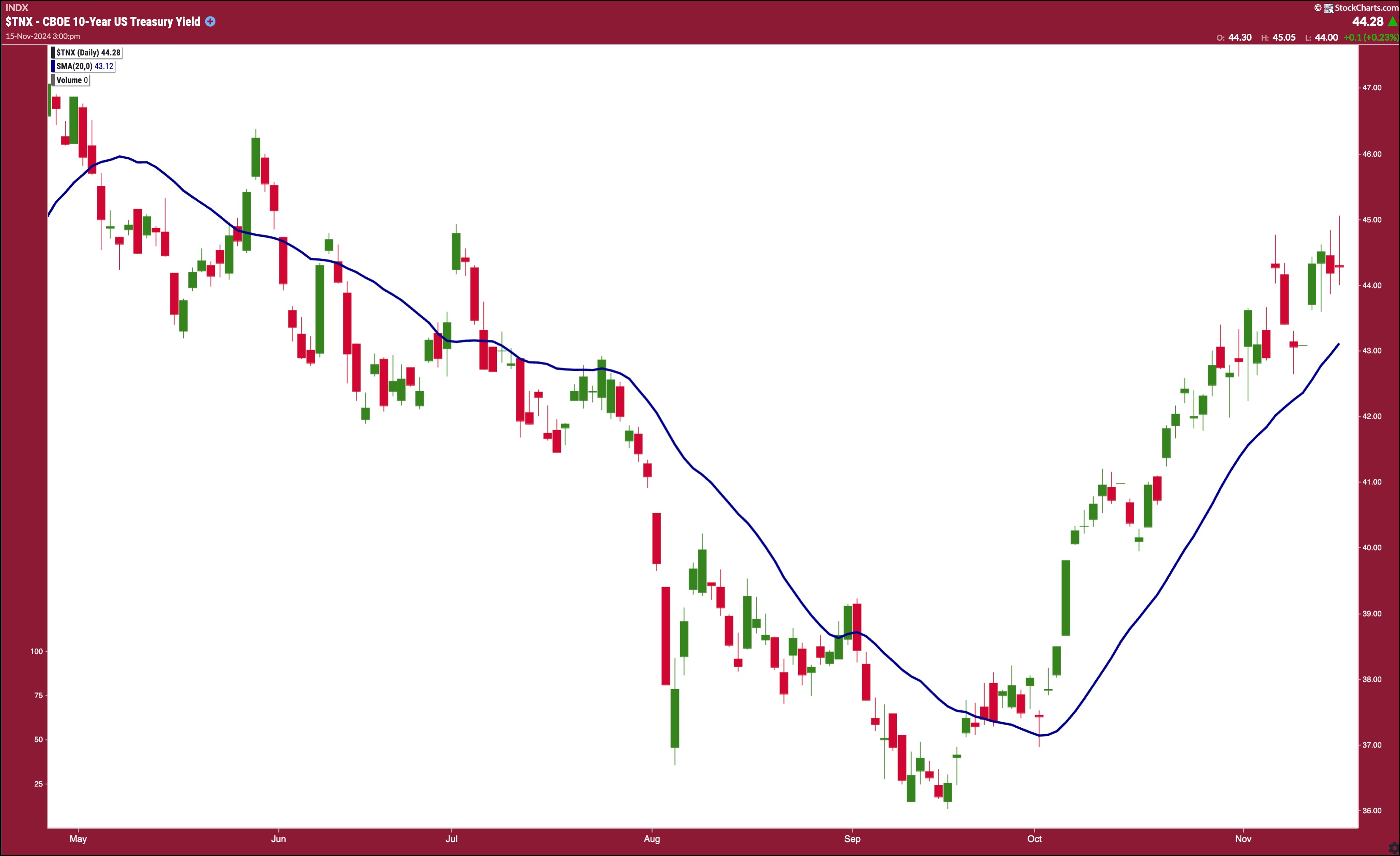

The Yield Rally

The financial system continues to be robust—retail gross sales information reveals that customers proceed to spend, which is pushing Treasury yields larger. The ten-year US Treasury Yield Index ($TNX) closed at 4.43% (see day by day chart under). TNX has been trending larger since mid-September and because the finish of September has been buying and selling above its 20-day SMA.

FIGURE 2. DAILY CHART OF THE 10-YEAR US TREASURY YIELD. Treasury yields have been on a relentless yield since September. A stronger US financial system would maintain yields larger.Chart supply: StockChartsACP. For instructional functions.

Fed Chairman Powell and Boston Fed President Susan Collins’ feedback lowered the chance of a 25-basis-point rate of interest lower within the December FOMC assembly. In accordance with the CME FedWatch Software, the chance is now 58.2%. It was near 70% on Thursday, earlier than Powell’s speech.

The relentless yield rally might have been one motive the Tech sector offered off. Increased yields do not profit development shares.

Greenback’s Roaring Rally

One asset class that’s gaining floor is the US greenback. When the phrases “Greenback units 52-week excessive” seem in my predefined alerts dashboard panel, it is one thing to investigate. The US greenback ($USD) has been in a comparatively steep rally since October (see chart under). With a powerful US financial system and the Fed indicating a extra impartial stance of their coverage selections, the greenback may proceed to strengthen.

FIGURE 3. DAILY CHART OF THE US DOLLAR. The greenback has been in a roaring rally since October. A powerful US financial system helps a powerful greenback.Chart supply: StockChartsACP. For instructional functions.

On the Shut

Excluding the Dow, the opposite broader indexes have fallen to the lows of November 6, the day after the US presidential election. The broad-based selloff may proceed into early subsequent week. There’s not a lot financial information for subsequent week, however Nvidia will announce earnings after the shut on Wednesday. That ought to shake up the chip shares.

When you have money on the sidelines, there could possibly be some “purchase the dip” alternatives. Nevertheless, as a result of there are some dynamics between shares, yields, and the US greenback, the three charts needs to be monitored to determine indicators of a reversal. While you’re assured of a reversal, leap on board.

If you wish to be notified of latest articles printed within the ChartWatchers weblog, enroll on this web page.

Finish-of-Week Wrap-Up

- S&P 500 down 2.08% for the week, at 5870.62, Dow Jones Industrial Common down 1.24% for the week at 43,444.99; Nasdaq Composite down 3.15% for the week at 18,680.12

- $VIX up 8.03%% for the week, closing at 16.14

- Greatest performing sector for the week: Financials

- Worst performing sector for the week: Well being Care

- High 5 Massive Cap SCTR shares: Applovin Corp. (APP); Palantir Applied sciences (PLTR); Summit Therapeutics (SMMT); MicroStrategy Inc. (MSTR); Redditt Inc. (RDDT)

On the Radar Subsequent Week

- October Housing Begins

- November Michigan Client Sentiment

- Fed speeches

- Nvidia earnings

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Website Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to coach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Study Extra