KEY

TAKEAWAYS

- Low VIX studying implies that circumstances are favorable for shares.

- The MOVE index is mainly a VIX for bonds, and might help to corroborate volatility readings throughout asset lessons.

- Excessive yield spreads stay fairly slender, implying bond traders understand a low danger surroundings.

“The market goes up the escalator and down the elevator.” It is a quote that one in all my mentors, Ralph Acampora, shared with me after I visited him years in the past at his farm in Minnesota. This market truism relies on the truth that volatility tends to stay low in bull market phases, and volatility tends to spike increased throughout bear phases.

Why does this have a tendency to occur? Nicely, when all the pieces goes nicely, and traders are optimistic, they have a tendency to slowly accumulate positions on the way in which up. However when traders get nervous, do they calmly and rationally start getting into promote orders? They don’t. Panic ensues, promoting begets additional promoting, and what’s generally known as a “waterfall decline” rapidly emerges on the charts.

Quite a few my latest podcast interviews have included discussions of the VIX and why volatility could also be a very powerful metric to observe. My fellow StockCharts contributor Tom Bowley (a fan of the Carolina Panthers, a staff with an equally painful document to my Cleveland Browns) instructed me it was on the prime of the listing of warning indicators to observe for into early 2025.

Russell Rhoads, who actually wrote the ebook on buying and selling the VIX, talked intimately concerning the relationship between the VIX and the S&P 500. In his expertise, the important thing was to search for the SPX to rally on increased volatility, suggesting that panic was simmering underneath the floor.

Let’s assessment three charts to trace the VIX to assist us determine when this low-volatility uptrend could also be nearing its ultimate phases.

Low Volatility Implies Circumstances are Favorable

Since popping to one in all its highest ranges in historical past again in August, the VIX spent September and October ranging between 15 and 23. In November, the VIX got here off a short-term peak round 23 and progressed down into the low teenagers, the place we discover the VIX in early December.

Now we are able to see that the VIX is again all the way down to the place it spent the second half of 2023 by July 2024. A volatility studying within the low teenagers suggests the market is “going up the escalator” and signifies the most probably path stays increased. And primarily based by myself expertise, in addition to conversations I highlighted above, a spike in volatility is normally a harmful signal it doesn’t matter what the S&P 500 itself is doing at that specific level.

On the lookout for some final minute present concepts for traders in your vacation listing? Our Really useful Studying Record might enable you to present the present of extra aware investing strategies! For these in your listing that aren’t large on the monetary markets but additionally tremendous essential to you, try the “Private Improvement” part on the backside!

Evaluating Volatility Between Shares and Bonds

Whereas many traders are acquainted with the VIX to trace volatility within the fairness markets, far fewer are conscious of the ICE MOVE index which tracks volatility for bonds. Maybe the bond markets are signaling uncertainty that’s not but mirrored within the motion of equities?

We are able to see a typically optimistic correlation between these two information sequence, though October noticed the MOVE surging a lot increased than the VIX. Submit-election, nevertheless, each the MOVE and the VIX have dropped in a really comparable style. For now, the 2 indexes replicate a low-volatility surroundings for his or her respective asset lessons. This chart has a spot of honor on my Market Misbehavior LIVE ChartList as a result of I’ve typically discovered the fastened revenue markets to function a number one indicator for shares, particularly relating to anticipating risk-off situations.

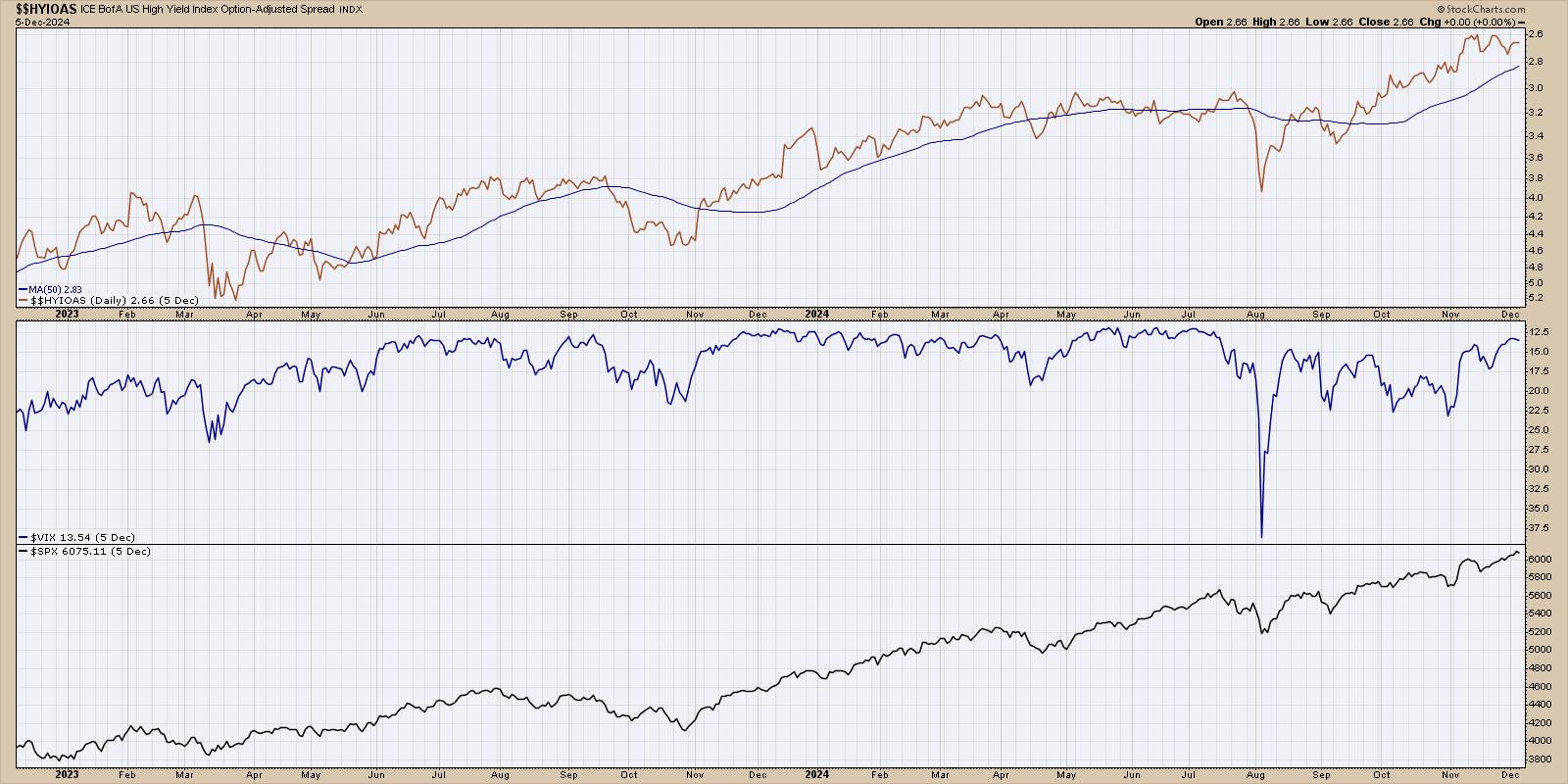

Excessive Yield Spreads Stay Fairly Slender

We are able to additionally take a look at the excessive yield or “junk” bond market to find out how that specific space of the fastened revenue area is performing relative to shares. I’ve discovered that top yield spreads, measuring the hole between yields on junk bonds versus risk-free Treasury bonds, typically transfer in tandem with the VIX.

I’ve plotted the ICE BofA Excessive Yield Index Possibility Adjusted Unfold within the prime panel utilizing an inverted scale, adopted by the VIX additionally on an inverted scale. The inverted scales are used right here due to the normal inverse relationship between these two information sequence and the S&P 500 index, proven on the backside.

Observe that top yield spreads are actually at their lowest ranges in years, indicating that bond traders are perceiving a low-risk surroundings. So bond traders are saying low danger, fairness traders are saying low danger, and which means this bull market is in nice form… for now.

Whereas all three of those charts affirm the present low volatility uptrend part for shares, these charts may also doubtless present us with clear alerts when that low volatility bull part is over. Utilizing these charts as a information, we are able to measure when the S&P 500 is maybe able to “take the elevator down” in a brand new correction part!

RR#6,

Dave

P.S. Able to improve your funding course of? Try my free behavioral investing course!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Analysis LLC

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

The writer doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the writer and don’t in any method symbolize the views or opinions of every other individual or entity.

David Keller, CMT is President and Chief Strategist at Sierra Alpha Analysis LLC, the place he helps energetic traders make higher choices utilizing behavioral finance and technical evaluation. Dave is a CNBC Contributor, and he recaps market exercise and interviews main consultants on his “Market Misbehavior” YouTube channel. A former President of the CMT Affiliation, Dave can also be a member of the Technical Securities Analysts Affiliation San Francisco and the Worldwide Federation of Technical Analysts. He was previously a Managing Director of Analysis at Constancy Investments, the place he managed the famend Constancy Chart Room, and Chief Market Strategist at StockCharts, persevering with the work of legendary technical analyst John Murphy.

Be taught Extra