KEY

TAKEAWAYS

- The market got here out of defensive mode after the election.

- Previous resistance at 585 is now help for SPY.

- XLC, XLY, and XLF are all exhibiting power.

Initially, for these of you in search of a brand new video this week, I’ve deliberately skipped it as a result of I did not wish to make a video proper earlier than such an vital occasion with a lot uncertainty.

After the elections, which had been clearly eventful, I wished to see what the market’s response can be and let the mud cool down earlier than diving into any evaluation, which could have been too preoccupied and presumptuous too early.

Nonetheless, it is now Friday, the top of the week, and we now have just a little extra shade on how markets have responded to the election outcomes. It is time to see what the sector rotation is telling us and the way the chart of the S&P 500 has modified—as a result of it has positively modified!

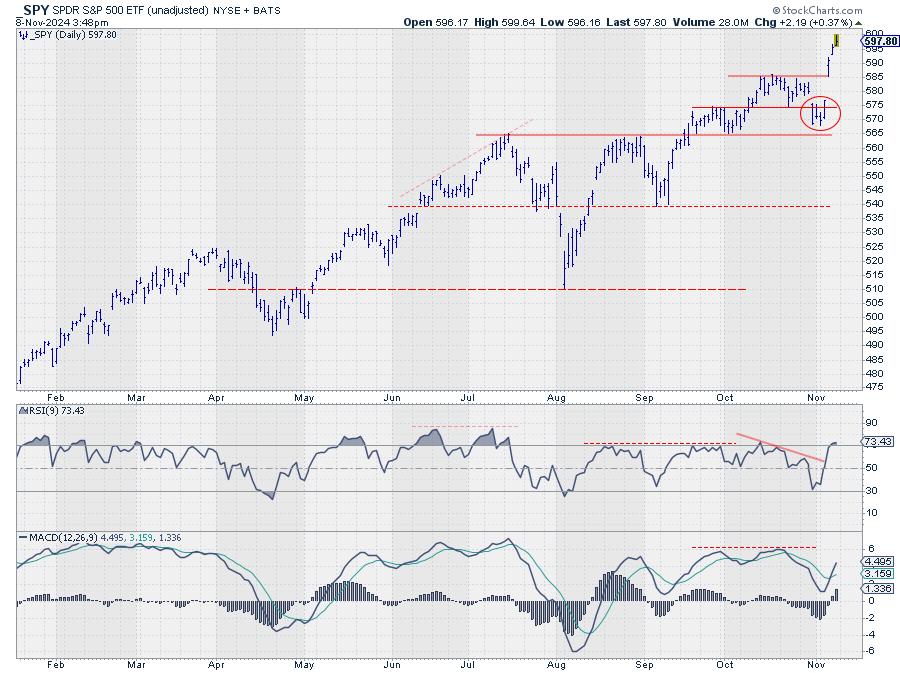

The S&P 500’s Publish-Election Reversal

In the event you have a look at that chart proper now with the annotations, which had been the cornerstone of my view, I’ve to say that it was just a little conservative going into the elections. This has now just about circled. On the chart, a really clear island reversal is now seen.

We’ve got the hole down on the thirty first of October, adopted by three kind of sideways days, which took SPY to a low of simply round 567. On November fifth, election day, the market closed on the excessive, adopted by a large hole up the day after. It was not solely a niche up but in addition a transfer above the S&P 500’s all-time highs.

So we now have a large hole up. We’ve got an island reversal, which accomplished simply above fairly vital help round 565, and we now have already got two days of fine follow-through. That could be a sturdy signal. This market needs to go increased, no less than within the close to time period.

If we change to the weekly chart for SPY, these gentle divergences between the RSI and worth and the MACD and worth are nonetheless seen, however the worth motion itself is so sturdy that it can not and shouldn’t be negated.

So, no less than within the close to time period, this market needs to go increased. For now, corrections holding above help round 585 (the previous peak) needs to be thought to be shopping for alternatives.

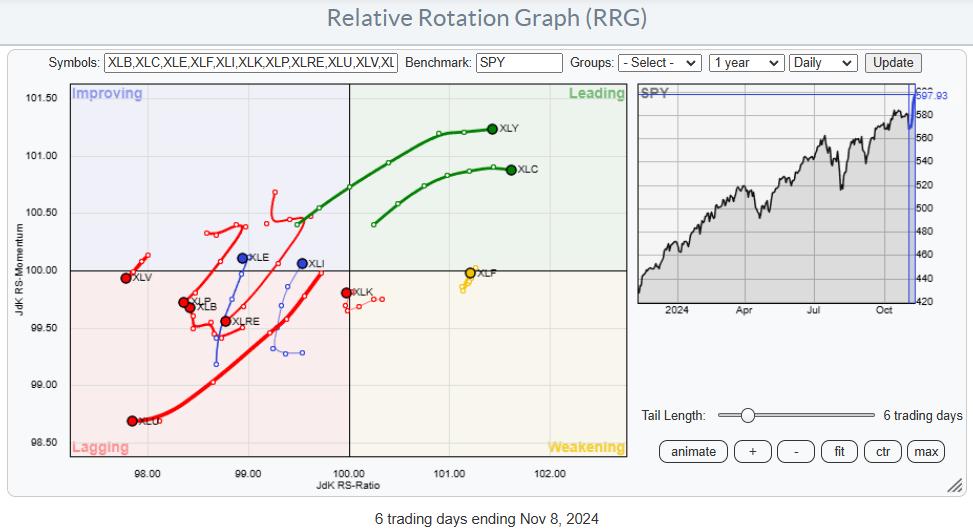

Reversals in Sector Rotation

On the relative rotation graph for the 11 S&P sectors above, I’ve deliberately set the tail size at six buying and selling days. That signifies that every tail has seven nodes, and the 4th node, so the center one, is November fifth. This enables us to see the three days main as much as election day after which the three days after election day. As you possibly can see, many of the tails have continued to journey within the path they had been already heading.

Essentially the most outstanding ones are client discretionary and communication companies, which entered and moved additional into the main quadrant. On the opposite facet is the utility sector, which accelerated additional into the lagging quadrant.

Sectors with Notable Adjustments

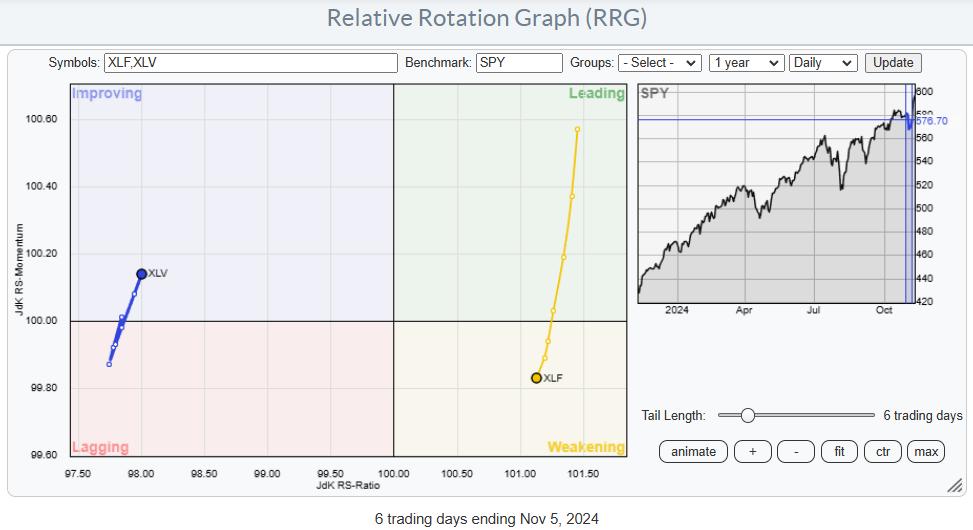

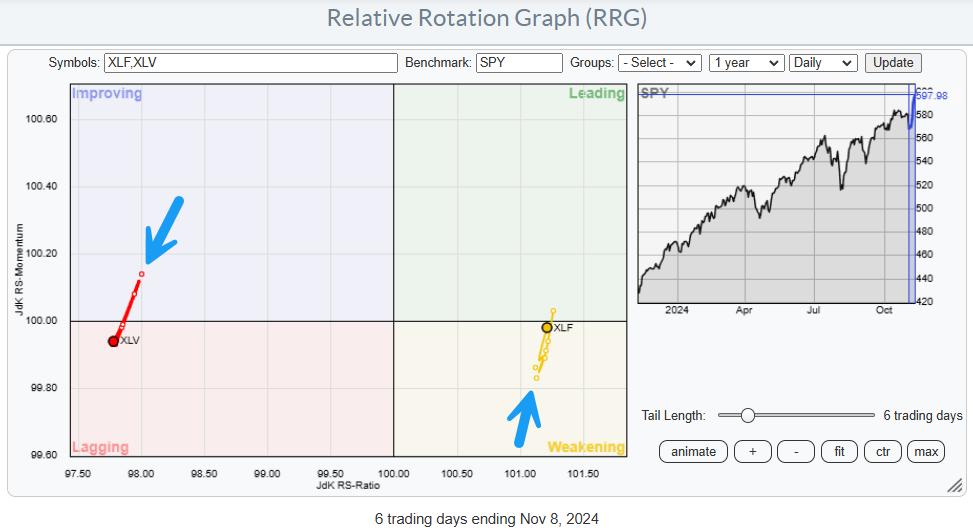

I wish to spotlight just a few sectors that basically modified path, the place we noticed a change intimately earlier than and after election day. The 2 sectors with essentially the most outstanding adjustments are financials and well being care.

This primary RRG exhibits the tails for each sectors ending on the fifth of November.

Financials Sector (XLF)

If we zoom in on the tail for XLF, you possibly can see that it ended November fifth simply contained in the weakening quadrant. It simply crossed over from resulting in weakening. Then, within the 3 days after November fifth, it fully reversed course and is now nearly again into the main quadrant.

Well being Care Sector (XLV)

The identical form of transfer is seen on the opposite facet of the chart for the healthcare sector, XLV. On November fifth, XLV had simply crossed into the bettering quadrant and was on a constructive heading. Within the 3 days after, the sector fully reversed course and is now again into the lagging quadrant at a damaging heading.

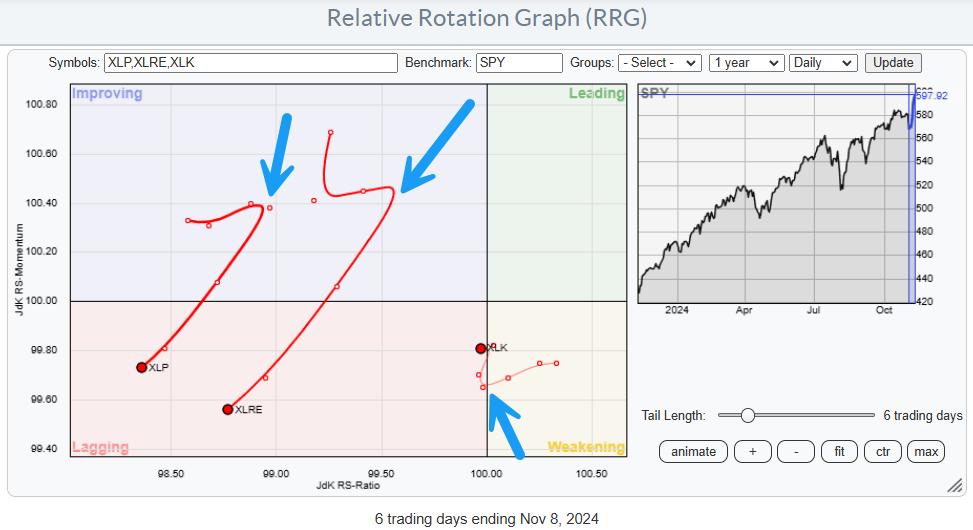

XLP and XLRE Rolling Over

Different sectors the place we see a change in the midst of the tail embrace client staples, which was contained in the bettering quadrant however hooked again down, rolled over, and is now again into the lagging quadrant, and actual property, which was additionally contained in the bettering quadrant however rolled over and is now accelerating into the lagging quadrant.

The expertise sector modified course a bit, however not as clearly as the opposite sectors. It’s nonetheless proper across the 100 stage on the RS ratio scale and really near the benchmark and not using a very clear path.

The Massive Winners Publish-Election

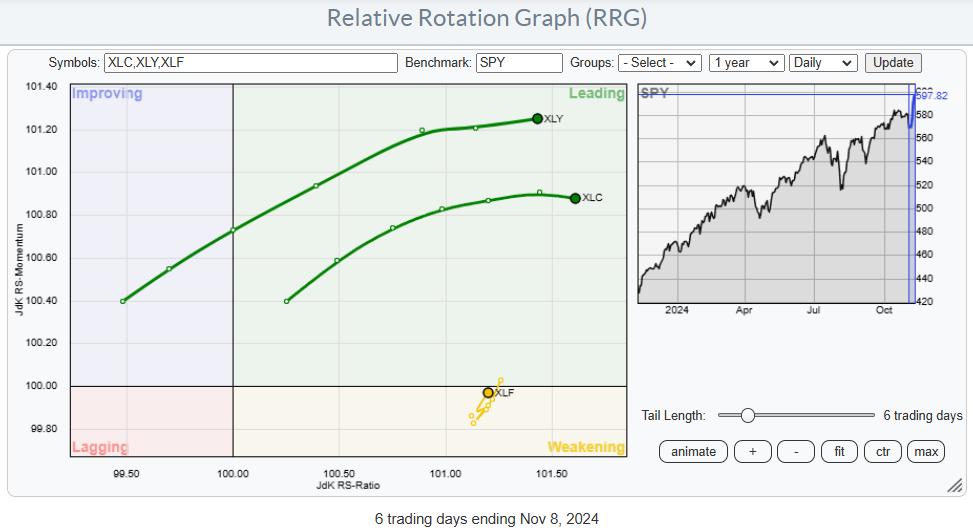

I believe the most important winners from these election outcomes with good potential going ahead are client discretionary (XLY), and Communication Companies (XLC).

XLY is clearly led by TSLA, which is distorting the efficiency of the patron discretionary sector with an nearly 27% acquire in 3 days. However client discretionary shares have picked up roughly between 3% and seven% throughout the board, which nonetheless signifies power. The communication companies sector is barely extra evenly unfold out, and has a superb base and a superb basis to maneuver increased and push additional into the main quadrant.

Conclusion

All in all, the market as a complete appears to have reversed its course. After solely a really gentle corrective transfer, it has now began a brand new up leg within the present uptrend. The sectors which have come out on high are client discretionary and communication companies, adopted by financials.

All 3 are on the right-hand facet of the RRG, both already contained in the main quadrant or nearly there, and touring at a constructive RRG heading. On the other facet, the sectors with a much less favorable outlook are well being care, client staples, and utilities. Total, the sector rotation has now shifted from protection again to offense.

#StayAlert, and have an important weekend. –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio under.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to reply to each message, however I’ll definitely learn them and, the place fairly doable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered emblems of RRG Analysis.