Yves right here. Richard Koo, famed for his creation of the steadiness sheet recession to clarify Japan’s misplaced a long time of development, affords a contemporary angle on why US and Japanese voters have gone into “Throw the incumbents out” mode. As many do, he sees Trump’s rise as strongly tied to the lack of manufacturing jobs. However Koo highlights the sturdy greenback as central to this growth. He places the beginning time as 1987, as of the Louvre Accord. It’s truly earlier.

The greenback spiked up after Volcker deserted his tremendous excessive rate of interest regime, I used to be in London in summer season 1984 when the dollar was at 1.10 to the pound; it later rose to 1.03.

In the course of the 30 months of the greenback surge, Japanese automakers gained market share bigly to the Massive Three and by no means gave it again. Thoughts you, American automakers have been within the midst of the fallout of their refusal/lack of ability to construct cheaper, extra gasoline environment friendly automobiles. However the greenback surge each tremendously accelerated their decline and made it appear much more futile to attempt to reply.

The US and the opposite members of the then G-5 agreed in 1985 to implement the Plaza Accord to drive the yen up. They did, much more so than supposed, resulting in the corrective Louvre Accord in 1987. What just isn’t nicely remembered from that period (I used to be then working with the Japanese) is that regardless that the large fall within the greenback did dent Japanese imports to the US, it did nothing to spice up Japanese imports of American items. Japanese strongly most well-liked Japanese merchandise and regarded US wares as inferior.

Pegging the sturdy greenback period earlier additionally ties it extra strongly to when US common wage development began diverging from productiveness development (1976).

By Richard Koo, Chief Economist of Nomura Analysis Institute with duties to supply impartial financial and market evaluation to Nomura Securities, the main securities home in Japan, and its purchasers. He’s the writer of many books and articles. Tailored from a report revealed by Nomura, cross posted from the Institute of New Financial Pondering web site

Why ruling events have been defeated in US and Japanese elections

Massive political adjustments are afoot in Japan, the US, and Europe. The US and Japan held nationwide elections previously few weeks, and in each circumstances the ruling celebration suffered a serious defeat, creating heavy uncertainty over financial coverage. In Germany, in the meantime, the withdrawal of the Free Democrats Celebration (FDP) from the three-party coalition has left the federal government in a predicament.

What’s widespread to all three areas is rising in style anger over the economic system regardless of excessive inventory costs and low unemployment. Within the US, the macro-level knowledge are moderately sturdy, however many individuals are merely not benefiting. In Japan, import inflation has weighed closely on family funds, and Germany is affected by a critical financial slowdown.

US asset costs have surged over the past 40-odd years, however wages have hardly budged

Turning first to the US, I believe many individuals anticipated the incumbent Democrats to be returned to the White Home given the comparatively low unemployment price, strong GDP development, and excessive inventory costs.

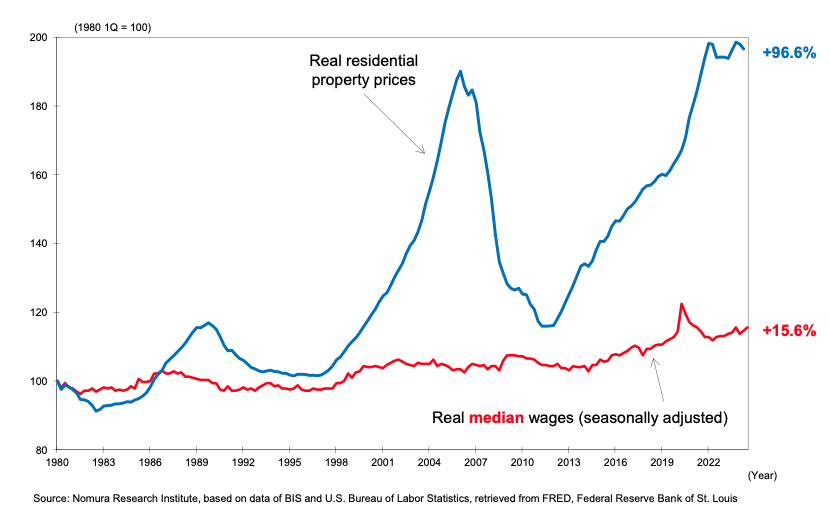

However as famous by David Smick, director of a documentary titled “America’s Burning” that was lately launched within the US, the DJIA has risen 5,000% within the 43 years since 1980, however the actual (median) wages of extraordinary People have elevated by solely 15%. Since this can be a median worth, it signifies that totally half of all People have seen their actual wages rise by lower than 15% within the final 43 years.

What is going on within the inventory market could not have an effect on the dwelling requirements of the folks immediately, however inflation-adjusted housing costs, which have a direct affect on family funds, have soared 96.6% (Determine 1). The truth that the actual wages of the extraordinary People searching for to purchase these homes have risen by solely simply over 15% makes it clear in lots of senses that their lifestyle has declined. It shouldn’t be stunning that they’re so sad with the present system.

Determine 1: Actual housing costs and actual wages within the US

Globalization-driven “hollowing-out” of trade is one purpose for sluggish wages

We subsequent must ask why actual wages are so depressed. At the least one contributing issue has been the motion towards globalization symbolized by the outsourcing of producing. Now that corporations in lots of developed economies are capable of make the most of cheap labor in rising markets, they don’t have any purpose to proceed paying excessive wages of their dwelling international locations.

This phenomenon is claimed to have begun when Taiwan created three export processing zones in Kaohsiung and elsewhere between 1966 and 1971 and invited international corporations to construct factories there to faucet the native pool of low cost labor. China then launched its reforms and open-door insurance policies in 1978, the Chilly Conflict got here to an finish in 1989, and in 1992 the North American Free Commerce Settlement (NAFTA) was signed. All of those occasions served to gasoline the unfold of globalization.

Previous to this period, it was tough for corporations within the developed economies to make the most of cheap labor in rising markets: China had a communist deliberate economic system, Southeast Asia had been thrown into turmoil by the Vietnam Conflict, Russia and Japanese Europe have been on the opposite facet of the Iron Curtain, and Latin America and India have been pursuing an import-substitution mannequin of financial development.

Globalization has introduced nice advantages to capitalists, corporations, and customers, but it surely has had critical antagonistic results on the employees in home manufacturing and agriculture who should compete with cheap merchandise produced abroad.

Neglect of sturdy greenback and commerce deficits has created extreme divisions in US society

Firms in Japan and Europe have additionally taken full benefit of globalization, however social divisions within the US have grown a lot wider than in different developed economies. Why is that this the case?

As I’ve argued beforehand, I consider the issue might be attributed to the sturdy greenback and the commerce deficits it produced.

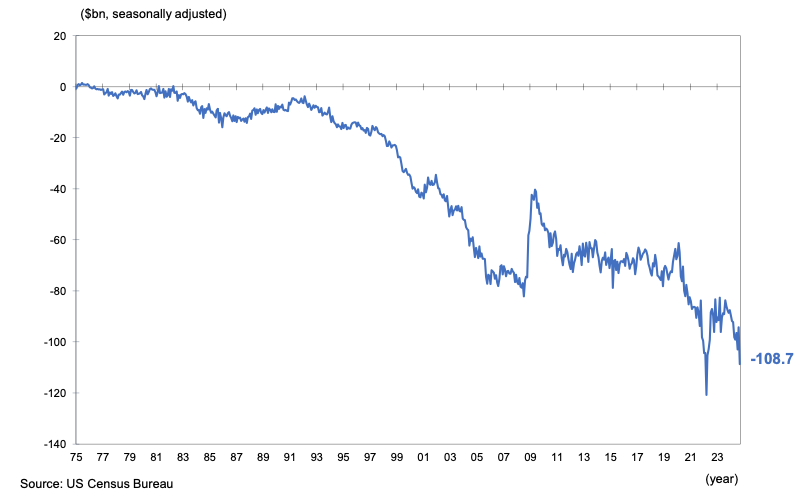

US commerce deficits weren’t an enormous downside by means of the late Seventies. Nevertheless, they elevated dramatically beginning within the Nineteen Eighties and have stayed that manner for greater than 40 years (Determine 2).

Determine 2: US steadiness of commerce, 1975 to current

As a commerce deficit immediately reduces GDP, the overwhelming majority of nations fear about operating bigger commerce deficits until the imported items liable for these deficits are capital items important to future financial growth.

40-plus years of US commerce deficits quantity to 153% of GDP

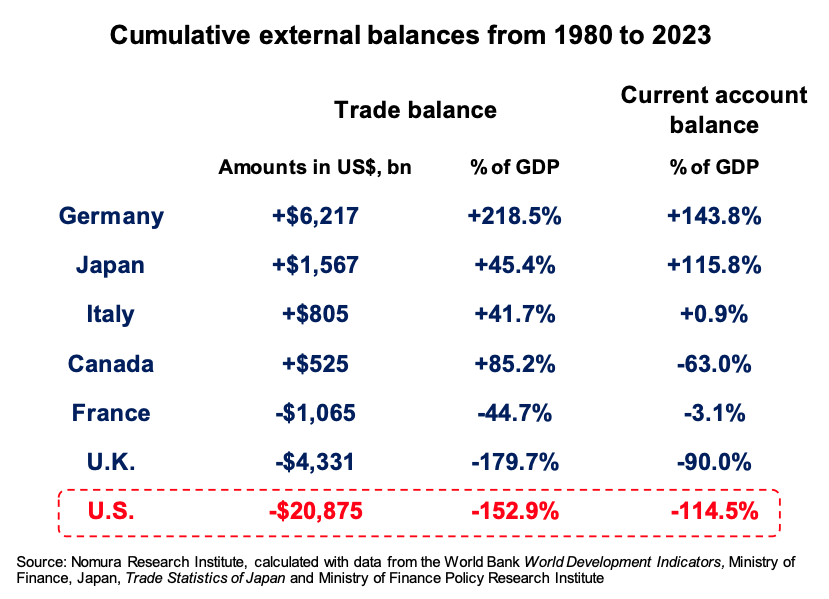

Nevertheless, the US has turned a blind eye to these commerce deficits for greater than 40 years. Consequently, the nation has misplaced cumulative earnings equal to 153% of GDP since 1980 (Determine 3). This 153% equates to $20.8tn if we merely add collectively the commerce deficits on the time, or to $41tn in right this moment’s {dollars}.

Determine 3: Cumulative exterior balances from 1980 to 2023

The cumulative US commerce deficit as a share of GDP is the second largest within the G7 after the UK. Nevertheless, the UK earns monetary companies earnings as a result of London is a world monetary heart. Once we take a look at the present account, which incorporates such earnings, the US ranks final among the many G7.

The rationale why I’m centered on the steadiness of commerce, nevertheless, is that commerce deficits are immediately linked to manufacturing and contain an incredible variety of blue-collar jobs, whereas within the monetary sector, a comparatively small group of individuals deal with giant volumes of cash. As such, I believe commerce deficits are extra helpful in analyzing social divisions and election outcomes.

In distinction to the US, international locations like Japan and Germany are operating giant commerce surpluses, as proven in Determine 3, and the GDPs of these two international locations have benefited tremendously from commerce regardless of globalization.

The overly sturdy greenback was uncared for as a result of capital flows have been liberalized

I attribute this distinction to the truth that the US has paid no heed to the sturdy greenback for the 37 years for the reason that Louvre Accord in February 1987. As mentioned intimately beneath, the huge US commerce deficits couldn’t have continued so lengthy with no sturdy greenback, which naturally proved extremely useful to US buying and selling companions.

This energy within the greenback started with main adjustments within the contributors of the international change market ensuing from the developed economies’ resolution to permit the liberalization of cross-border capital flows beginning in 1980. Previous to that, the primary contributors on this market have been importers and exporters. Their transactions robotically served to decrease the worth of currencies of commerce deficit nations and improve the worth of currencies of commerce surplus nations. This helped stop extreme development in commerce imbalances.

However from the Nineteen Eighties onward, portfolio traders and speculators turned the primary contributors within the foreign exchange market, and as they stepped up their purchases of high-yield greenback belongings, the dollar rose to ranges that might by no means be justified given the scale of US commerce deficits. Furthermore, whereas the US authorities sharply lowered the worth of the greenback with the Plaza Accord in September 1985, it has by no means tried to deal with subsequent greenback energy for the reason that Louvre Accord that signaled the tip of the sooner correction.

Briefly, the US has turned a blind eye to the sturdy greenback and the resultant 41 trillion {dollars} price of outflows of earnings from its manufacturing and agriculture sectors for greater than 40 years, and that’s probably why—regardless of experiencing the identical globalization pattern as international locations like Japan and Germany—the US has seen social divisions widen to this extent.

Trump compelled each US events to leap from free commerce to protectionism

The individuals who have suffered from these commerce deficits for greater than 40 years are the core supporters of President Trump. This may be seen from the truth that protectionist measures to defend home trade and employees have been primarily the one concrete coverage proposal he supplied in Could 2015, when he first introduced he was operating for president. The truth that this so shortly grew into an enormous political phenomenon tells us simply how many individuals have been harmed by commerce deficits through the years.

Mr. Trump’s championing of protectionist insurance policies enabled him to instantly win the assist of an enormous variety of blue-collar employees. The Democratic candidate, Hillary Clinton, was shocked to see this and responded by abandoning the Trans-Pacific Partnership (TPP) that she herself had helped negotiate (it was stated to be probably the most superior free-trade settlement ever) and reversing course in favor of protectionism. However it was already too late, and she or he was defeated by Mr. Trump within the 2016 presidential election.

President Biden, who took again the White Home from Mr. Trump after the latter’s botched response to COVID-19, not solely didn’t rejoin the TPP however left almost all of President Trump’s tariffs in place and even raised some on his personal.

This was proof that the 2 main US political events had lastly begun to consider the victims of the huge commerce deficits that they’d allowed to fester for the previous 40 years.

Why did Vice President Harris not marketing campaign on commerce points?

The Republican Celebration was additionally stunned to see the depth of assist for Mr. Trump and did an about-face on its conventional assist without spending a dime commerce. Right now it has reworked itself into Trump’s celebration and is a proponent of protectionist insurance policies.

Then-President Barack Obama, whose celebration was liable for creating the TPP, knew there was no manner the treaty could be ratified within the US with out the assist of the Republican Celebration, which had historically been a pacesetter of the free commerce motion. Nevertheless, those self same Republicans have now outdone the Democrats—historically skeptics of free commerce—and grow to be full-fledged supporters of protectionism.

The unanswered query is why the Democrats in 2024 have been unable to be taught from their errors in 2016. Though they knew that commerce and industrial revitalization would grow to be key marketing campaign points in the event that they confronted former President Trump, President Biden and Vice President Harris prevented these points virtually totally.

If we assume that almost all of Mr. Trump’s supporters have been supporting him due to this challenge, Vice President Harris ought to have tried to whittle away at his assist amongst this group by presenting concrete insurance policies to deal with their considerations. But the Democrats did virtually nothing on this space.

Biden successfully spurned commerce deficit victims with a remark endorsing a powerful greenback

In truth, President Biden went as far as to declare that he was not apprehensive concerning the sturdy greenback. In response to the greenback’s sharp transfer increased a couple of months earlier, he memorably stated, “Our foreign money, their downside.”

He was successfully saying that he would flip a blind eye to the sturdy greenback as a result of it solely induced issues for different international locations, not the US. In truth, nevertheless, there are lots of People who’ve been harmed by a powerful greenback, and most of them have grow to be supporters of former President Trump. It’s subsequently exhausting to grasp why Mr. Biden would declare to folks affected by a powerful greenback that he deliberate to do nothing about it.

Democrats misplaced as a result of they did not strategy victims of sturdy greenback and commerce deficits

A well-known economist thought of a number one determine within the Democratic Celebration stated {that a} weak-dollar coverage ought to be prevented as a result of it will result in increased inflation. Whereas this can be an affordable argument when inflation is an issue, in apply it raises some pretty critical political points.

A authorities that implements a strong-dollar coverage to curb inflation is basically saying that it plans to show up the ache for people who find themselves already affected by the rising commerce deficits attributable to a powerful greenback. This can appear extraordinarily unfair to those that work in industries that should compete with imported merchandise.

If there have been only some victims of the sturdy greenback and the commerce deficits it causes, the election affect would possibly certainly be minor. However given {that a} majority of the opposite celebration’s supporters had in reality suffered from foreign money and commerce coverage, I believe this message was clearly counterproductive—notably because it got here at a time when assist for the 2 candidates was so evenly matched.

In distinction to the best way the Democrats largely ignored the sturdy greenback and commerce deficits, former President Trump responded to the greenback’s surge above 160 yen by warning in no unsure phrases that this was an enormous mistake for the US.

Vice President Harris was initially well-received by all quarters when she introduced her candidacy, however she was unable to draw wider assist as a result of she didn’t even attempt to whittle away in style assist for former President Trump. That compelled her to contest the election with solely the Democratic Celebration’s conventional supporters, and she or he in the end misplaced to Mr. Trump in all the key battleground states.

Democratic Celebration supporters are usually insulated from the affect of a powerful greenback

In recent times, supporters of the Democratic Celebration have tended to be extremely educated city dwellers who work in service sectors like finance, media, or academia. On this election as nicely, the Democrats dominated in almost all main cities like New York and Los Angeles.

However these persons are virtually totally insulated from the draw back of a powerful greenback. Of the 16 Nobel-laureate economists who joined a marketing campaign encouraging folks to not vote for former President Trump, I believe few had ever felt the ache of watching one’s trade be hollowed out by a powerful greenback.

If any of them had gone by means of such an expertise, I believe they might have shortly talked about this to Vice President Harris and urged the Democratic Celebration to give you another coverage to the protectionism of Mr. Trump.

Equally, I believe few if any of the traders and speculators who made cash betting on the sturdy greenback in what was referred to as the Trump commerce gave any thought to the adverse affect a powerful greenback would have on US trade and the folks it employs.

Mistrust of the institution returned Trump to the White Home

Till Mr. Trump first declared his candidacy in 2015, it was these high-income, extremely educated “elites” who fashioned the mainstream of each the Republican and Democratic events. And it was the victims of the commerce deficits and industrial hollowing-out attributable to those self same elites’ neglect of the sturdy greenback for almost 40 years who got here out to assist the previous President.

From the attitude of Mr. Trump and his backers, there isn’t any purpose why they need to pay any consideration to the logic or widespread sense of an institution that had induced them and their households such nice hurt.

This case is harking back to what Einstein stated concerning the futility of attempting to unravel issues with the identical pondering used to create them. Whereas we’d discover public statements and insurance policies of Trump appalling, they might merely argue that it’s inconceivable to repair the economic system utilizing the identical concepts that broke it within the first place.

And by “broke,” I’m referring to the truth that actual wages have elevated solely 15% over the past 40 years.

Trump is sweet at difficult current norms however could have problem constructing new buildings

To make sure, breaking away from the previous doesn’t essentially result in dangerous penalties. In his first time period, for instance, Mr. Trump defied one of many unstated guidelines of US diplomacy within the previous a long time—that no president ought to meet with the chief of North Korea given its human rights issues—and met with Mr. Kim in Singapore in June 2018, shortly easing the tensions that had constructed up between the 2 nations.

I believe this assembly was an ideal success in as a lot because it narrowed the rift between the US and North Korea, and it will have been unthinkable underneath another president.

Sadly, the 2 leaders’ subsequent assembly, in Hanoi, broke off as a result of President Trump had performed no homework for the assembly, and consequently tensions heightened once more and have stayed that manner ever since. This means that whereas as an outsider Mr. Trump might be able to push previous conventional constraints, he could have problem constructing new frameworks to interchange the previous ones.

The mistaken perception that everybody advantages from free commerce induced Democrats to let down their guard

The subsequent query is, precisely what did the elites—together with the 16 Nobel laureate economists famous above—get flawed, and the way? One factor is the best way the thought of free commerce is taught in colleges.

Standard economics holds that free commerce creates winners and losers inside a nationwide economic system however is a internet constructive for the broader economic system as a result of the advantages accruing to the winners are better than the losses sustained by the losers. This means there are all the time extra winners from free commerce than there are losers.

However arriving at this conclusion requires making an enormous assumption that nobody appears to have observed—particularly, that the nation’s commerce account have to be balanced or in surplus. If the nation is operating an enormous commerce deficit and people deficits persist over a few years, the variety of losers from free commerce will proceed to develop. Ultimately, it should produce a state of affairs through which, as within the US presidential elections of 2016 and 2024, the losers have sufficient votes to ship a protectionist like Mr. Trump to the White Home.

Democrats are inclined to have nearer ties to so-called mainstream economists than Republicans, however it will seem that none of these economists had thought of the likelihood that free commerce may produce extra losers than winners.

In distinction, the Republican Celebration acknowledged this chance after witnessing the Trump phenomenon in 2016 and shortly modified its stance on free commerce, as famous above.

Elected politicians can not implement insurance policies primarily based on I/S steadiness principle

As well as, many mainstream economists argue that US commerce deficits mirror an extra of US funding (I) over financial savings (S), and that until this downside is addressed any makes an attempt to weaken the greenback will solely finish in failure. In impact, they’re saying that the US runs commerce deficits as a result of it depends on abroad producers to supply the issues it can not provide for itself.

That is similar to the so-called Komiya principle that was previously in style in Japan, but it surely totally fails to clarify what has truly occurred within the US. If the idea have been right, US corporations competing with imports ought to have been posting giant earnings since home demand was a lot better than home provide. In actuality, nevertheless, the overwhelming majority of them have been unable to compete with cheap imports given the persistent energy of the greenback, and have been in the end compelled out of business. Briefly, commerce deficits and the hollowing-out of US trade might be defined by a powerful greenback however not by the I/S steadiness principle.

Furthermore, the I/S steadiness principle which holds sway amongst many tutorial economists argues that, in an effort to scale back commerce deficits, insurance policies are wanted to depress home demand. However such insurance policies that may result in recession have been off-limits to elected politicians. And that’s one purpose why commerce deficits have been uncared for as much as the current day.

The Plaza Accord has been largely forgotten by students and market contributors

Moreover, many economists and international change market contributors argue that even when the governments desired a weaker greenback, the central banks of the world merely should not have sufficient funds to intervene on the dollar’s behalf, making it inconceivable for them to change change charges.

Right here it will be nicely to recollect the Plaza Accord, which was carried out beginning in September 1985 by President Reagan with the assistance of the opposite G5 (subsequently G7) nations. The settlement was signed at a time like right this moment when the sturdy greenback had produced highly effective protectionist pressures throughout the US and was extraordinarily profitable in relieving these pressures by halving the greenback’s worth in opposition to the yen.

House constraints pressure me to go away an in depth dialogue of why this strategy was profitable to my e book (Chapter 9 of Pursued Financial system: Understanding and Overcoming the Difficult New Realities for Superior Economies). Sadly, 39 years later, there’s virtually nobody in US political, monetary, or tutorial circles right this moment who remembers why the Plaza Accord was signed and what it produced.

Due to all these incorrect notions, the Democrats have been unable to supply a counterproposal to the protectionist insurance policies of former President Trump. Certainly, if these incorrect notions have been truly right, then protectionism is the one logical treatment for individuals who are affected by the sturdy greenback. I believe that at the least a few of the duty for that loss lies with the economists who have been making dangerous financial arguments.

Free commerce emerged from the failures of protectionism

The subsequent query is whether or not the protectionist insurance policies espoused by Mr. Trump can save the people who find themselves asking for his assist. Sadly, the commerce wars of the Nineteen Thirties recommend the reply might be “No.”

Within the Nineteen Thirties, the worldwide economic system was thrown into turmoil by the sharp will increase in US import duties carried out in 1930 underneath the Smoot-Hawley Tariff Act and the retaliatory tariffs by different nations that adopted. The worth of worldwide commerce plunged 66% from the height, and economies around the globe suffered closely.

The ensuing financial turmoil ultimately led to World Conflict II. The US, which bought by means of the best tragedy in human historical past by mobilizing its army capabilities, determined the world mustn’t ever repeat this error. To that finish, it launched the system of free commerce symbolized by the 1947 GATT (Normal Settlement on Tariffs and Commerce).

This US-led free commerce system produced unprecedented prosperity for humanity, however cracks began appearing when the character of the foreign money market modified after the developed nations started liberalizing capital flows in 1980.

Right now, simply as within the Nineteen Thirties, free commerce is dealing with a possible disaster within the type of a pointy improve in US tariffs. If the authorities significantly want to keep away from this final result, I believe the nations of the world should come collectively and perform an change price adjustment much like the Plaza Accord.

Essential buying and selling companions of the US may enable their currencies to rise collectively

Within the case of the Plaza Accord, it was President Reagan—a powerful believer in free commerce—who adopted a weak-dollar coverage to defend free commerce from protectionism. This time the state of affairs is reversed, and the incoming US president is a powerful believer in protectionism.

In that sense, it could be too late to stroll again an issue that has been festering and rising for 37 years. However even when the US does nothing, it will theoretically be attainable for different nations to forge an settlement just like the Plaza Accord.

I believe Japan, the UK, and the international locations of Europe ought to cooperate with China and different commerce companions to give you a coverage that can enable their currencies to understand by, say 20% in opposition to the greenback, in change for which they ask the US to forgo additional tariff hikes.

A situation through which different nations carried out such a coverage with out US management could appear extremely unrealistic, and in any case, there isn’t any assure that President-elect Trump would settle for such a deal. However whereas Germany, France, and Italy every had their very own foreign money when the Plaza Accord was signed, this time they’re all utilizing the euro, which solely leaves Japan, the UK, Canada, and China. If these international locations and the eurozone had a adequate sense of urgency, the inconceivable would possibly grow to be attainable.

It has additionally been reported that President-elect Trump as soon as had nice respect for a similar President Reagan who in the end saved free commerce with the Plaza Accord.

Whereas this will all look like a pipe dream, I believe will probably be tough to unravel an issue that has been festering for 37 years with no plan of this magnitude.

Japan’s ruling celebration additionally misplaced as a result of it failed to deal with the economic system and inflation

Turning to Japan’s latest basic election, there have been many stories saying the foremost defeat suffered by the ruling LDP was attributable to its slush-fund scandal. Nevertheless, I believe the celebration was truly performed in by financial issues.

The LDP noticed its proportional illustration votes decline by 26.8% over the past election in 2021, but it surely was not alone in receiving fewer votes. Many events discovered themselves in the identical boat—in reality, the one two opposition events receiving considerably extra votes this time have been the Democratic Celebration for the Individuals (DPP), whose vote rely surged by 138.0% over the past election, and Reiwa Shinsengumi (“Reiwa”), which noticed a 71.7% improve.

In the meantime, the Constitutional Democratic Celebration (CDP), which ran a marketing campaign criticizing the LDP over the slush-fund scandal, acquired solely 0.6% extra votes. The Japanese Communist Celebration (JCP), which performed a serious position in bringing the funding scandal to mild, garnered 19.3% fewer votes, and the Japan Innovation Celebration (“Ishin”) suffered an even bigger defeat than the LDP itself, bringing in 36.6% fewer votes.

Each of the events that garnered considerably extra assist on this election emphasised financial points of their campaigns. In different phrases, solely the 2 events that put the economic system entrance and heart managed to win extra votes, whereas the remaining noticed assist stagnate or decline.

Japanese additionally indignant with inflation, together with a decline in actual wages

This demonstrates that the difficulty of best concern to most voters is the economic system, and specifically inflation—one thing I’ve famous in earlier publications. The inflation Japan at the moment faces is elevating the value of things customers should purchase on daily basis, like vitality and meals, which might be why folks have been so upset.

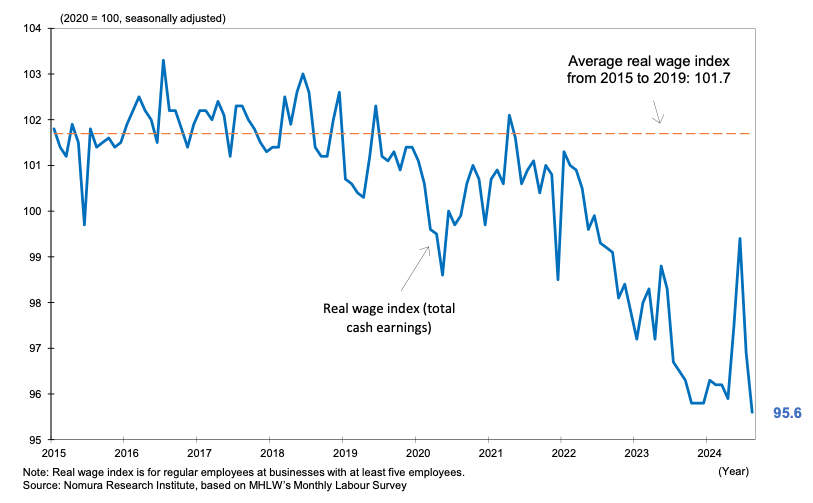

Actual wages, that are immediately tied to dwelling requirements, have fallen considerably because of inflation (Determine 4) and stay depressed in 2024 other than a short uptick pushed by an enormous improve in summer season bonuses.

Determine 4: Actual wages in Japan

Notes: (2020 = 100, seasonally adjusted); Actual wage index (complete money earnings); Common actual wage index from 2015 to 2019; Actual wage index is for normal workers at companies with at the least 5 workers. Supply: Nomura Analysis Institute, primarily based on MHLW’s Month-to-month Labor Survey

However the LDP—and notably those that have been near former Prime Minister Shinzo Abe—continued to emphasise the advantages of and want for inflation on this election, simply as Mr. Abe as soon as did.

Not like then, nevertheless, Japan is now experiencing inflation that’s having an enormous adverse affect on dwelling requirements. The LDP was successfully standing up in entrance of individuals affected by inflation and telling them how a lot the LDP contributed to increased inflation charges. It’s hardly stunning that the celebration acquired fewer votes.

Inflation was by no means liable for the sturdy Japanese economic system

When there was no inflation, the arguments made by former Prime Minister Abe and former BOJ Governor Haruhiko Kuroda—that the primary precedence was to finish deflation and that the economic system would enhance as soon as inflation took maintain—have been merely an expression of their hopes and had little antagonistic affect on election outcomes.

On the time, furthermore, those that remembered the horror of skyrocketing costs of the Seventies have been already turning into a minority. Many held a nostalgic view of the distant previous (till about 35 years in the past), remembering solely that Japan’s interval of sturdy financial development was accompanied by inflation. That will have led a few of them to imagine {that a} pick-up in inflation would possibly jump-start the economic system.

The precise causal relationship was fairly totally different, nevertheless. The economic system was sturdy not as a result of costs have been rising; costs have been rising as a result of provide couldn’t maintain tempo with demand. On the time, furthermore, comparatively few factories had been moved abroad, so wages rose in each nominal and actual phrases as home labor market circumstances tightened.

LDP was blamed for inflation due to its give attention to Abenomics

When the asset bubble burst in 1990 and the steadiness sheet recession started, arresting development in home demand, Japanese corporations started to undergo from extreme employment. It was additionally round this time that transferring factories to China or Southeast Asia turned a practical choice for Japanese corporations.

Nevertheless, economists ignored deflationary components reminiscent of globalization and steadiness sheet issues and as a substitute blamed deflation solely on the coverage errors of the Financial institution of Japan. There have been many such economists in academia—together with former Fed Chair Ben Bernanke previous to 2008—they usually argued that the BOJ ought to attempt to stoke inflation, even when that required unconventional financial lodging.

The Financial institution of Japan responded to this stress by taking rates of interest into adverse territory and finishing up astronomical quantities of quantitative easing. Nevertheless, these measures prompted few to renew borrowing, and inflation did not take root in Japan till the pandemic and the struggle in Ukraine triggered provide chain issues.

The LDP ought to have acknowledged at this level that the BOJ was not liable for the shortage of inflation and that one thing else was inflicting the economic system to stagnate. However it didn’t, and as a substitute continued to push for simple financial coverage that sought to amplify inflation. When the affect of inflation lastly hit the pocketbooks of extraordinary Japanese customers, the LDP acquired all of the blame for it, and that’s the reason the election turned out because it did.

A lot of the present inflation in Japan is import inflation ensuing from abroad provide points and isn’t truly attributable to the LDP. However as a result of the celebration continued to insist on simple financial coverage, the yen weakened in opposition to almost all different currencies, and what would usually have been a light bout of import inflation grew into one thing far more critical.

In that sense, the truth that the ruling celebration fell for a specious financial principle at a time when the economic system was a key concern for voters performed a serious position within the latest election leads to each Japan and the US.

Elevating the tax-free earnings threshold for part-time employees would ease labor shortages and tremendously profit Japan’s economic system

The LDP-Komeito minority coalition will now need to work along with opposition events—together with the DPP, which gained many extra votes by specializing in financial points—to pursue its coverage agenda. I do assume that is good within the sense that the economic system will now grow to be a precedence for the Ishiba administration.

Particularly, I consider a considerable improve within the ¥1.03mn annual tax-free earnings threshold for part-time employees sought by the DPP is a vital challenge for a rustic dealing with extreme labor shortages.

Some throughout the authorities estimate that elevating the fundamental earnings tax deduction by ¥750,000, bringing the mixed deduction to ¥1.78mn, would price central and native governments a complete of ¥7.6tn in forgone tax revenues. Nevertheless, I believe the assumptions underpinning this estimate could be very totally different for a situation through which corporations have been affected by extra personnel (as was once the case) and one through which labor shortages have left many companies unable to fulfill the demand for his or her merchandise (as is now the case).

When labor shortages are a serious bottleneck for financial exercise, as is true right this moment, the federal government ought to do no matter it may well to ease the shortages by eradicating or altering the assorted obstacles creating a man-made bottleneck. If such actions produced a speedy enlargement of the economic system, the ensuing improve in tax revenues could possibly be substantial. In that sense, I believe we’re lucky that the election outcomes have led to efforts to boost the annual earnings threshold (“wall”) for part-time employees.

I believe now can also be the time for the Ishiba administration to reestablish itself as an inflation fighter in view of the election outcomes. However the inventory market, the place international traders have a substantial amount of affect, tends to choose a weak yen. There may be additionally the thriller of the Rengo commerce union federation eagerly searching for inflation regardless of the already substantial decline in actual wages.

It is going to most likely be tough for the minority coalition to construct a coverage consensus underneath such confused circumstances, and it could take a while for it to reach at a transparent route for inflation-related coverage.