This text is concerning the what’s the greatest threat to reward ratio in forexp0. You may Obtain the preview so you’ll be able to discuss with it everytime you want. We even have one other article associated to this matter that you just would possibly discover fascinating.

Definition of Danger to Reward Ratio

The Danger to Reward Ratio is a important idea in buying and selling that helps merchants consider the potential threat concerned in a commerce relative to the anticipated reward. Primarily, it quantifies how a lot threat one is taking for a possible achieve. An excellent understanding of this ratio is important for making knowledgeable buying and selling selections.

Calculating Danger to Reward Ratio

Calculating the Danger to Reward Ratio is easy. It entails figuring out the quantity you’re keen to threat on a commerce and evaluating it to the anticipated positive factors. For instance, should you threat $50 for a possible revenue of $150, the ratio can be 1:3. This calculation permits merchants to see if the potential reward justifies the danger concerned.

Finest Sign Buying and selling for Freshmen / Free sign buying and selling in Foreign exchange alerts Advertising and marketing

Significance of Understanding greatest threat/reward ratio for day buying and selling

Danger to Reward Ratio

Understanding the Danger to Reward Ratio for day buying and selling is important for a number of causes.

– Knowledgeable Determination-Making: It permits merchants to make extra knowledgeable selections when getting into and exiting trades.

– Danger Administration: By establishing a good ratio, merchants can handle dangers extra successfully, lowering potential losses.

– Lengthy-Time period Profitability: Persistently making use of a superb Danger to Reward Ratio can result in long-term profitability in buying and selling, because it ensures that successful trades considerably outweigh dropping ones.

This text is about one of the best threat/reward ratio for day buying and selling. You may Obtain the preview so you’ll be able to discuss with it everytime you want. We even have one other article associated to this matter that you just would possibly discover fascinating.

The Finest Danger to Reward Ratio in Foreign exchange

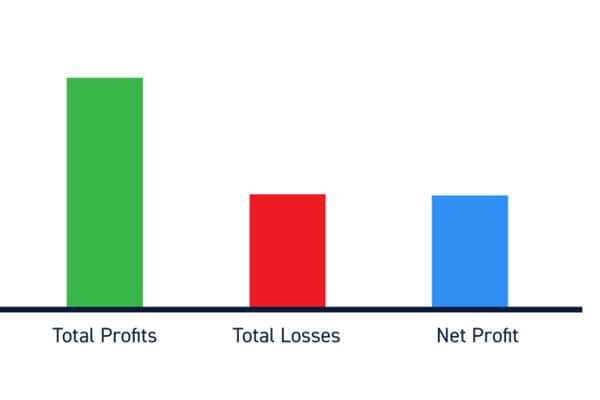

To realize constant earnings from this buying and selling technique over the long run, it’s important that your rewards exceed your dangers .It is necessary to think about that there are additionally buying and selling and non-trading bills that have to be coated. Ideally, when the success price is 50%, the risk-to-reward ratio needs to be a minimum of 1:2 or larger. Because of this for each unit of threat you’re taking, you need to intention to achieve a minimal of two models of reward to attain sustainable earnings in the long term.

what is an effective threat to reward ratio foreign exchange

The Danger/Reward Ratio is a vital idea in buying and selling and investing, significantly in Forex. To find out a superb threat to reward ratio, many merchants usually search for a benchmark of1:3. Because of this for each unit of threat they tackle, they anticipate a return of three models. When contemplating what is an effective threat to reward ratio foreign exchange, merchants intention for eventualities the place their potential revenue outweighs their potential loss. In actual fact, understanding what is an effective threat to reward ratio foreign exchange can considerably affect buying and selling methods.As an example, if a dealer has a setup that implies they might achieve 300 pips whereas risking only100 pips, they successfully have a threat/reward ratio of1:3. Thus, figuring out what is an effective threat to reward ratio foreign exchange helps merchants make knowledgeable selections that may result in profitable outcomes. So, in abstract, a superb threat to reward ratio Foreign exchange evaluation usually results in a choice for ratios of at least1:3. This permits merchants to maximise their returns relative to the dangers taken whereas constantly evaluating what is an effective threat to reward ratio foreign exchange for his or her buying and selling fashion and technique.

Is a 1:2 threat to reward ratio favorable?

The chance of dropping $50 for the chance to earn $100 is likely to be enticing. This presents a 1:2 risk-reward ratio, which is a proportion that {many professional} traders start to search out interesting, because it permits traders to double their funding. Likewise, if the person proposed $150, then the ratio shifts to 1:3.

What’s a1:1 RR technique?

A 1:1 threat/reward ratioThis ratio is usually employed by extra seasoned or adventurous merchants, who’re ready to threat a bigger share of their capital in alternate for a better doable revenue. A threat/reward ratio of 1:1 signifies that an investor is keen to threat the identical quantity of capital that they make investments right into a place.

Utilizing Technical Patterns

Analyzing technical patterns is a necessary ability for merchants aiming to foretell future market actions. Varied patterns can present insights into potential worth adjustments, enabling merchants to ascertain optimum entries and exits whereas assessing the Danger to Reward Ratio successfully. Let’s delve into a number of the commonest technical patterns and their significance:

Chart Patterns

Head and Shoulders: This reversal sample signifies a change in development course. An upward development forming a peak (head) between two smaller peaks (shoulders) alerts a possible market reversal.-

Double Tops and Bottoms: These patterns seem at market extremes. A double prime signifies bearish reversal after an upward motion, whereas a double backside signifies bullish reversal following a downward development.

Candlestick Patterns

Engulfing Patterns: A bullish engulfing sample consists of a smaller bearish candle adopted by a bigger bullish candle, signaling a possible upward worth motion, which merchants can capitalize on.#

Development Strains and Channels

Development Strains: Drawing development strains helps merchants determine the general market course. An upward development line connects the lows of worth motion, whereas a downward development line connects the highs, indicating potential help and resistance ranges.

Buying and selling Channels: Channels shaped by parallel development strains can point out potential worth targets. Merchants can set their stop-loss and take-profit ranges based mostly on the channel boundaries, enhancing their Danger to Reward calculations.

This text is concerning the what’s the greatest threat to reward ratio in foreign exchange, Obtain the preview so you’ll be able to discuss with it everytime you want.We now have one other article associated to this matter that you could be discover intriguing.

Fibonacci Retracement Ranges

Using Fibonacci retracement ranges can help merchants in figuring out reversal factors. A typical technique entails getting into trades when costs pull again to key Fibonacci ranges (like38.2%,50%, or61.8%). By calculating the potential revenue and evaluating it to the danger concerned, merchants can refine their Danger to Reward Ratio.

Conclusion**Within the dynamic world of buying and selling, understanding the Reward-to-Danger Ratio is important for formulating efficient methods and guaranteeing long-term profitability. By quantifying the danger taken relative to potential positive factors, merchants could make knowledgeable selections that align with their threat tolerance and monetary objectives.Efficient calculation of this ratio permits merchants to judge the feasibility of their trades, guaranteeing that potential rewards outweigh the dangers concerned. A good Reward-to-Danger Ratio not solely aids in threat administration but additionally positions merchants for sustainable success within the market.

Incorporating technical patterns and instruments, reminiscent of Fibonacci retracement ranges and candlestick formations, enhances the power to anticipate market actions and refine threat evaluation. In the end, persistently striving for an optimum Reward-to-Danger Ratio empowers merchants to navigate the complexities of the market with higher confidence, resulting in extra profitable buying and selling outcomes.Moreover, specializing in the Reward-to-Danger Ratio in Foreign currency trading helps merchants to systematically assess every commerce’s potential revenue towards its doable losses. By sustaining a disciplined method to buying and selling based mostly on the Reward-to-Danger Ratio, merchants can enhance their total efficiency and profitability.In abstract, the Reward-to-Danger Ratio is a elementary software that each dealer ought to grasp, significantly within the unstable realm of Foreign currency trading. This ratio acts as a guideline, providing insights into which trades to pursue and which to keep away from, thus enhancing the strategic decision-making course of. Subsequently, by prioritizing the Reward-to-Danger Ratio of their buying and selling technique, merchants can considerably improve their capability to attain long-lasting development and success of their buying and selling endeavors.