Throughout 2018-19, the U.S. levied import tariffs of 10 to 50 p.c on greater than $300 billion of imports from China, and in response China retaliated with excessive tariffs of its personal on U.S. exports. Estimating the combination impression of the commerce struggle on the U.S. economic system is difficult as a result of tariffs can have an effect on the economic system by many alternative channels. Along with altering relative costs, tariffs can impression productiveness and financial uncertainty. Furthermore, these results can take years to turn into obvious within the information, and it’s troublesome to know what the long run implications of a tariff are prone to be. In a latest paper, we argue that monetary market information might be very helpful on this context as a result of market members have sturdy incentives to rigorously analyze the implications of a tariff announcement on agency profitability by varied channels. We present that researchers can use actions in asset costs on days through which tariffs are introduced to acquire estimates of market expectations of the current discounted worth of agency money flows, which then can be utilized to evaluate the welfare impression of tariffs. These estimates counsel that the commerce struggle between the U.S. and China between 2018 and 2019 had a adverse impact on the U.S. economic system that’s considerably bigger than previous estimates.

Tariff Bulletins Brought on Massive Declines in U.S. Inventory Returns

Our analysis exhibits that the tariff bulletins significantly impacted agency stock-market valuations. We doc this impact by inspecting the market motion on the earliest announcement dates within the media of every spherical of tariffs applied by the U.S. and China.

The desk beneath presents the listing of announcement dates, an outline of the bulletins, and the corresponding (value-weighted) U.S. stock-market return on the buying and selling day following the announcement. We discover that stock-market returns are constantly large and adverse, with notably massive drops following the March 2018 and Could 2019 tariff bulletins. The final line of the desk exhibits the cumulative impact of those bulletins throughout all occasion dates. General, the U.S. inventory market fell 11.5 p.c on days when tariffs have been introduced, which quantities to a $4.1 trillion loss in agency fairness worth.

Inventory Market Returns on Days with Tariff Bulletins

| Occasion Date | ln RM,t (x100) | Nation | Description |

|---|---|---|---|

| 23 Jan 2018 | 0.3 | U.S. | U.S. imposes tariffs on photo voltaic panels and washing machines |

| 01 Mar 2018 | -1.1 | U.S. | U.S. imposes metal and aluminum tariffs |

| 22 Mar 2018 | -2.4 | U.S. | U.S. imposes $60 billion in annual tariffs on China |

| 23 Mar 2018 | -1.9 | China | China retaliates and proclaims tariffs on 128 U.S. exports |

| 15 Jun 2018 | -0.2 | China | China proclaims retaliation in opposition to U.S. tariffs on $50 billion of imports |

| 19 Jun 2018 | -0.4 | U.S. | U.S. proclaims imposition of tariffs on $200 billion of Chinese language items |

| 02 Aug 2018 | 0.5 | China | China unveils retaliatory tariffs on $60 billion of U.S. items |

| 06 Could 2019 | -0.4 | U.S. | U.S. to boost tariffs on $200 billion of Chinese language items as much as 25 p.c |

| 13 Could 2019 | -2.5 | China | China to boost tariffs on $60 billion of U.S. items beginning June 1 |

| 01 Aug 2019 | -0.9 | U.S. | U.S. imposes a ten p.c tariff on one other $300 billion of Chinese language items |

| 23 Aug 2019 | -2.5 | China | China retaliates with greater tariffs on soy and autos |

| Cumulative | -11.5 |

Notes: The primary and final columns report the date and outline of every occasion day. The second column studies the log stock-market return on every announcement day. ln RM,t is the log of 1 plus the proportional change of the stock-market return, outlined because the value-weighted market portfolio return from CRSP.

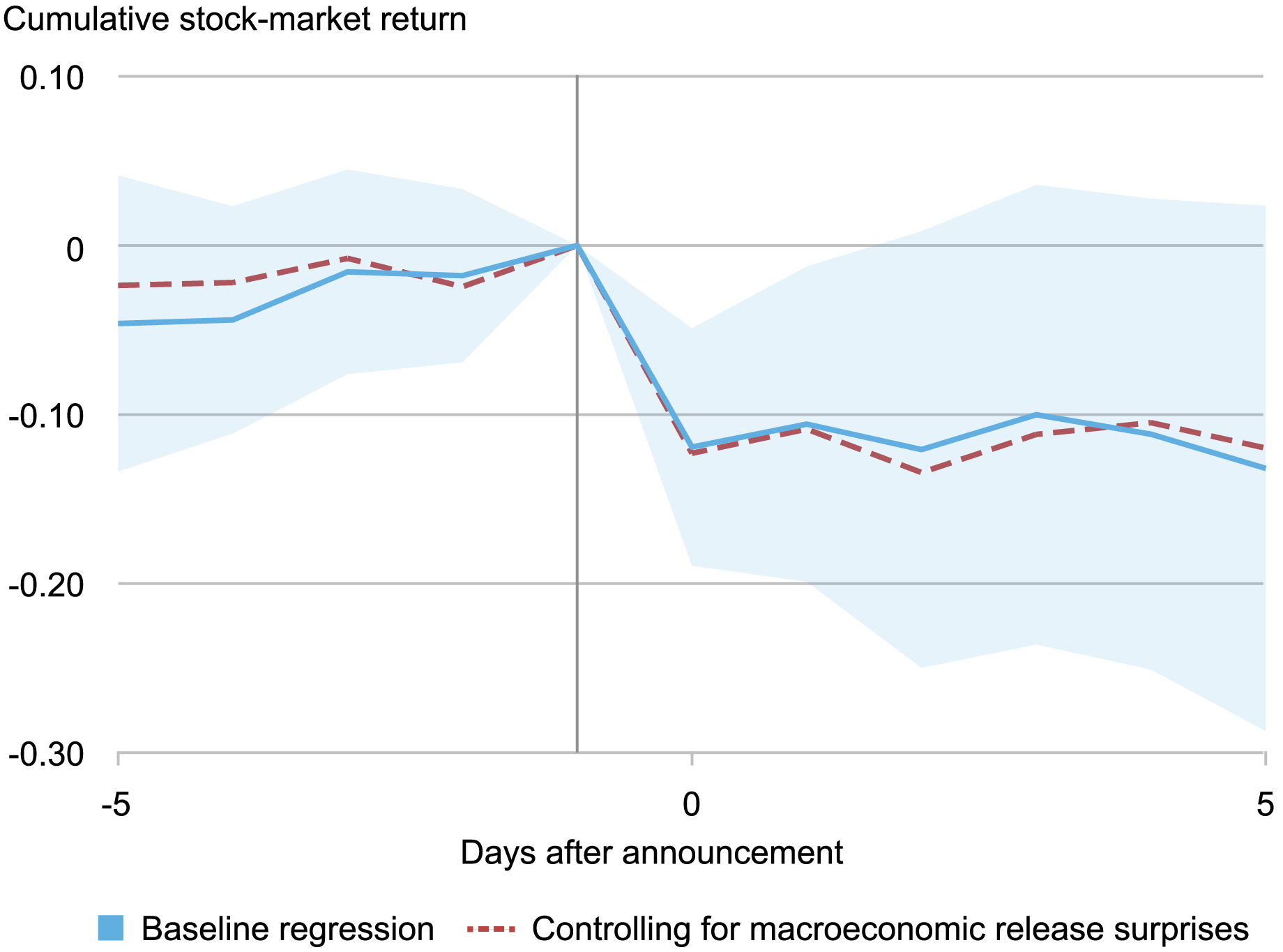

Whereas one is perhaps tempted to dismiss these declines as market overreactions, the info militates in opposition to this interpretation as a result of the declines have been persistent. The chart beneath exhibits the cumulative stock-market return over a ten-day window across the tariff bulletins. We discover that the impact totally happens on the buying and selling days equivalent to the bulletins, indicating that the market didn’t anticipate these bulletins and didn’t bounce again within the week following the bulletins. We additionally verify that our findings can’t be defined by simultaneous bulletins of different financial information (for instance, bulletins on employment) by controlling for the impression of those different bulletins within the dashed line.

The Dynamics of Inventory Market Returns Round Tariff Bulletins

Tariff Bulletins Led to Elevated Uncertainty within the U.S. Economic system

These stock-market value declines are prone to mirror two forces. First, markets might have turn into extra pessimistic about future agency income, and second, market members might have turn into much less prepared to carry dangerous property even when the anticipated path of future income remained unchanged. To differentiate between these two forces, we analyze the impact of tariff bulletins on market-based low cost fee measures, which seize traders’ willingness to carry dangerous property.

We start by inspecting the cumulative response of Treasury yields, that are considered as risk-free property, on tariff announcement days. As proven within the chart beneath, tariff bulletins result in a pointy drop in nominal Treasury yields by 50 foundation factors throughout all maturities, with the biggest impact noticed at a five-year horizon. The chart additionally studies the response of actual Treasury yields, which drop by 40 foundation factors. The drop in Treasury yields possible displays market members’ elevated need to carry protected property.

Subsequent, we study the impact of tariff bulletins on the fairness premium, outlined because the anticipated fee of return on fairness relative to risk-free property. Whereas the fairness premium shouldn’t be immediately observable, we deal with a decrease sure constructed from the value of S&P 500 choices (SVIX). As proven within the chart beneath, we estimate that the implied annualized fairness premium will increase by a number of share factors (cumulatively) on announcement days.

To summarize, our proof signifies that tariff bulletins decreased actual yields and elevated fairness premia, which is suggestive of a “flight to security” amongst traders. After adjusting the decline in fairness costs for these adjustments in low cost charges, we estimate that roughly 40 p.c (4.7 share factors) of the decline in fairness costs on tariff-announcement days might be attributed to adjustments in anticipated agency dividends (versus adjustments in fairness premia). Word that this estimate is silent on the timing of those dividend declines, which is in line with the truth that no decline was noticed instantly after the tariffs have been introduced.

Cumulative Impact of Tariff Bulletins on Low cost Charges

Word: The models on the vertical axes are the decimal illustration of share adjustments, so 0.01 corresponds to a 1 share level change.

Reassessing the Combination Influence on the U.S. Economic system

We use these outcomes to estimate the general welfare impact of tariffs. Conceptually, the welfare impact of tariffs is a weighted common of their results on dividend earnings, curiosity earnings, labor earnings, and tax revenues. Combining the adverse results on companies and staff within the U.S. with elevated authorities income from the tariffs, we estimate that the general impression of tariff bulletins on anticipated welfare is -3 p.c. Though this welfare impact is significantly smaller than the -11.5 p.c drop in stock-market valuations, it’s considerably bigger than the welfare predictions from normal commerce fashions. This discovering means that these fashions might overlook vital channels by which tariffs might have an effect on the economic system, such because the dampening impact of tariffs on innovation, the adverse penalties of elevated commerce uncertainty on funding, or the destabilizing impression of tariff bulletins on world commerce insurance policies.

Mary Amiti is the top of Labor and Product Market Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Matthieu Gomez is an affiliate professor of economics at Columbia College.

Sang Hoon Kong is an economics PhD scholar at Columbia College.

David E. Weinstein is the Carl S. Shoup Professor of the Japanese Economic system at Columbia College.

How one can cite this put up:

Mary Amiti, Matthieu Gomez, Sang Hoon Kong, and David E. Weinstein, “Utilizing Inventory Returns to Assess the Combination Impact of the U.S.‑China Commerce Conflict,” Federal Reserve Financial institution of New York Liberty Avenue Economics, December 4, 2024, https://libertystreeteconomics.newyorkfed.org/2024/12/using-stock-returns-to-assess-the-aggregate-effect-of-the-u-s-china-trade-war/.

Disclaimer

The views expressed on this put up are these of the creator(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the creator(s).