In a truncated buying and selling week, the Indian equities closed the week with features because of a strong technical rebound that it witnessed on Friday. The Nifty continued to put on a corrective search for three days; on the final buying and selling day of the week, the Index managed to get itself into constructive territory at shut. Had it not been for the technical rebound on Friday, the Index would have been heading to one more detrimental weekly shut. The buying and selling vary stayed wider on the anticipated traces. The Nifty oscillated within the 692.95 factors vary over the previous 4 buying and selling periods. The volatility edged increased; the India VIX surged and closed 8.95% increased at 16.10 on a weekly foundation. The headline index closed with a internet weekly acquire of 374.55 factors (+1.59%).

The markets noticed some vital technical ranges getting examined. The Nifty examined and violated the 200-DMA, presently positioned at 23593. It additionally examined the 50-week MA, which is presently at 23312. Due to the rebound seen on Friday, the Nifty managed to rebound from these ranges and shut above the 200-DMA. Nevertheless, the Nifty is seen testing the essential sample resistance ranges and isn’t completely out of the woods but. We additionally enter the expiry week of the month-to-month spinoff collection; the approaching days will probably keep influenced by rollover-centric actions. In any case, 23500-23300 is an important assist zone for the Index; so long as this zone stays defended, we’re unlikely to see any additional draw back. Nevertheless, if this zone will get violated, we might be in for an prolonged corrective interval.

We’re prone to see a secure begin for the approaching week. The degrees of 24150 and 24300 shall act as resistance ranges. Helps are prone to are available at 23650 and 23500 ranges.

The weekly RSI stands at 47.59; it stays impartial and doesn’t present any divergence in opposition to the worth. The weekly MACD is bearish and trades under the sign line. The PPO is detrimental.

The weekly chart sample evaluation signifies that the Nifty is supported by an prolonged trendline, which aligns with the 50-week shifting common presently at 23312. This stage is an important assist for the Nifty, and a breach of this level would weaken the markets additional.

Regardless of a strong technical rebound after testing the 50-week MA, the Nifty shouldn’t be but out of the woods. The Nifty should defend the 23300 on a closing foundation; it would additionally must cross above the 24150-24300 to verify a base formation on the present lows. Market members want to protect their earnings at increased ranges. Whereas preserving the leveraged publicity at modest ranges, a cautious outlook is suggested for the week.

Sector Evaluation for the approaching week

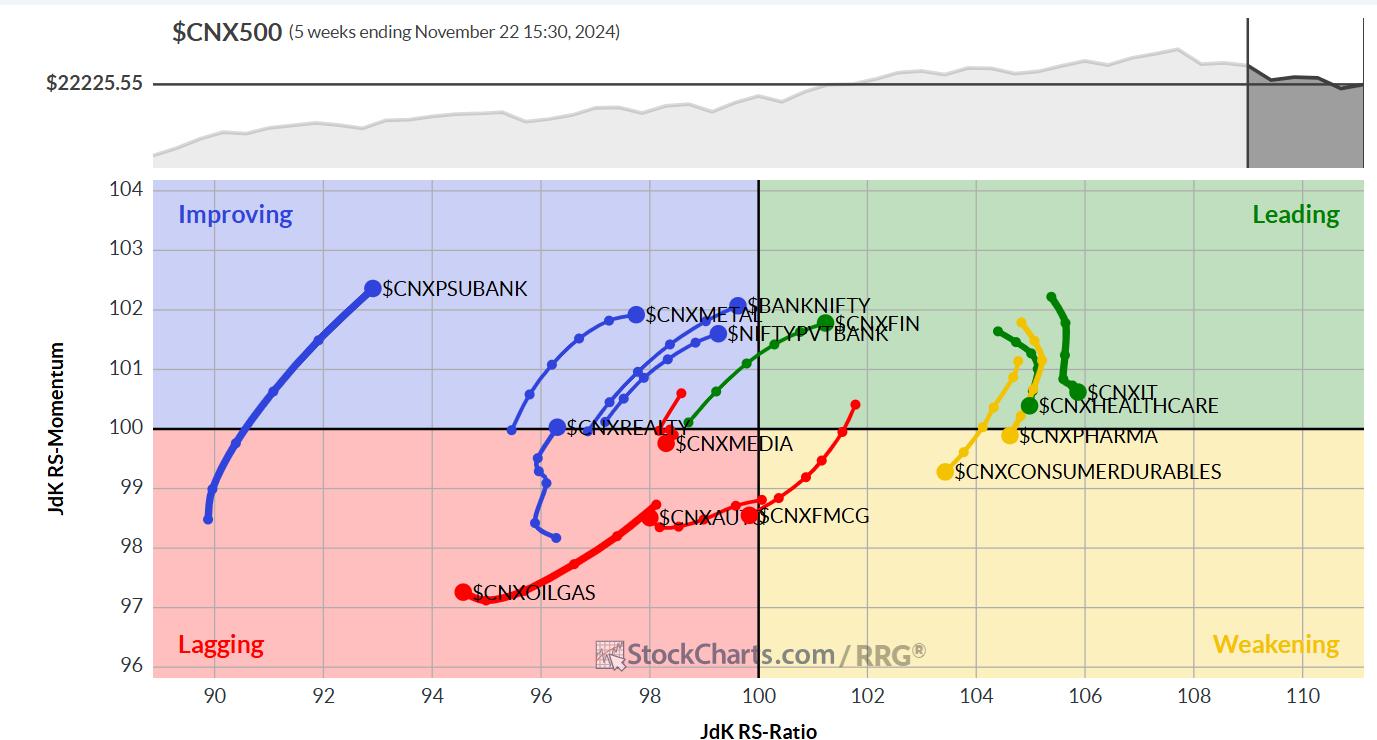

In our have a look at Relative Rotation Graphs®, we in contrast numerous sectors in opposition to CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

Relative Rotation Graphs (RRG) present a scarcity of management as solely Nifty IT, Monetary Providers, and Providers Sector indices are contained in the main quadrant. Nevertheless, these teams are anticipated to outperform the broader markets comparatively.

The Nifty Pharma Index has rolled contained in the weakening quadrant. Nifty Midcap 100 and Consumption Index are additionally contained in the weakening quadrant.

The FMCG Index has rolled contained in the weakening quadrant. The Nifty Auto, Power, Commodities, PSE, Infrastructure, and Media Indices are contained in the weakening quadrant and will comparatively underperform the broader markets. Nevertheless, the PSE and the Infrastructure indices are bettering relative momentum in opposition to the broader Nifty 500 index.

The Nifty Realty Index has rolled contained in the bettering quadrant, doubtlessly signaling the onset of a part of relative outperformance. The Metallic, Nifty, Financial institution, and PSU indices are additionally within the bettering quadrant.

Necessary Word: RRG™ charts present the relative energy and momentum of a gaggle of shares. Within the above Chart, they present relative efficiency in opposition to NIFTY500 Index (Broader Markets) and shouldn’t be used instantly as purchase or promote alerts.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near 20 years. His space of experience contains consulting in Portfolio/Funds Administration and Advisory Providers. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Providers. As a Consulting Technical Analysis Analyst and together with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Shoppers. He presently contributes every day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Every day / Weekly Market Outlook” — A Every day / Weekly Publication, presently in its 18th yr of publication.