The markets had a wide-ranging week as soon as once more; nevertheless, they ended close to its excessive level this time. The Nifty had ranged periods for 4 out of 5 days; the final buying and selling day of the week noticed the Nifty swinging wildly earlier than closing close to its excessive level. The buying and selling vary additionally remained wider; the Index oscillated 611 factors over the previous periods. The volatility, although, took a again seat. The India VIX got here off by 7.69% to 13.05 on a weekly foundation. The Nifty closed a notch above its rapid resistance factors; the headline index completed the week with a web weekly acquire of 90.50 factors (+0.37%).

The week was set to finish on a damaging observe had the markets not surged larger on Friday. From a technical perspective, Nifty has resisted the 100-DMA positioned at 24709 over the previous a number of days. Following a large rebound that the Nifty witnessed from decrease ranges, the Index has closed a notch above this necessary resistance stage. For this upmove to increase itself, Nifty should keep above the 24700 stage. Any slippage under this level will once more ship the Nifty again contained in the extensive 24400-24700 buying and selling vary. Failure to maintain above the 24700 mark will imply an prolonged interval of consolidation for the markets. Nevertheless, the longer the Nifty stays above 24700, the larger the potential for this upmove extending itself.

The approaching week is predicted to begin quietly, with the degrees of 24790 and 25000 performing as resistance factors. The helps are available at 24590 and 24400 ranges. The buying and selling vary will proceed to remain wider than regular.

The weekly RSI is 56.37. It’s impartial and doesn’t present any divergence towards the value. The weekly MACD is bearish and stays under its sign line.

The sample evaluation of the weekly charts exhibits that the Nifty suffered a brutal imply reversion course of. The Index was 16% larger than its 50-week MA at one cut-off date. In the course of the latest sharp corrective transfer, the Nifty examined this stage once more. It subsequently discovered help and staged a robust technical pullback. The market’s discovering help on the 50-week MA has bolstered the credibility of this stage as one of many necessary sample helps for the market. On the every day timeframe, the Nifty has tried to cross above the 100-DMA stage after resisting it for a few days.

The markets might try and resume the technical pullback that it began by rebounding off the 50-week MA stage. For this to occur, it might be essential for Nifty to maintain its head above the 24700 mark. It’s also necessary to notice that any slip under the 27400 stage would drag the markets again contained in the consolidation zone. The volatility is as soon as once more in the direction of the decrease finish of its vary; there’s a chance that we may even see a surge in volatility within the coming week. It is strongly recommended that traders keep invested in comparatively stronger shares and sectors. Quite than blindly chasing the rising shares, investments should be appropriately rotated into the sectors exhibiting stronger or enhancing relative energy. Whereas mindfully defending income at larger ranges, a cautious outlook is suggested for the approaching week.

Sector Evaluation for the approaching week

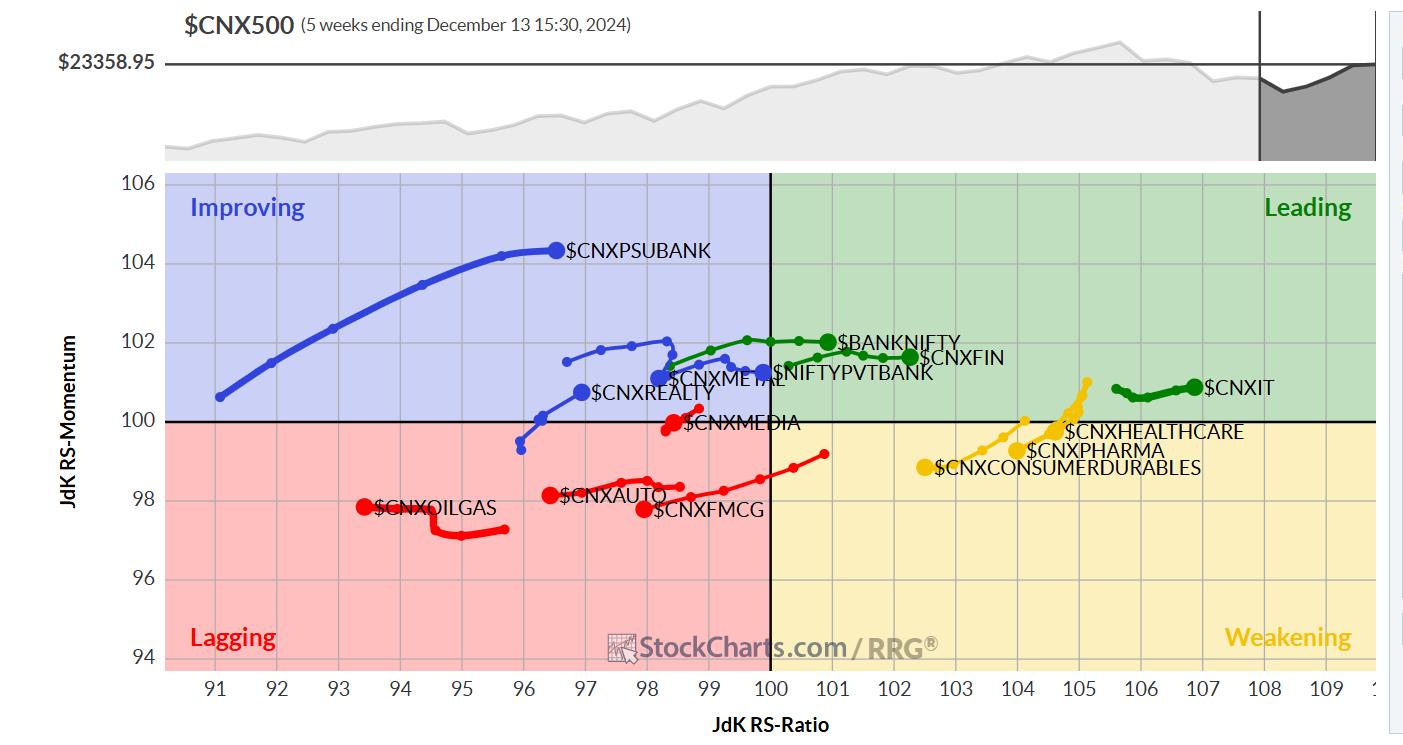

In our take a look at Relative Rotation Graphs®, we in contrast numerous sectors towards CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

Relative Rotation Graphs (RRG) present no main change within the sectoral setup. The Nifty Financial institution, Monetary Companies, Personal Banks, and IT indices are contained in the main quadrant. These teams are more likely to outperform the broader markets comparatively.

The Pharma and Midcap 100 indices are contained in the weakening quadrant. These sectors are more likely to see a continued slowdown of their relative efficiency.

The FMCG, Vitality, Media, Auto, Vitality, and Infrastructure indices are contained in the main quadrant. These teams might exhibit relative underperformance towards the broader Nifty 500 index.

The PSU Financial institution index continues to rotate firmly contained in the enhancing quadrant. The Realty and Steel indices are additionally contained in the enhancing quadrant, and these teams are possible to enhance their relative efficiency towards the broader markets.

Vital Observe: RRG™ charts present the relative energy and momentum of a gaggle of shares. Within the above Chart, they present relative efficiency towards NIFTY500 Index (Broader Markets) and shouldn’t be used straight as purchase or promote alerts.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near twenty years. His space of experience contains consulting in Portfolio/Funds Administration and Advisory Companies. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Companies. As a Consulting Technical Analysis Analyst and together with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Unbiased Technical Analysis to the Shoppers. He presently contributes each day to ET Markets and The Financial Occasions of India. He additionally authors one of many India’s most correct “Day by day / Weekly Market Outlook” — A Day by day / Weekly E-newsletter, at the moment in its 18th 12 months of publication.