KEY

TAKEAWAYS

- A head-and-shoulders high sample has to finish three phases earlier than it may be thought of legitimate.

- Even when semiconductors would full this bearish worth sample, power in different sectors suggests restricted influence on the broader fairness house.

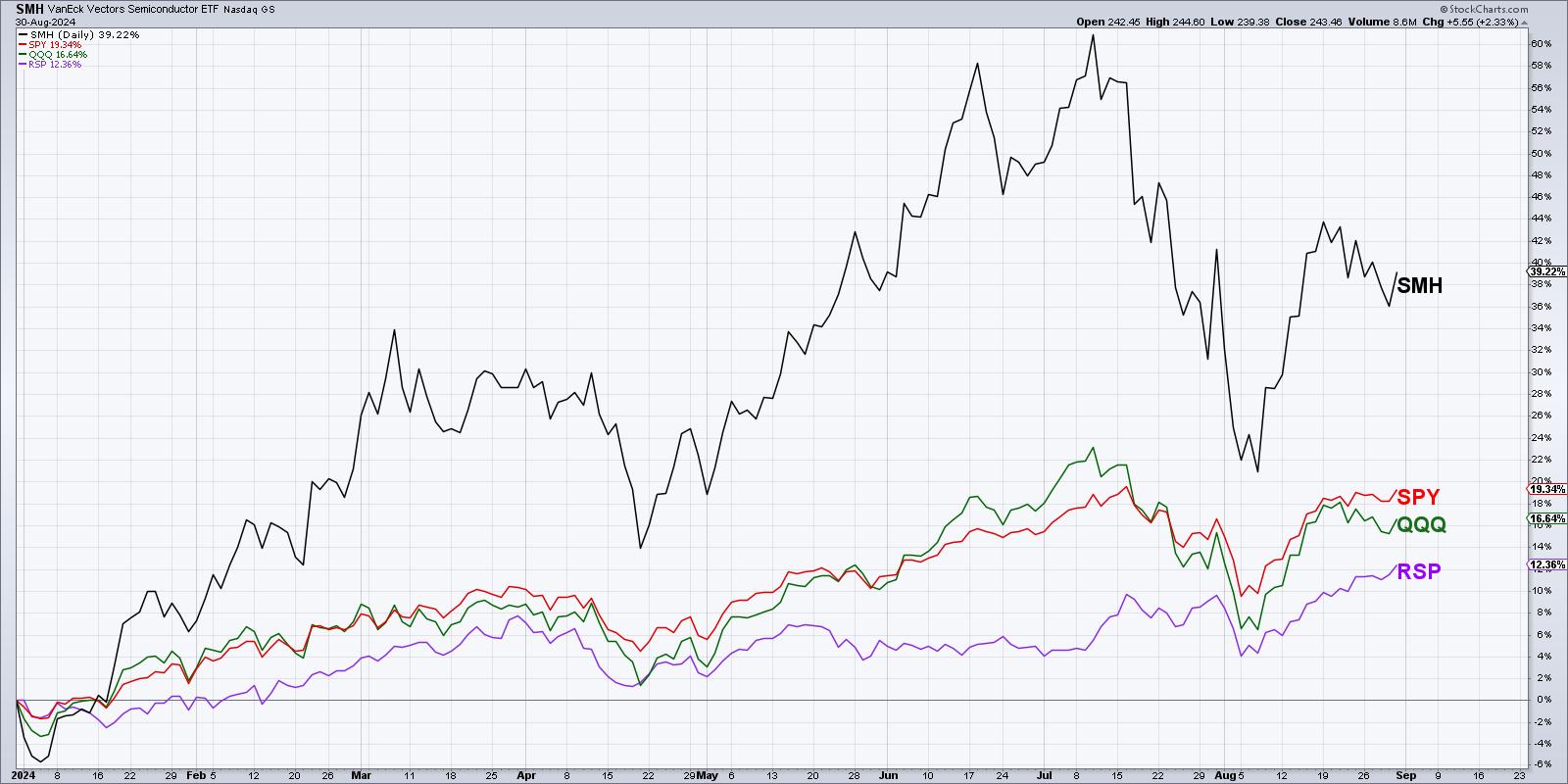

After Nvidia (NVDA) dropped after earnings this week, buyers are as soon as once more reminded of the significance of the semiconductor house. I consider semis as a “bellwether” group, as power within the VanEck Vectors Semiconductor ETF (SMH) often means the broader fairness house is doing fairly effectively. As we speak, we’ll take a look at a possible topping sample forming for the SMH, what ranges would verify a high for semiconductors, and what weak spot on this key group might suggest for our fairness benchmarks.

Presenting the Dreaded Head-and-Shoulders High Sample

Ralph Edwards and John Magee, of their traditional textual content Technical Evaluation of Inventory Tendencies, laid out the analytical course of for outlining a head-and-shoulders high. I’ve discovered that any worth sample like this consists of three essential phases.

First, we now have the “Setup” section, the place the worth motion begins to tackle the looks of a sure section. That is when your mind tells you, “That is undoubtedly a head and shoulders topping sample.” On this case, we’re on the lookout for a big excessive surrounded by two decrease highs, creating the looks of a head and two shoulders.

We are able to clearly observe the setup section on the chart of the SMH, with the June and July highs forming a considerably nontraditional, however nonetheless legitimate, head. The decrease peaks in March and August full the image. It is value noting right here that, in every of these peaks, we are able to see a bearish engulfing sample, serving as an exquisite reminder for longer-term place merchants: ignore candle patterns at your individual threat!

What Would Affirm This Topping Sample for Semis?

However the setup section solely means there’s a potential sample forming right here. Subsequent we’d like the “set off” section, the place the worth completes the sample by breaking by way of a key set off stage on the chart. For a head-and-shoulders high, which means a break under the neckline, shaped by drawing a trendline connecting the swing lows between the top and two shoulders.

Utilizing the bar chart above, that might counsel a neckline round $200, over $40 under Friday’s shut. One other college of thought entails taking a look at closing costs solely, for a cleaner perspective and extra easy measurements.

Utilizing closing costs, we get an upward-sloping neckline which presently sits just under the 200-day transferring common round $215. In both case, till we break under neckline help, this isn’t a legitimate head-and-shoulders topping sample. The third section, which I name the “affirmation” section, entails some kind of follow-through past the breakout stage. This might imply one other down shut after the break, or maybe a sure share threshold under that help stage. And as soon as all three phases are full, then we now have a legitimate topping sample.

Gauging Potential Broad Market Impression

So let’s assume that semiconductors do certainly full the topping sample. What would that imply for the broader fairness panorama?

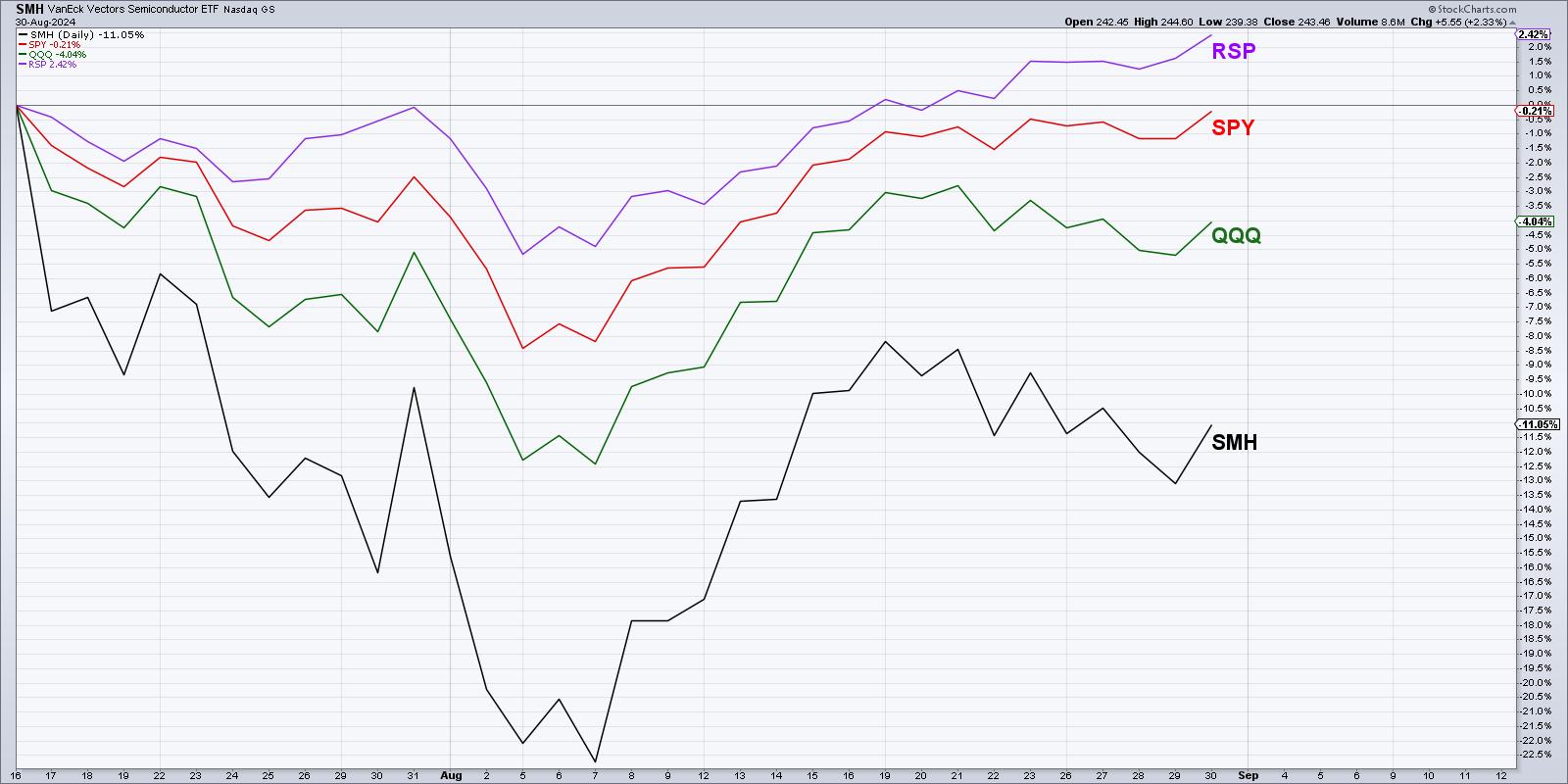

As of Friday’s shut, the SMH is up about 38.2% year-to-date. That compares to the S&P 500 (SPY) at +18.9%, the Nasdaq 100 (QQQ) with +16.2%, and the equal-weighted S&P 500 (RSP) at +12.1%. So semiconductors have definitely been a stronger management group in 2024. However what about because the July market peak?

Now we are able to see that, whereas the S&P 500 is nearly again to its July peak, the Nasdaq continues to be 4% under that day’s shut and semis are a full 11% under the market peak in July. And the equal-weighted S&P 500 is definitely above its July peak already, chatting with the power that we have noticed in non-growth sectors off the early August low.

There isn’t a doubt that semiconductors are wanting a bit susceptible after Nvidia’s earnings this week. However given the power that we’re seeing outdoors of the semiconductor house over the past two months, weak spot within the SMH doesn’t essentially imply weak spot for shares. Keep in mind that it is at all times an excellent time to personal good charts!

RR#6,

Dave

P.S. Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any means symbolize the views or opinions of some other individual or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps buyers reduce behavioral biases by way of technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor choice making in his weblog, The Conscious Investor.

David can also be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency targeted on managing threat by way of market consciousness. He combines the strengths of technical evaluation, behavioral finance, and information visualization to determine funding alternatives and enrich relationships between advisors and purchasers.

Be taught Extra