This decade of investing has come to be outlined by one factor: rates of interest.

The federal funds price has sat north of 5% for greater than a yr now, a stage neither seen nor sustained for the reason that runup to the Nice Recession. Which has everybody from bond merchants to homebuyers asking the identical query:

When will charges lastly begin to fall?

Optimism that the Federal Reserve would reduce charges all through 2024 was widespread to start the yr, however inflation’s small uptick to begin the yr has thrown chilly water on these expectations.

So how far sooner or later might the primary reduce be? Nobody is aware of the precise reply, however historical past gives a number of reference factors.

Price peaks are frequent, plateaus much less so

Whenever you check out the previous 40 years, the cyclical nature of short-term charges stands out:

- The financial system heats up, the Fed raises charges.

- The financial system cools down, the Fed lowers charges.

Rinse and repeat.

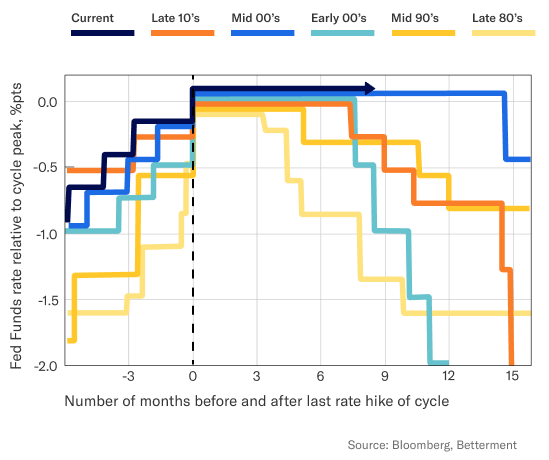

Traditionally-speaking, nevertheless, it’s often solely a matter of months till charges drop after peaking, which implies our present cycle is beginning to look extra like a plateau by comparability. It’s already lasted longer than all however one different cycle for the reason that Nineteen Eighties.

Price peaks have lasted 8 months on common for the reason that late 80s

This holding sample isn’t with out cause, after all. Inflation has slowed significantly since 2022, however it’s been caught in its personal holding sample as of late, hovering greater than a full proportion level over the Fed’s acknowledged goal of two%.

This holding sample isn’t with out cause, after all. Inflation has slowed significantly since 2022, however it’s been caught in its personal holding sample as of late, hovering greater than a full proportion level over the Fed’s acknowledged goal of two%.

On the flip aspect, provide and demand seem higher balanced, so if inflation resumes its slowdown within the coming months, then indicators level to doable price cuts late within the yr.

So what’s a saver to do?

Contemplate deploying extra {dollars}

At any time when the federal funds price falls, different rates of interest observe, together with variable rates of interest on high-yield money accounts. Shares and bonds, then again, have a tendency to profit from price cuts.

Due to this, we recommend taking one other take a look at your money state of affairs. In the event you’ve been stockpiling money above and past an emergency fund and different main purchases, it might be the time to begin investing a few of that extra within the coming months.

Feeling anxious about diving into the market proper now? Our all-bonds BlackRock Goal Revenue portfolio gives the potential for increased yields than money in alternate for taking over some danger. If or when a long-term purpose involves thoughts for these funds, think about switching to a diversified portfolio of shares and bonds.

And have in mind you don’t have to maneuver all of your cash without delay. With just a few clicks, you possibly can arrange a recurring inside switch to slowly however steadily dollar-cost common your means from money to investing.