Scalping is a extremely dynamic buying and selling technique targeted on making small, constant earnings via quite a few fast trades in unstable markets like Foreign exchange, shares, and cryptocurrencies. Merchants who excel in scalping perceive the significance of market information, danger administration, and fast decision-making.

A vital think about reaching success is figuring out which technique is finest for scalping; this contains using efficient indicators, applicable timeframes, and sustaining self-discipline in a fast-paced atmosphere. By constantly evaluating and refining their strategy, merchants can improve their efficiency and higher navigate the challenges of scalping.

In the end, understanding which technique is finest for scalping empowers merchants to unlock the potential of this thrilling buying and selling fashion, fostering constant profitability and success of their buying and selling endeavors.

simply spend money on the gold Foreign exchange Sign Buying and selling Market

you will note in finest foreign exchange sign Commerce, how you possibly can simply spend money on the gold market, in a one yr interval. On this indicstor Obtain excessive revenue with very low danger share. Watch full video to how get tradingview indicators purchase promote alerts to scalping indicator tradingview :

Initially , what’s scalping?

Scalping is a buying and selling technique that focuses on making small earnings repeatedly over very brief time frames. The 5-minute scalping technique is designed for merchants aiming for fast exchanges in unstable markets akin to Foreign exchange, shares, and cryptocurrencies…

Is scalping actually worthwhile?

Scalping can certainly be extremely worthwhile for merchants who possess the suitable abilities and efficient methods. This buying and selling approach entails making quite a few trades all through the day, capitalizing on small worth actions to generate constant earnings. Listed here are a number of components to contemplate when evaluating the profitability of scalping:

1. Market Data: Profitable scalpers have a deep understanding of market dynamics, together with technical evaluation, chart patterns, and financial indicators. This comprehension permits them to establish doubtlessly profitable short-term alternatives.

2. Danger Administration: A strong danger administration technique is crucial in scalping. Merchants typically set strict stop-loss orders to restrict potential losses and use correct place sizing to handle their total danger publicity.

3. Pace and Execution: Scalping requires quick execution of trades. A dependable and environment friendly buying and selling platform is essential, as even slight delays can have an effect on profitability. Merchants typically use direct market entry (DMA) to make sure swift order execution.

4. Self-discipline and Focus: Profitable scalpers preserve a excessive stage of self-discipline and focus. Given the fast tempo of scalping, feelings can run excessive, and merchants should keep on with their methods with out being swayed by short-term fluctuations.

5. Transaction Prices: Since scalpers make many trades per day, transaction prices (akin to brokerage charges and spreads) can considerably affect earnings. It is important to decide on a dealer with aggressive pricing and low charges for frequent buying and selling.

6. Market Situations: Scalping methods could carry out otherwise in varied market circumstances. Unstable markets could current extra alternatives, whereas low-volatility durations could make it difficult to realize revenue targets.

7. Expertise and Instruments: Superior instruments and software program can improve a scalper’s effectiveness. Many merchants use algorithms, charting software program, and real-time information feeds to establish entry and exit factors rapidly. In conclusion, whereas scalping could be a worthwhile technique, it requires a singular ability set, disciplined execution, and sound danger administration. Merchants should constantly refine their methods and adapt to altering market circumstances to reach this fast-paced buying and selling fashion.

This text is about (mql5 scalping technique) and figuring out (Which technique is finest for scalping) We even have one other article associated to this matter that you just would possibly discover fascinating.

MetaTrader5 (MT5) is certainly thought-about platform for scalping.It provides a number of benefits:

One-click buying and selling: This function permits for fast order placement, which is crucial for scalping methods that require fast entries and exits.

Pace: MT5 is understood for its quick execution occasions, which is essential for scalpers who have to capitalize on small worth actions.

Is MT5 good for scalping?

Nevertheless, there’s a notable problem.For merchants who open50-100 positions per day, manually setting stop-loss orders for every place will be cumbersome. This repetitive process can add important stress and enhance the chance of lacking important commerce administration steps.General, whereas MT5 is great for scalping as a consequence of its options, the guide means of setting stop-loss ranges for a number of trades could be a downside for merchants working at excessive frequencies.

To handle this problem, now we have a product that simplifies your complete scalping course of.With our revolutionary answer, setting stop-loss ranges turns into a lot simpler, enabling merchants to deal with their methods with out the trouble of repetitive duties.We extremely advocate you test it out!

Which timeframe is finest for scalping?

One of the best timeframes for scalping sometimes vary from one minute to15 minutes, with most scalpers favoring the one- to three-minute intervals.Right here’s a breakdown of why these timeframes are most well-liked:

-One to Three Minutes: These shorter timeframes enable scalpers to seize small worth actions and react rapidly to market modifications. The excessive frequency of trades can result in quite a few alternatives all through the day.

– 5 Minutes: This timeframe is well-liked amongst scalpers preferring a barely longer perspective, permitting for a bit extra evaluation whereas nonetheless enabling fast trades. It supplies sufficient information to acknowledge short-term traits.

Fifteen Minutes: Whereas scalpers normally deal with shorter intervals, the15-minute timeframe might help establish stronger assist and resistance ranges and traits, serving as framework for executing trades.Selecting one of the best timeframe finally will depend on particular person buying and selling fashion, methods, and luxury with fast decision-making in fast-moving markets.

This text is about (mql5 scalping technique) and figuring out (Which technique is finest for scalping) We have now one other article associated to this matter that you could be discover intriguing.

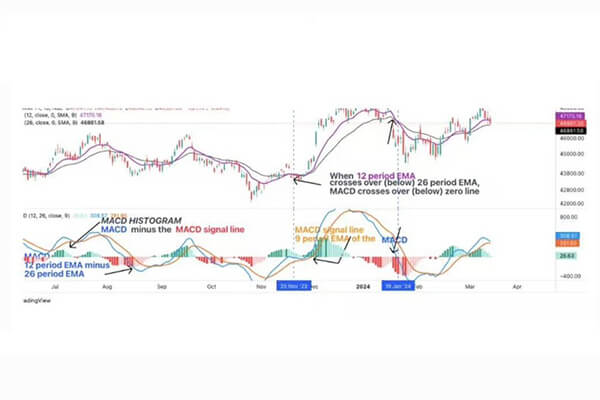

What are the MACD settings for five min scalping?

For five-minute scalping utilizing the MACD (Transferring Common Convergence Divergence) indicator, the next settings are generally really useful:

These settings are commonplace for the MACD and will be helpful for shorter time frames like

5 minutes, as they assist seize fast worth actions. You may additionally need to regulate these parameters primarily based in your buying and selling technique and backtest to search out one of the best match on your particular circumstances.

What’s the finest indicator for scalping 5 minutes?

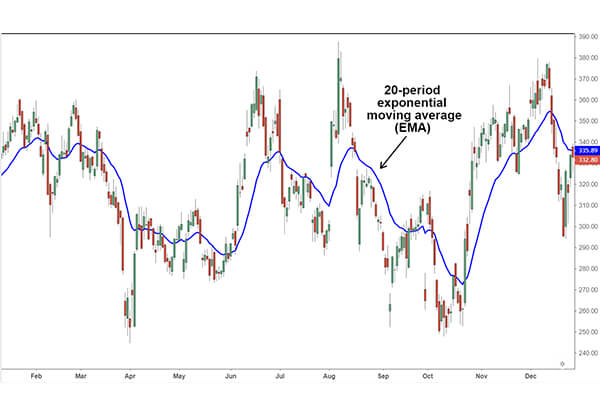

For a 3-5 minute scalping technique, use a mix of the Exponential Transferring Common (EMA) for pattern course (eg, 9 EMA and 21 EMA) and the Relative Power Index (RSI) to identify overbought/oversold ranges.

What’s the finest mt5 indicator for scalping?

Essentially the most environment friendly indicator for scalping in Foreign exchange is the Exponential Transferring Common (EMA), significantly the 5 EMA and 20 EMA crossover approach. This device assists in recognizing short-term traits quickly, making it good for high-frequency buying and selling.

The best scalping buying and selling strategy ? Which technique is finest for scalping

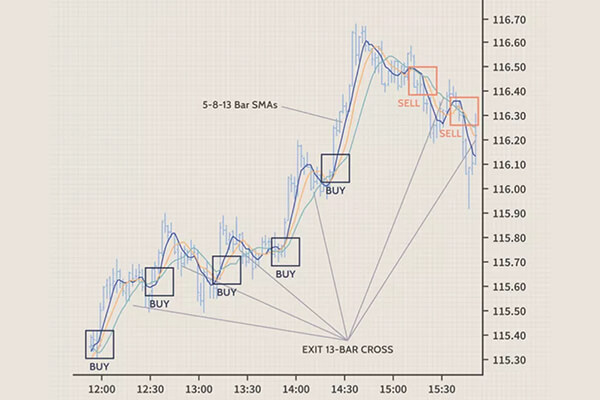

Make the most of a mix of 5-8-13 Easy Transferring Averages (SMA) on the two-minute chart to detect strong traits that may be acquired or bought brief throughout counter swings, together with receiving alerts for upcoming pattern shifts which can be unavoidable in a typical buying and selling day. This scalping buying and selling strategy is simple to grasp.