Within the classroom we might have college students alter their view of charts they had been evaluating to realize contemporary perspective and probably improve their evaluation. College students usually had Ah-Ha moments after freshening their interpretation of a chart they’d beforehand laid eyes on many instances. Inventory chart evaluation closely emphasizes the left hemisphere of the mind which is taken into account the logical aspect. The precise hemisphere is related to creativity, artwork, instinct and creativeness. By characterizing charts and knowledge in several modes the proper aspect of the mind might be engaged. By using a ‘complete mind’ examine, facets of the mind are engaged that may improve views of inventory market and buying and selling evaluation. Complete mind considering can even enhance downside fixing method when growing and enhancing indicator and methodology improvement. Merchants and analysts will usually describe this as bolts of instinct. My educating companion Dr. Hank Pruden known as this course of ‘Chart Studying within the R-Mode’. He dedicates a bit of his e-book ‘The Three Abilities of High Buying and selling’ to those chart studying strategies (pages 202-211). To be taught extra about Hank’s e-book and to buy it (click on right here).

Within the classroom we might have college students alter their view of charts they had been evaluating to realize contemporary perspective and probably improve their evaluation. College students usually had Ah-Ha moments after freshening their interpretation of a chart they’d beforehand laid eyes on many instances. Inventory chart evaluation closely emphasizes the left hemisphere of the mind which is taken into account the logical aspect. The precise hemisphere is related to creativity, artwork, instinct and creativeness. By characterizing charts and knowledge in several modes the proper aspect of the mind might be engaged. By using a ‘complete mind’ examine, facets of the mind are engaged that may improve views of inventory market and buying and selling evaluation. Complete mind considering can even enhance downside fixing method when growing and enhancing indicator and methodology improvement. Merchants and analysts will usually describe this as bolts of instinct. My educating companion Dr. Hank Pruden known as this course of ‘Chart Studying within the R-Mode’. He dedicates a bit of his e-book ‘The Three Abilities of High Buying and selling’ to those chart studying strategies (pages 202-211). To be taught extra about Hank’s e-book and to buy it (click on right here).

There are lots of methods to have interaction the proper hemisphere. Right here is one which was a favourite of scholars, and straightforward to make use of.

So, let’s get a bit playful with the charts whereas we interact our R-Mode. Within the classroom we might take an ordinary inventory chart and flip it over to view the chart by the again of the sheet. This may invert the dimensions so {that a} downtrend was upward, and an uptrend was declining. In these days we might place the web page on the window so mild would illuminate the chart on the reverse aspect of the web page. Then we might do the chart evaluation on the again of the sheet. College students usually discovered that when inverting the chart, they’d see facets of the chart construction that had been hidden to them with their prior conventional evaluation. Thus, the advantages of Studying Charts within the R-Mode.

The excellent news is that StockCharts.com has made it straightforward to invert Sharp Charts and conduct the evaluation. Extra on that under.

Here’s a case examine of chart studying within the R-Mode:

ProShares Brief Dow 30 ETF (DOG)

ProShares Brief Dow 30 ETF (DOG)

This chart just isn’t really inverted. It’s the unleveraged quick ETF of the Dow Jones Industrial Common (DOG). It isn’t an actual duplicate of the DJIA money index, so please examine and distinction. Now interact your R-Mode and permit this chart to clean over you. A primary step can be to generate a DJIA chart ($INDU or DIA) and refresh your self on the present chart place of the index, then examine the DOG chart above with annotations. How does your perspective of the current place of the DJIA change with the inversion of the chart? Did you see chart attributes that had been beforehand obscured? Did it affect your view of the DJIA?

In my case the Wyckoff construction was instantly evident within the DOG chart. The annotations mirror what stood out.

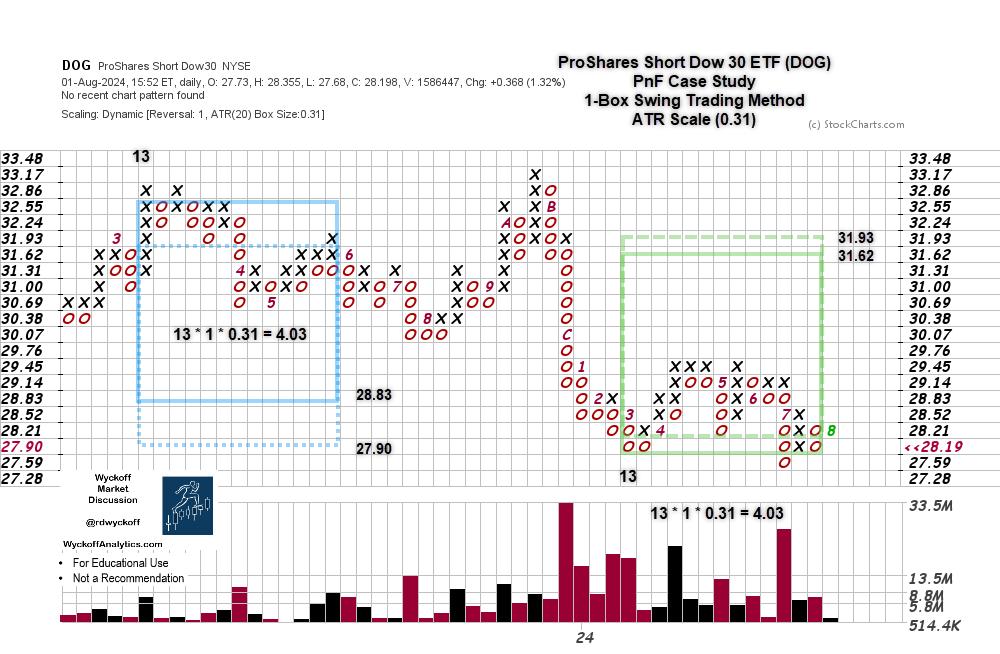

ProShares Brief Dow 30 ETF PnF Case Examine

ProShares Brief Dow 30 ETF PnF Case Examine

The swing PnF of the construction we simply analyzed almost counts to the overhead resistance. The construction seems to be unfinished. A rally to Signal of Power (SoS) above 29.45 after which a response, known as a Final Level of Help (LPS), would full an Accumulation construction. The unfinished depend suggests the potential for a significant correction of the DJIA.

Chart Notes:

- PnF depend of the prior distribution (in blue) got here inside one field of fulfilling the down depend. As that is an inverted chart, the depend goal reached to 1 field from the last word excessive, to this point.

- The present depend is unfinished and should be thought of a preliminary depend. Till the reversal is confirmed we should maintain open the thought the present development remains to be in drive.

Chart Studying within the R-Mode can improve your evaluation, and it’s straightforward to do. In SharpCharts put a Minus Register entrance of a logo to invert the dimensions. I do that usually and it is extremely useful to my chart research.

All of the Greatest,

Bruce

@rdwyckoff

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

Wyckoff Assets:

Distribution Definitions (Click on Right here)

Wyckoff Energy Charting. Let’s Overview (Click on Right here)

Further Wyckoff Assets (Click on Right here)

Wyckoff Market Dialogue (Click on Right here)

For extra sources and to be taught extra about Dr. Hank Pruden (Click on Right here)

Bruce Fraser, an industry-leading “Wyckoffian,” started educating graduate-level programs at Golden Gate College (GGU) in 1987. Working intently with the late Dr. Henry (“Hank”) Pruden, he developed curriculum for and taught many programs in GGU’s Technical Market Evaluation Graduate Certificates Program, together with Technical Evaluation of Securities, Technique and Implementation, Enterprise Cycle Evaluation and the Wyckoff Technique. For almost three a long time, he co-taught Wyckoff Technique programs with Dr.

Study Extra