Why Making an attempt to Forecast Gold Costs May Destroy Your Buying and selling Account – And What to Do As an alternative

On this planet of buying and selling, there’s nothing fairly as tempting as making an attempt to foretell the following large market transfer—particularly with gold. Whether or not it is geopolitical tensions, inflation fears, or financial downturns, gold has traditionally been a go-to protected haven. However currently, issues have gotten wild.

The issue? When you’ve been following gold costs not too long ago, you’ve seen how risky this market could be. Simply when it looks as if costs will drop, they spike, and if you anticipate a rally, the value plummets. And for day merchants, this sort of unpredictability could be catastrophic.

The Gold Worth Lure: Why Forecasting Is a Idiot’s Errand

Take the previous few weeks for example. Gold costs have moved so erratically that even seasoned merchants are struggling to maintain up. What’s worse, anybody who tried to quick gold throughout a sudden rally seemingly noticed their positions worn out, dropping cash quick. Whenever you’re buying and selling on leverage—and let’s face it, most merchants are—that volatility can blow up your account in a matter of hours.

Right here’s the factor: nobody can predict the market completely. Not even the so-called consultants who spend hours analyzing traits, information, and financial indicators. Gold is influenced by so many unpredictable variables that making an attempt to forecast its motion is like making an attempt to foretell the climate a month from now—positive, you may guess, however it’s a dangerous recreation. And if a sample works nicely, it will not work anymore 6 months later.

Leverage: The Double-Edged Sword

For day merchants, leverage is each a blessing and a curse. It lets you management a big place with a small quantity of capital, however it additionally amplifies your losses. When gold costs swing violently—and so they do—it’s powerful to carry on. It’s possible you’ll begin with a sound technique, however one unpredictable transfer in opposition to your place can wipe out days, weeks, and even months of earnings in minutes.

It’s not unusual for merchants ready and holding quick positions in gold to search out themselves margin-called when the market strikes in opposition to them. They’re pressured to promote at a loss, typically watching helplessly as their accounts dwindle to zero. Forecasting gold costs, particularly in at this time’s chaotic market, is just too dangerous for many merchants to deal with.

Enter AI + Mr. Foreign exchange EA: The Recreation Changer

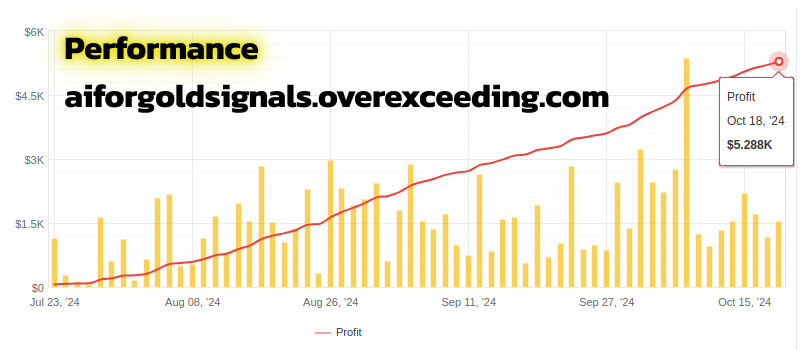

Now, think about in case you didn’t must predict gold costs in any respect. Think about in case you might earn money buying and selling gold with out worrying concerning the subsequent large transfer. That is the place AI + Mr. Foreign exchange EA comes into play.

AI + Mr. Foreign exchange EA isn’t about making an attempt to outguess the market. It’s about leveraging superior algorithms and strong commerce administration methods that take the guesswork out of buying and selling. This technique doesn’t depend on making an attempt to foretell the path of gold—or another asset, for that matter. As an alternative, it routinely adapts to the market, making changes in real-time primarily based on what’s truly occurring.

Right here’s the kicker: Even when Mr.Foreign exchange, the grasp dealer who publishes the gold sign, opens a brief place in the course of a bull run, it might probably nonetheless handle that commerce in a method that minimizes danger and maximizes profitability. How? By way of superior hedging methods and dynamic danger administration, which ensures that even when the market strikes in opposition to your place, you’re not left excessive and dry.

Chill out and Watch Your Account Develop on Autopilot

The great thing about utilizing AI + Mr. Foreign exchange EA is that you just don’t must spend sleepless nights worrying about each tick out there. You don’t want to watch information occasions, attempt to interpret financial knowledge, or agonize over when to enter or exit a place. The system does all of it for you.

Whereas different merchants are glued to their screens, frantically adjusting their positions in response to each headline or worth spike, you may calm down, understanding that the AI + Mr. Foreign exchange EA is managing your trades within the background, working in the direction of rising your account with precision and effectivity.

It really works so nicely due to these 3 danger administration methods

The EA not simply executes the trades from the Gold Sign channel. It manages them utilizing rigorously designed and validated algorithms. These algorithms have been constructed to make revenue from random trades – irrespective of how silly they may be.

Which one could be your favourite? ❤️🔥

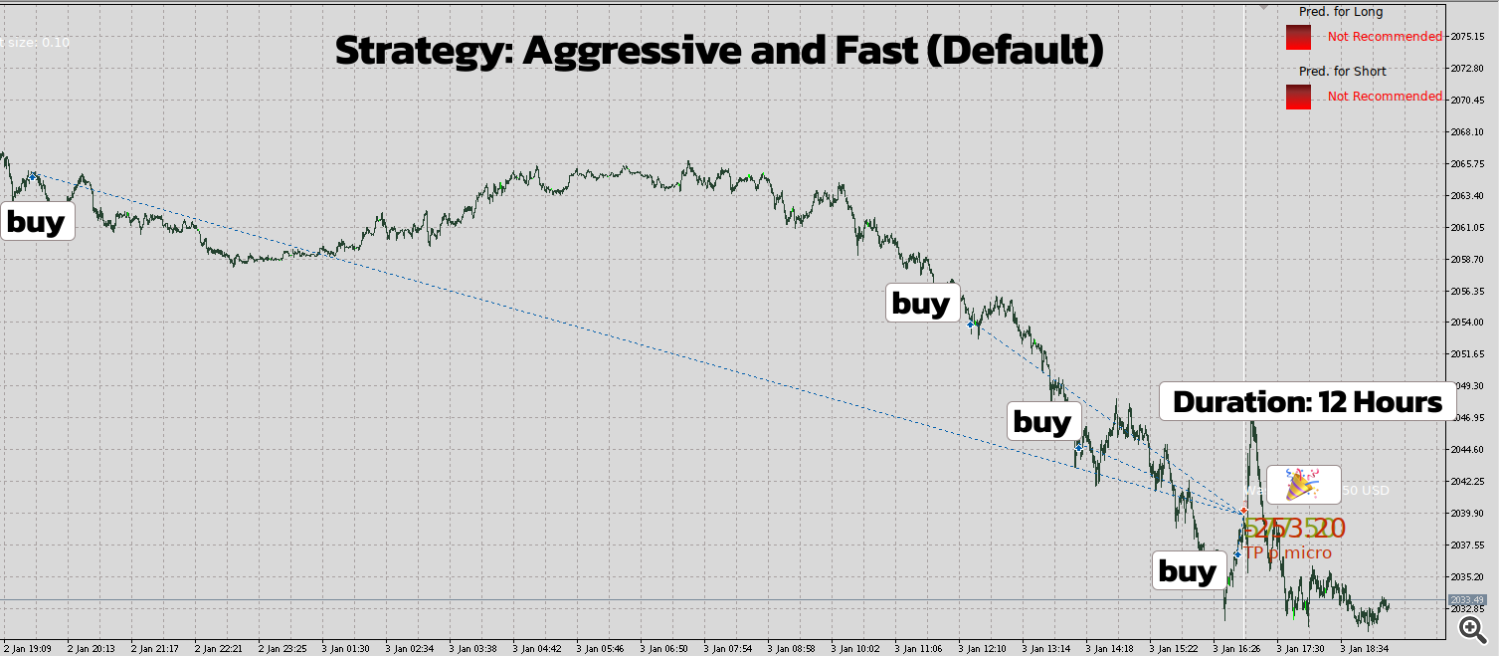

Technique 1: The Predator

This technique makes use of sample primarily based greenback value averaging system. New positions are added relying on the value motion, time and market motion velocity. 99% of the trades are closed inside 24 hours.

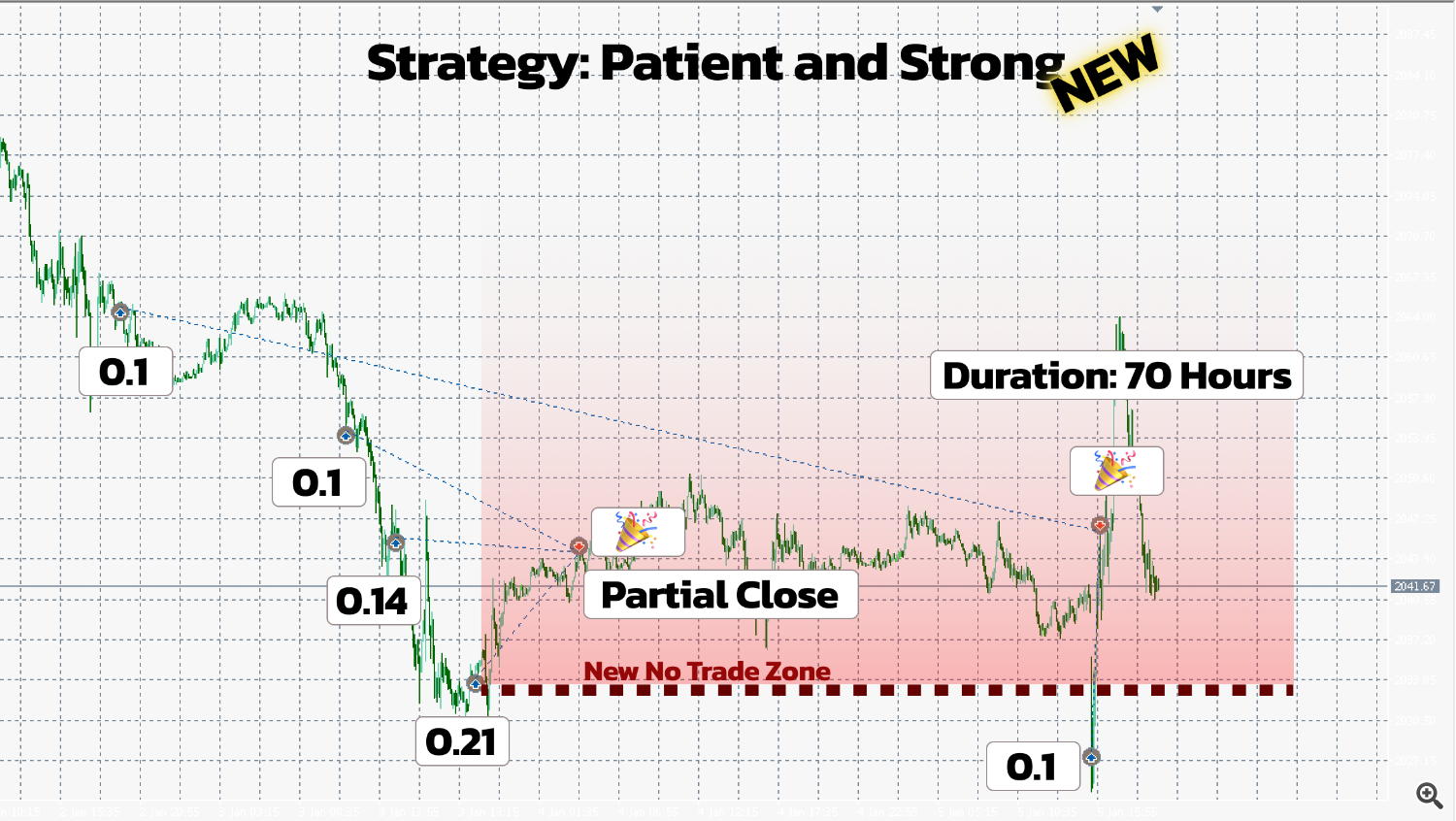

Technique 2: Affected person and Sturdy

With a purpose to scale back the drawdown, this technique makes use of the very efficient “Danger Cleaner” method. It closes final largest positions and retains the publicity danger low even when the value strikes in opposition to us.

After that cleansing step, the algorithm waits for the value to maneuver up the place it might probably shut the remaining place.

If the value strikes under the newest (closed) place, the algorithm prompts the scaling once more however continues with the small lot sizes. After some time it closes all positions. See the picture under for an instance.

Technique 3: Development Hedger

This technique has escaped the key labs of a hedge fund. It’s nice in case you choose to attend very long time and to keep away from any dangers.

If the value retains shifting deeper and deeper, it opens SHORT positions as HEDGES. If the value continues its motion down, the quick positions make extra revenue than the unique lengthy positions and every part could be closed with revenue.

If the value goes up once more (like within the picture under) lengthy trades are closed and the hedges are managed individually.

Remaining Ideas: Cease Forecasting, Begin Profiting

Making an attempt to foretell the following transfer in gold costs is a idiot’s errand, particularly in at this time’s risky market. As an alternative of risking your hard-earned cash on forecasts and guesswork, why not use a system designed to take the stress out of buying and selling?

With AI + Mr. Foreign exchange EA, you don’t have to fret about being on the improper aspect of a commerce. The system’s superior algorithms guarantee you can revenue, even when the market doesn’t go your method.

It’s time to cease making an attempt to foretell the longer term and begin having fun with the advantages of automated buying and selling on autopilot. Let AI + Mr. Foreign exchange EA do the heavy lifting, whilst you sit again and watch your account develop.

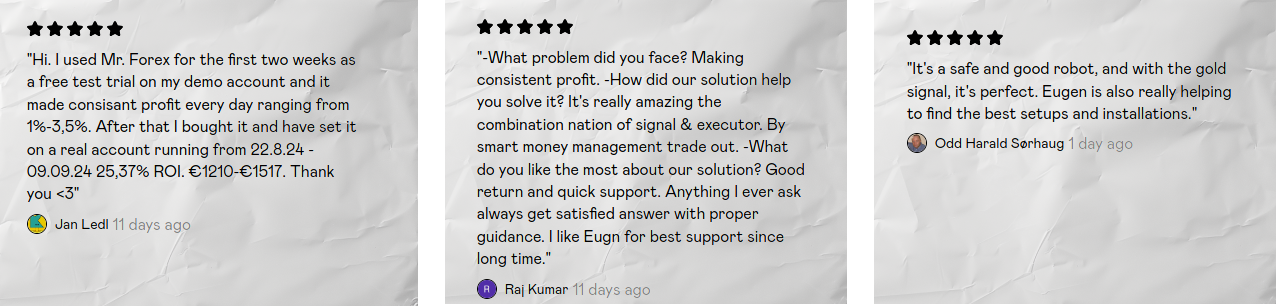

PS: That is what the customers are saying