In a technical evaluation shared along with his followers on X, crypto analyst Bobby A (@Bobby_1111888) supplies a bullish prediction for XRP regardless of the US Securities and Alternate Fee’s choice to attraction the ruling in its case towards Ripple Labs. Amid the regulatory turmoil, Bobby’s interpretation of the macro charts suggests a bullish outlook for XRP, contradicting the potential bearish sentiment stirred by the SEC’s newest authorized maneuver.

Bobby contrasts the rapid market reactions usually triggered by high-profile authorized information with the precise long-term traits noticed in asset costs. “Many neglect that, even amid information of the SEC lawsuit in 2020, the asset appreciated from $0.11 to $1.95,” he factors out.

XRP Month-to-month Charts Nonetheless Look Bullish

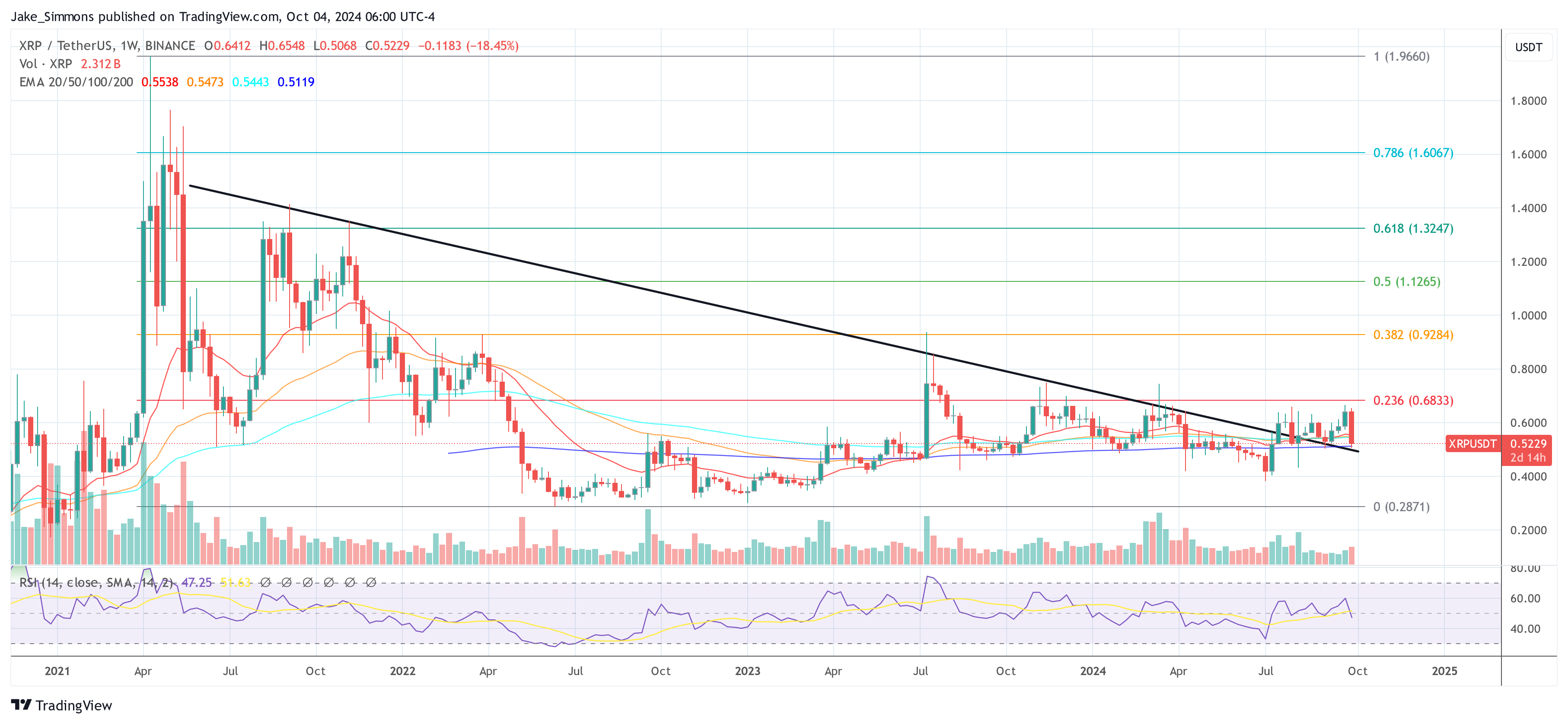

The analyst highlights that XRP has been buying and selling for the previous practically seven years in a constant sideways consolidation which he describes as a “macro base.” In keeping with Bobby, this prolonged interval of consolidation is essential for understanding the potential for upward motion.

Associated Studying

“The month-to-month timeframe exhibits that put up the Bitcoin Halving, throughout each cyclical rotation of the momentum oscillators, the asset [XRP] experiences speedy value appreciation, which might provoke at any second. This occurred in 2017 and 2020,” Bobby additional explains.

An argument of Bobby’s evaluation focuses on the month-to-month Bollinger Bands of the XRP/USD chart, an indicator used to measure market volatility and establish potential value targets based mostly on earlier market habits. “Very like throughout 2016, the worth is tightly wound round all important greater timeframe transferring averages, together with the median line of the month-to-month Bollinger Bands,” the analyst writes.

He provides, “Whereas we’re on the subject of the Bollinger Bands, they’re the tightest they’ve ever been within the coin’s historical past,” he notes. This tightness means that XRP is at a pivotal level the place any enhance in volatility might result in a considerable value motion.

Associated Studying

Notably, Bobby’s take revenue zone lies between the 1.618 Fibonacci extension stage at $5.31 and 4.236 Fibonacci extension stage at $13.72. Thus, Bobby’s anticipated return for this bull run is between a whopping 950% to 2,600%.

Bobby theorizes that the preliminary actions when volatility returns could be misleading, doubtlessly designed to mislead market individuals in regards to the true path of the worth. He attracts parallels to Bitcoin’s sudden rally in March 2020, suggesting that XRP might expertise an analogous misleading but finally bullish breakout.

“The XRPETH and XRPBTC charts don’t appear to be that is the beginning of an extended, drawn-out bear market however, as an alternative, potential capitulation at deep worth areas. Do not forget that the worst information comes on the backside and the most effective information on the high,” Bobby added.

The upcoming US presidential election might additionally play a important position in shaping the regulatory panorama affecting cryptocurrencies like XRP. Bobby speculates in regards to the potential outcomes: “Ought to Donald Trump be re-elected as president, I can not see any state of affairs the place Gary Gensler stays chair of the SEC.” He argues {that a} change within the SEC’s management might chill out the regulatory scrutiny over Ripple and, by extension, XRP, fostering a extra favorable market setting.

In his closing remarks, Bobby reiterates his sturdy conviction within the bullish thesis for XRP. “Nobody ever stated this may be simple, and investing by no means is,” he displays, encouraging his viewers to undertake a strategic, long-term view of their funding in XRP.

At press time, XRP value stood at $0.52.

Featured picture created with DALL.E, chart from TradingView.com